Asia’s top chip stocks tumbled yesterday, ensnared in an escalating US-China tech race that has erased more than US$240 billion from the sector’s global market value.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, plunged a record 8.3 percent, while Samsung Electronics Co and Tokyo Electron Ltd also declined.

The selloff spread to the foreign-exchange market as investors tally up the damage from the sweeping curbs the US is imposing on companies that conduct technology business with China.

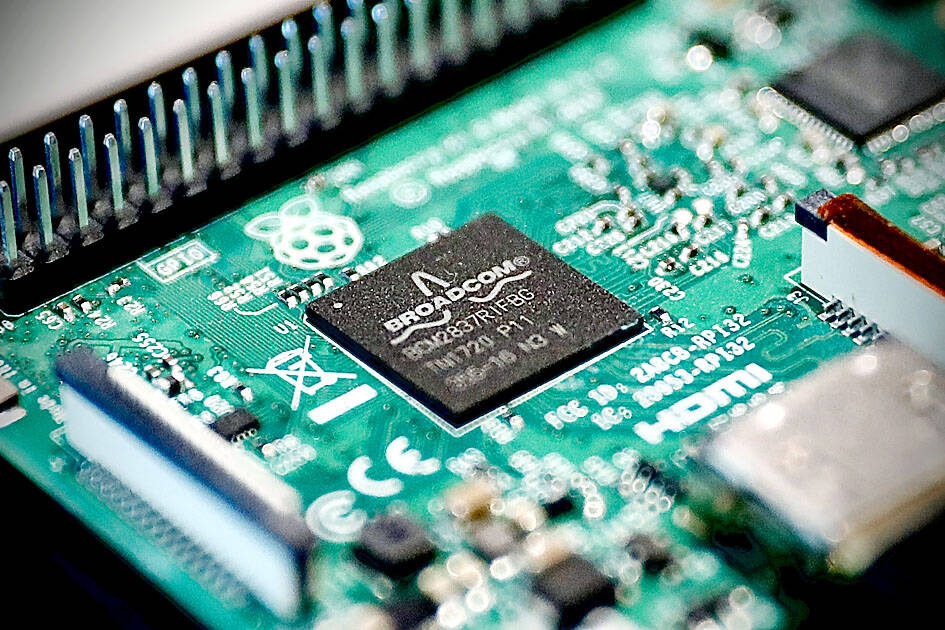

Photo: RITCHIE B. TONGO, EPA-EFE

The measures imposed by the administration of US President Joe Biden erect barriers of entry to China’s market by limiting the ability of US firms to sell equipment and tech to their Chinese counterparts. There are concerns that the restrictions could spread if Washington widens the initiative to include other countries, while questions also remain over the scope and final impact of the moves.

“It is difficult to call a bottom on the performance of the chip sector,” Global CIO Office chief executive officer Gary Dugan said. “The big story is that the West is becoming profoundly more concerned about security around any form of technology. We see no reason to re-enter the sector for the moment despite the profound poor performance.”

US chip stocks were on track to decline for a third day, with Nvidia Corp, Advanced Micro Devices Inc, Qualcomm Inc and Texas Instruments Inc all down more than 1 percent yesterday before the bell.

Chip toolmaker ASML Holding NV traded down 2.3 percent in Amsterdam, bringing three-day losses to more than 11 percent.

The US announced the export curbs on Friday and there have been suggestions that similar actions might be deployed in other countries to ensure international cooperation.

The announcement spurred a two-day rout of more than 9 percent in the Philadelphia Stock Exchange Semiconductor Index, which closed on Monday at its lowest level since November 2020.

Samsung lost as much as 3.9 percent, the most in a year, while SK Hynix Inc, one of the world’s largest makers of memory chips that has facilities in China, slid 3.5 percent before paring losses.

In Tokyo, Renesas Electronics Co shed almost 6 percent, with Tokyo Electron losing a similar amount.

The current rout has already wiped out more than US$240 billion from chip stocks worldwide since Thursday’s close, data compiled by Bloomberg showed.

The selloff extended to currency markets, with the South Korean won sliding as much as 1.8 percent versus the greenback while the New Taiwan dollar declined 0.7 percent.

The curbs are a “big setback to China” and “bad news” for global semiconductors, Nomura Holdings Inc analyst David Wong (黃作慶) wrote in a note on Monday.

China’s localization efforts might also be “at risk as it may not be able to use advanced foundries in Taiwan and [South] Korea,” Wong wrote.

Shares of Chinese chipmakers extended their recent losses yesterday, with Morgan Stanley saying that the broader restrictions around supercomputers and multinational capital investment in China could be “disruptive.”

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,