Burberry Group PLC’s new leadership plans a return to “Britishness” after a revamp by an Italian executive duo failed to keep the UK brand abreast of its luxury rivals.

The new team of chief executive officer Jonathan Akeroyd and creative head Daniel Lee want to increase accessories to more than 50 percent of sales in the long term, banking on high-margin products in their overhaul of the trench-coat maker.

Comparable store sales rose by double digits in the three months ended in September as US tourists took advantage of a strong US dollar to snap up luxury goods in Europe.

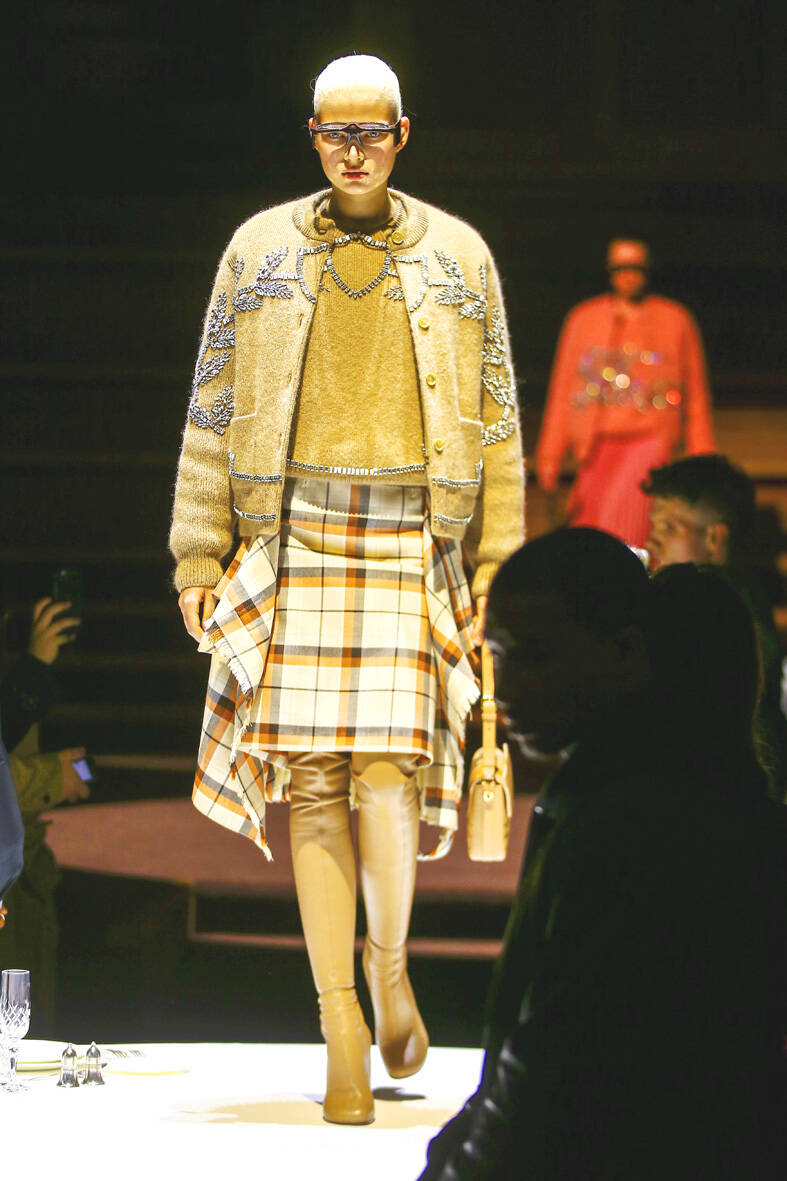

Photo: AP

Still, growth fell short of the high bar set by rivals such as LVMH SE and Hermes International.

In a first step toward shaking up the brand, the Versace veteran, who took charge in March, in September named Lee to succeed Riccardo Tisci as creative director.

Akeroyd succeeded previous CEO Marco Gobbetti, who was midway through an effort to take the Burberry brand further upmarket when he left to head Italian competitor Salvatore Ferragamo SpA.

Yorkshire-born Lee was previously head designer at Bottega Veneta, where he helped reinvigorate the Kering SA brand before leaving for undisclosed reasons a year ago.

He is due to present his first collection for Burberry during London Fashion Week in February.

Among a slew of new goals announced yesterday, the UK firm said it is aiming to generate £4 billion (US$4.7 billion) of sales in the medium term and hopes to add another £1 billion in the long term. To do so, it plans to roughly double sales of leather goods, shoes and women’s ready to wear, as well as grow outer wear by 50 percent in the medium term.

It would also seek to boost the share of e-commerce to 15 percent of retail sales over that time frame.

The new strategic plan comes as the outlook for the global economy darkens. UK inflation last month hit the highest level in more than four decades on soaring energy prices, figures on Wednesday showed.

There are signs of faltering demand, especially for lower-priced luxury products in the US.

Revenue in the Americas fell 3 percent in the quarter, following a 4 percent drop in the preceding three months, the company said.

“Burberry is one of the most exposed brands to aspirational consumers,” Luca Solca, analyst at Sanford C. Bernstein, wrote by e-mail.

“Aspirational consumers are far more exposed to energy and food price inflation, as they have a more limited discretionary spend capacity. Hence the weakness,” he added.

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to