Chip designer Nvidia Corp said on Wednesday that US officials told it to stop exporting to China two top computing chips needed for artificial intelligence work, a move that could cripple Chinese firms’ ability to conduct advanced work such as image recognition, and could hamper Nvidia’s business in China.

The announcement also signals a major escalation of the US crackdown on China’s technological capabilities, as tensions bubble over the fate of Taiwan, where chips for Nvidia and almost every other major chip firm are manufactured.

Nvidia shares fell 6.6 percent after hours.

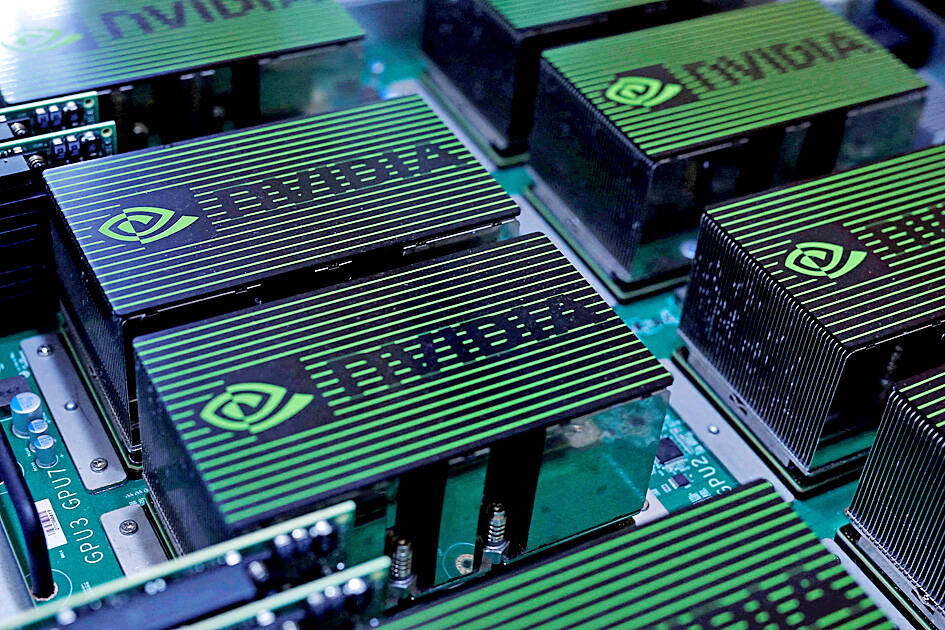

Photo: Tyrone Siu, Reuters

The company said the ban, which affects its A100 and H100 chips designed to speed up machine learning tasks, could interfere with completion of developing the H100, the flagship chip Nvidia announced this year.

Shares of Nvidia rival Advanced Micro Devices (AMD) Inc fell 3.7 percent after hours.

AMD had received new license requirements that stop its MI250 artificial intelligence chips from being exported to China, but it said that its MI100 chips would not be affected, a company spokesperson said, adding that it does not believe the new rules will have a material impact on its business.

Nvidia said that US officials told it the new rule “will address the risk that the covered products may be used in, or diverted to, a ‘military end use’ or ‘military end user’ in China.”

The US Department of Commerce said that it is reviewing its China-related policies and practices to “keep advanced technologies out of the wrong hands.”

“While we are not in a position to outline specific policy changes at this time, we are taking a comprehensive approach to implement additional actions necessary related to technologies, end-uses, and end-users to protect US national security and foreign policy interests,” a spokesperson said.

The Chinese Ministry of Commerce said that the US’ move affects the stability of global industrial and supply chains, while the Chinese Ministry of Foreign Affairs said that US’ attempts to impose a technology blockade to safeguard its hegemony are bound to fail.

Without US chips from companies such as Nvidia and AMD, Chinese organizations would be unable to cost-effectively carry out the kind of advanced computing used for image and speech recognition, among many other tasks.

Image recognition and language processing are common in consumer applications such as smartphones to answer queries and tag photos.

They also have military uses, such as scouring satellite imagery for weapons or bases and filtering digital communications for intelligence-gathering purposes.

Nvidia said that it had booked US$400 million in sales of the affected chips to China this quarter, and would be lost if Chinese firms decide not to buy alternative Nvidia products.

It said it plans to apply for exemptions to the rule, but has “no assurances” that US officials would grant them.

About 10 percent of Nvidia’s data center sales, which investors have closely monitored in recent years, were coming from China and the hit to sales is likely “manageable” for Nvidia, Bernstein financial analyst Stacy Rasgon said.

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be

INFLATION CONSIDERATION: The BOJ governor said that it would ‘keep making appropriate decisions’ and would adjust depending on the economy and prices The Bank of Japan (BOJ) yesterday raised its benchmark interest rate to the highest in 30 years and said more increases are in the pipeline if conditions allow, in a sign of growing conviction that it can attain the stable inflation target it has pursued for more than a decade. Bank of Japan Governor Kazuo Ueda’s policy board increased the rate by 0.2 percentage points to 0.75 percent, in a unanimous decision, the bank said in a statement. The central bank cited the rising likelihood of its economic outlook being realized. The rate change was expected by all 50 economists surveyed by Bloomberg. The