The price of DRAM chips is expected to fall at a steeper rate of 13 to 18 percent next quarter, as high inflation continues to weigh on demand for consumer electronics, causing chip inventories to soar, market researcher TrendForce Corp (集邦科技) said yesterday.

The downtrend in DRAM prices could extend from a quarterly decline of 10 to 15 percent in the third quarter, the Taipei-based researcher said.

“Demand for consumer electronics continued to stagnate during the third quarter, which used to be a high demand season,” TrendForce said in a statement.

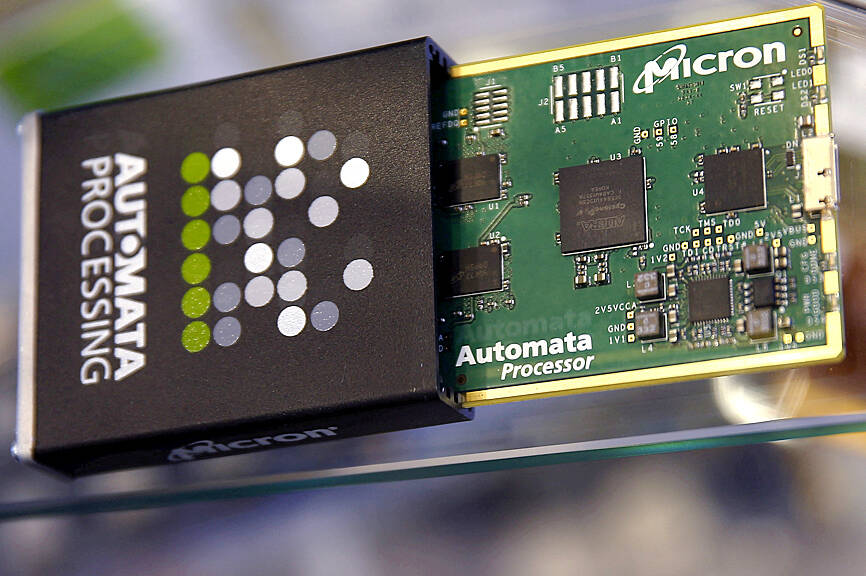

Photo: Reuters

“During the quarter, memorychip consumption and shipments both showed quarterly declines,” it said.

“As demand for memory chips slumped significantly, consumer electronics suppliers have been hesitant to place new orders. As such, chip suppliers are under mounting pressure to offload excessive inventory,” it said.

To sell more chips and to protect their market shares, some memorychip makers switched to a soft stance by consolidating price negotiations for the third and fourth quarters, or negotiating quantity before quoting prices, TrendForce said.

Chipmakers usually negotiate prices on a quarterly basis.

Prices of DRAM chips used in notebook computers are expected to drop 10 to 15 percent next quarter from the previous quarter as most suppliers refused to cut production, despite sluggish demand, the researcher said.

That is because DRAM chip makers still enjoy good profit margins, it said.

Prices of server DRAM chips are expected to tumble 13 to 18 percent next quarter, attributable to a delay in launches of new processors, TrendForce said.

Intel Corp is reportedly to postpone the launch of its new Intel 7-based server processors, dubbed Sapphire Rapids, to February or March next year.

Demand for server DRAM semiconductors has been sluggish as customers consume fewer chips, which has caused inventory to climb to nine to 12 weeks, surpassing normal levels of six to eight weeks, the researcher said.

Demand from server makers and cloud service providers in China and the US all stagnated, it said.

Mobile DRAM chip prices are expected to slide 13 to 18 percent next quarter, TrendForce said.

The decline could accelerate further, given that mobile phone vendors continued to cut sales forecasts amid a gloomy outlook, it said.

Excessive inventory at the level of seven to nine weeks also crimped chip demand, it added.

Facing similar issues of slowing demand and mounting inventory, memorychip makers are expected to experience quarterly price declines of 10 to 15 percent for graphics DRAM and consumer electronics DRAM chips, TrendForce said.

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

CHIP DUTIES: TSMC said it voiced its concerns to Washington about tariffs, telling the US commerce department that it wants ‘fair treatment’ to protect its competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reiterated robust business prospects for this year as strong artificial intelligence (AI) chip demand from Nvidia Corp and other customers would absorb the impacts of US tariffs. “The impact of tariffs would be indirect, as the custom tax is the importers’ responsibility, not the exporters,” TSMC chairman and chief executive officer C.C. Wei (魏哲家) said at the chipmaker’s annual shareholders’ meeting in Hsinchu City. TSMC’s business could be affected if people become reluctant to buy electronics due to inflated prices, Wei said. In addition, the chipmaker has voiced its concern to the US Department of Commerce

STILL LOADED: Last year’s richest person, Quanta Computer Inc chairman Barry Lam, dropped to second place despite an 8 percent increase in his wealth to US$12.6 billion Staff writer, with CNA Daniel Tsai (蔡明忠) and Richard Tsai (蔡明興), the brothers who run Fubon Group (富邦集團), topped the Forbes list of Taiwan’s 50 richest people this year, released on Wednesday in New York. The magazine said that a stronger New Taiwan dollar pushed the combined wealth of Taiwan’s 50 richest people up 13 percent, from US$174 billion to US$197 billion, with 36 of the people on the list seeing their wealth increase. That came as Taiwan’s economy grew 4.6 percent last year, its fastest pace in three years, driven by the strong performance of the semiconductor industry, the magazine said. The Tsai