The Financial Supervisory Commission (FSC) yesterday tightened its regulations on short selling by lowering the maximum number of securities that can be borrowed and increasing the margin requirement, moves intended to stabilize local stock markets.

The new curbs come after a bout of volatility in global markets, driven by concerns about the US Federal Reserve’s rate hikes and recession fears.

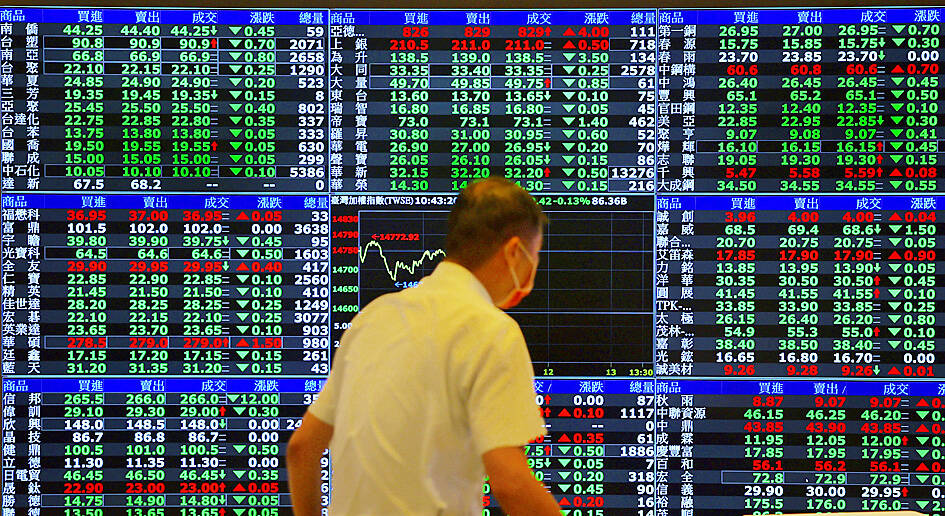

Taiwan’s benchmark index tumbled nearly 5 percent this week to close at its lowest since November 2020, its sixth consecutive week of losses.

Photo: CNA

The TAIEX fell 0.81 percent, or 109.68 points, to 13,424.58 yesterday, with turnover totaling NT$207.934 billion (US$6.55 billion), Taiwan Stock Exchange data showed.

The index sank to its lowest in about 22 months, with foreign institutional investors selling a net NT$5.9 billion of local shares, the eighth consecutive day of net outflows, the data showed.

The new measure, which takes effect today, limits the volume of intraday securities lending orders to 20 percent of the average daily trading volume over the previous 30 days, Securities and Futures Bureau Director-General Sam Chang (張振山) told a virtual news conference.

That is down from 30 percent previously, Chang said.

The commission cut the ratio after short-selling activity by foreign institutional investors rose over the past nine months, he said.

It expects the measure to help prevent the TAIEX from falling further, he said.

Short selling is when investors borrow securities, typically from brokerages and sell them, expecting the price to fall so they can make a profit by buying them back at a lower price.

It has been more than two years since the FSC tightened its regulations on short selling in March 2020 to mitigate the negative impact of the COVID-19 pandemic on local stock markets.

On that occasion, it slashed the ratio of securities lending to 10 percent.

“The TAIEX plunged about 10 percent in September, less than the 2020 fall of 20 percent,” Chang said, adding that “foreign institutional investors did not sell as much as they did that year.”

“Therefore, we do not need to go as far” as the March 2020 change, he added.

The commission also boosted the margin requirement of securities lending to 100 percent from 90 percent to increase costs for bearish investors of local stocks, it said.

It did not say how long the tightened short-selling regulations would last, although it would review its rules based on market activity.

The 2020 change lasted about three months.

Taiwan’s decline is broadly in line with regional peers. The TAIEX fell 11 percent last month, while the MSCI Asia Pacific Index slumped 12 percent.

The market has seen one of the biggest foreign outflows in the region this quarter.

Additional reporting by Bloomberg

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.