Softbank Group Corp has long stood out for its flamboyant earnings events. As the former telecoms firm morphed into the world’s largest venture capital investor, they had become must-watch material, a kind of psychedelic version of billionaire investor Warren Buffett’s annual letter to shareholders.

Softbank founder Masayoshi Son’s slide decks and comments had it all — golden eggs, flying unicorns, comparisons to Jesus Christ, inexplicable WeWork Inc profit projections.

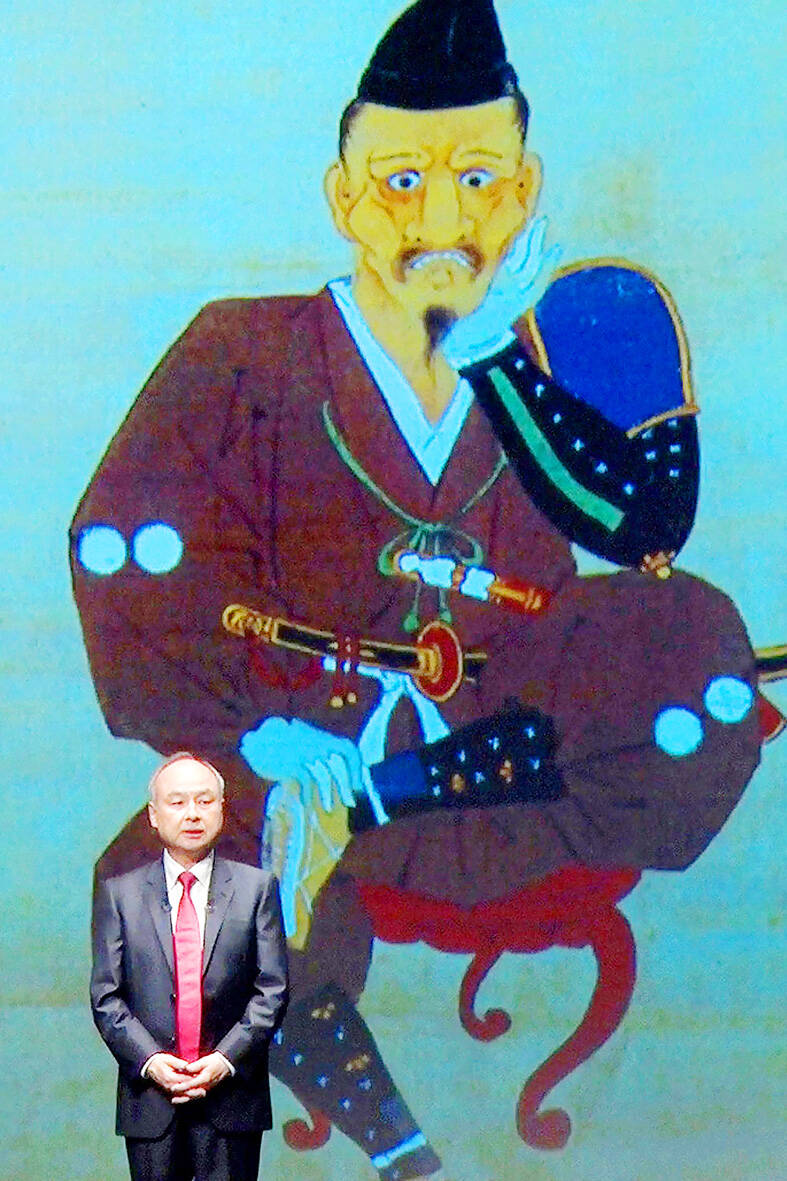

Even in the bad times, Son would give us a mysterious equation to solve, or a history lesson about an apologetic feudal warlord. By comparison, last week’s earnings event was, frankly, pretty dull.

Photo: AFP

And they are to get duller. Son revealed that he is to step away from future events — as well as day-to-day running of the firm itself — to focus on building up Arm Ltd, the chip design firm Softbank failed to sell to Nvidia Corp.

Investors’ only chance to hear from Son will be at the annual shareholders’ meeting in June.

That is breaking with decades of precedent. Son spoke last week for a final time for now, giving about 25 minutes on his plans for Arm before handing over to Softbank chief financial officer (CFO) Yoshimitsu Goto. While no slouch, Goto gave a much more traditional numbers-and-graphs briefing.

