Global banks are turning bullish on Taiwanese and South Korean shares, expecting a revival in semiconductors to drive a rally next year, while they see Japan’s market as resilient thanks in part to its weak currency.

The calls come as US rates are still rising, with most markets around the world eyeing their worst annual returns since the 2008 global financial crisis and with chipmakers’ profits cratering.

Goldman Sachs Group Inc said South Korean stocks are the bank’s top “rebound candidate” for next year due to low valuations, made cheaper by a nosediving won, and as companies benefit from an expected recovery in Chinese demand.

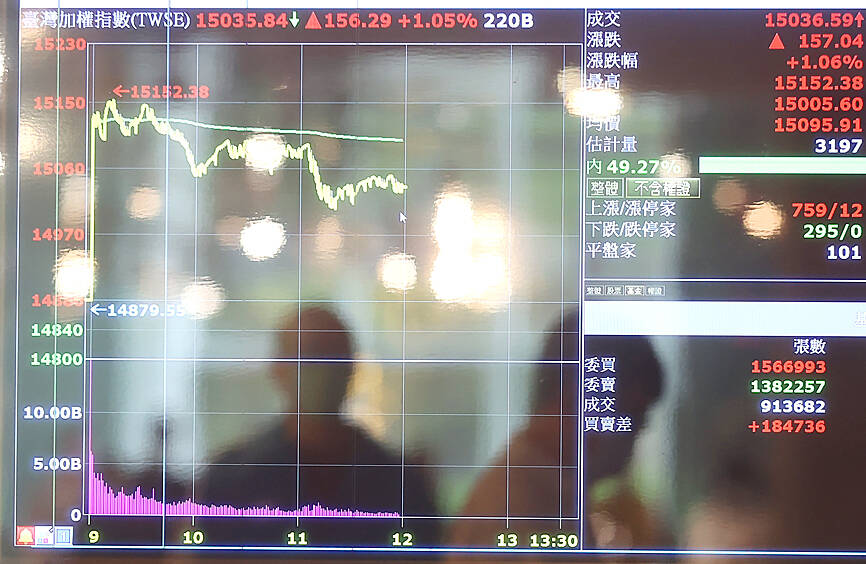

Photo: CNA

It expects a return in US dollar terms of 30 percent next year.

Morgan Stanley also gives South Korea top billing.

Together with Taiwan, it is the best place to be, as the two markets have a reputation as “early cycle” leaders in the demand recovery, the bank said.

Bank of America Corp, UBS Group AG, Societe Generale SA and Deutsche Bank AG’s wealth manager DWS Group are all bullish on South Korean stocks, with analysts’ conviction in that trade lying in sharp contrast to their divided view on India and China.

“In the semiconductor area, demand should bottom in the first quarter of next year and the market always starts to run before that,” said DWS Asia-Pacific chief investment officer Sean Taylor, who added South Korean exposure in recent months.

“We think [South Korean stocks] sold off too much in September and August,” he said.

South Korea’s benchmark KOSPI has lost about 17 percent this year and the won has declined 9 percent, although both have shown signs of recovery in recent months.

Goldman Sachs said that five years of selling has driven foreign ownership of South Korean stocks to its lowest level since 2009, but inflows of about US$6 billion since the end of June “indicates a turn in foreign interest” that could lift the market further.

Societe Generale’s recommendation for investors to increase their exposure to Taiwan and South Korea comes at the expense of China, India and Indonesia. Goldman’s preference for South Korean stocks comes as it has suggested a reduction in Brazil exposure. Morgan Stanley downgraded its view on Indian exposure in October, when it upgraded its recommendation for South Korea.

Morgan Stanley is most bullish on chipmakers turning out commoditized low-cost chips, as well as chips destined for consumer goods — including companies such as Samsung Electronics Co or SK Hynix Inc. Morgan Stanley has a price target for SK Hynix about 50 percent above the current share price.

Taiwan and Japan offer attractions for some similar and some novel reasons. Like South Korea, Taiwan is another heavily sold and chipmaker-dominated market — although tensions with China make some investors a bit less enthusiastic.

Goldman Sachs is underweight on Taiwanese stocks, citing geopolitical risk, while Bank of America is neutral and its most recent survey of Asian fund managers shows they are bearish.

Japan also offers chips exposure, as well as some security and diversification, with a weak yen also a tailwind for exporters and typically a boon for equities.

“A sustained stay at such undervalued levels, as expected by our FX strategists, augurs well for Japan equities,” said Bank of America analysts, who recommend overweight Japan.

Morgan Stanley, DWS and UBS are also positive, as is Goldman Sachs, especially for the second half when it forecasts inflows.

There is less agreement when it comes to China, where big investors seem to be in a wait-and-see mode, or India where investment houses feel an 8 percent rally for the benchmark SENSEX has left valuations a bit pricey.

Much of the banks’ investment calls rest on assumptions that US interest rates eventually stop going up and China eventually relaxes its COVID-19 rules.

Meanwhile, Taiwan and South Korea are both geopolitical flashpoints, but analysts said at least some of that is already in the price.

“There has been some political issue in both [South] Korea and Taiwan for a long time,” Societe Generale Asia equity strategy head Frank Benzimra said.

“Things can always get worse,” he said. “But in terms of the risk-reward, what we find is that a number of the lowly valued markets, whether it’s [South] Korea or Taiwan ... have more limited downside because of the accumulation of bad news that we have seen over the last 12 months.”

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the