Photo: REUTERS

It is not unusual in Japan for a CFO to give most earnings presentations.

Last month, Sony Group Corp CFO Hiroki Totoki was the one speaking to the media, not Sony CEO Kenichiro Yoshida.

However, Softbank has long been anything but the traditional Japanese company: In addition to those slide decks, Son’s forthrightness and willingness to take all questions and combination of self-deprecation and boastfulness (along with the potential for some truly jaw-dropping figures) made the earnings must-see TV.

If that is coming to an end, then it is in keeping with how the company wants to operate right now — low-key and out of the spotlight, at least until market conditions are more favorable to its often-questioned investment business model.

“Inflation isn’t going to be controlled any time soon, and it’s going to be tough even for listed firms, much less unlisted ones,” Son said before handing over the reins to Goto. “We have to tighten our defense.”

Softbank was not kidding when it earlier this year pledged to go into defensive mode, a shift that former banker Goto would take the lead on. As a result, there was little to talk about this quarter — no new buyback announcement, no new asset sales and no significant update on the initial public offering (IPO) for Arm, which was pushed out beyond the end of the fiscal year ending March.

Son has seemingly become infatuated with the firm he now says he never really wanted to sell, and which he has proclaimed would be a new engine of growth for the company — and for his “information revolution.”

What might end up occupying most of his time is trying to boost the valuation of the IPO to the levels he expects, which would not be easy in this market.

A far more traditional figure than Son, Goto emphasized safety and stability, played up the firm’s strong cash position and low loan-to-value ratio, and noted that while market conditions would eventually get better, the firm was to take a conservative approach.

That is a mood already seen in the plunge in new Vision Fund investment. The firm spent just US$300 million in the three months ended September, down 97 percent from a year earlier.

Future quarters are likely to look even more miserly — it is a bad time to be a start-up seeking investment.

Goto emphasized his skepticism over China, saying it is “growing more unstable day by day,” and cryptocurrencies, which he said are “not part of the Vision Fund’s vision.”

Son’s speech had something of an end-of-an-era feeling to it. With the founder planning to focus on Arm for now, it even feels a little like this might be the swan song for the “information era venture capitalist” Softbank.

The company has reincarnated itself numerous times over the years, from broadband supplier to mobile phone magnate to investment giant. Perhaps their next incarnation is simply a little boring.

Gearoid Reidy is a Bloomberg Opinion columnist covering Japan and the Koreas. He previously led the breaking news team in North Asia and was the Tokyo deputy bureau chief.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

OpenAI has warned US lawmakers that its Chinese rival DeepSeek (深度求索) is using unfair and increasingly sophisticated methods to extract results from leading US artificial intelligence (AI) models to train the next generation of its breakthrough R1 chatbot, a memo reviewed by Bloomberg News showed. In the memo, sent on Thursday to the US House of Representatives Select Committee on China, OpenAI said that DeepSeek had used so-called distillation techniques as part of “ongoing efforts to free-ride on the capabilities developed by OpenAI and other US frontier labs.” The company said it had detected “new, obfuscated methods” designed to evade OpenAI’s defenses

NEW IMPORTS: Car dealer PG Union Corp said it would consider introducing US-made models such as the Jeep Grand Cherokee and Stellantis’ RAM 1500 to Taiwan Tesla Taiwan yesterday said that it does not plan to cut its car prices in the wake of Washington and Taipei signing the Agreement on Reciprocal Trade on Thursday to eliminate tariffs on US-made cars. On the other hand, Mercedes-Benz Taiwan said it is planning to lower the price of its five models imported from the US after the zero tariff comes into effect. Tesla in a statement said it has no plan to adjust the prices of the US-made Model 3, Model S and Model X as tariffs are not the only factor the automaker uses to determine pricing policies. Tesla said

Australian singer Kylie Minogue says “nothing compares” to performing live, but becoming an international wine magnate in under six years has been quite a thrill for the Spinning Around star. Minogue launched her first own-label wine in 2020 in partnership with celebrity drinks expert Paul Schaafsma, starting with a basic rose but quickly expanding to include sparkling, no-alcohol and premium rose offerings. The actress and singer has since wracked up sales of around 25 million bottles, with her carefully branded products pitched at low-to mid-range prices in dozens of countries. Britain, Australia and the United States are the biggest markets. “Nothing compares to performing