A year after the last wisps of smoke disappeared into the skies from the imposing chimneys of the Moorburg coal plant, hopes had grown that the mothballed site would see new life as Germany scrambles to secure energy supplies.

Moscow’s curtailing of gas exports to Germany in the wake of Russia’s invasion of Ukraine has forced Berlin to make the radical decision to restart coal power stations, at least temporarily.

However, infrastructure issues, worker shortages and logistical problems are proving to be major obstacles for the restart.

Photo: EPA-EFE

At Moorburg, operator Vattenfall GmbH has dashed hopes of new operations, saying that “restarting the plant would be neither technically, economically nor legally feasible.”

“Many parts have been dismantled and sold,” said Robert Wacker, director of the site.

Even power plants that had not been completely shut, but put in reserve to generate power only occasionally, are struggling with a complete reboot.

Further south from Moorburg, energy group Uniper SE is planning to fire up its Heyden 4 site, which had been a reserve plant since the middle of last year.

However, the company warned that its output would be affected by railway capacity limits in ferrying hard coal to the site.

Germany began winding down its coal-fired power plants in the past few years, in view of meeting a target to end the usage of fossil fuels by 2030.

The Ukraine war has upended those plans, as Moscow reduced energy exports to Germany in what Berlin believes is retaliation for its support for Kyiv.

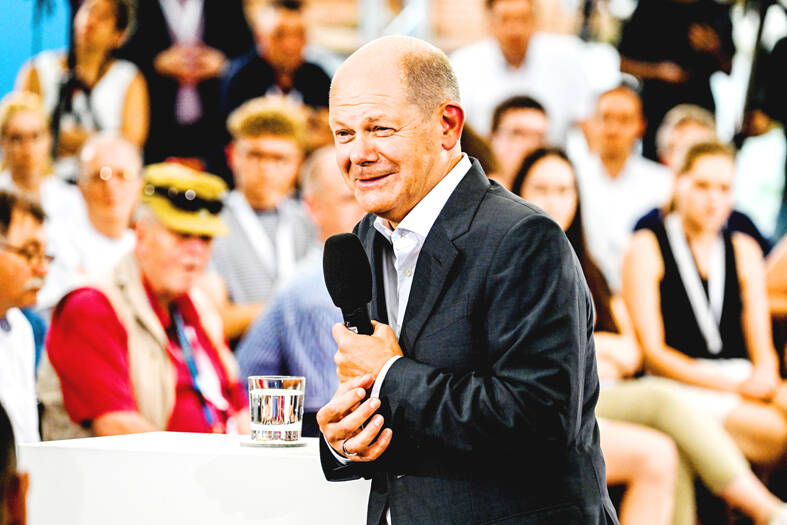

The administration of German Chancellor Olaf Scholz has said it would stick to the 2030 coal exit goal, but in the meantime, it authorized the restart of 27 mothballed plants or those put in reserve to help fill the gap until March 2024.

With a capacity of 875 megawatts (MW), Uniper’s Heyden 4 figures as the largest on the list, while the Moorburg plant, in a suburb of Hamburg, had been one of the most modern in the world.

It was shut down in the summer of last year, just six years after it was put into service, in exchange for a public subsidy program aimed at cutting coal from Germany’s energy mix.

Since then, the operator has started dismantling and selling the parts that are not necessary for hydrogen — a priority for Germany’s future energy sources.

Before it closed, the plant generated about 1.1 terawatts per year — the equivalent of the electricity consumption of Hamburg, Germany’s second-largest city.

Now, the installation is no longer complete. In the turbine hall, thousands of small components have been packed away into boxes. A rotor, an element that allows the turbine to turn, is packed in aluminum, ready to be sent off. The transformer is also no longer functioning.

“Without the transformer, the power plant is no longer linked to the network and cannot produce any electricity,” the operator said.

Pointing at rust that has accumulated on the components over the past year, Vattenfall spokeswoman Gudrun Bode said: “We can’t restart a plant just like that.”

With winter around the corner, the race is getting tighter for Germany to ramp up its power generation capacity.

However, so far, only one — the Mehrum plant with a capacity of 690MW — has restarted. Besides technical issues, power suppliers are struggling with an acute worker shortage.

In Moorburg, “most of those who left have found a job, or are retired,” Wacker said.

Energy giant RWE AG said it is seeking several hundreds of workers as it prepares to reopen three plants with a capacity of 300MW each.

Logistics was also turning out to be tricky, with a drought further putting pressure on the distribution network.

The Rhine River has been a key route for coal transport to power plants in the west of the country, but record-low water levels over the past week have limited shipments and forced suppliers to turn to rail transport, putting further pressure on strained cargo trains.

Uniper has said Heyden 4’s operation would be “limited partly by limits of rail transport capacity bringing coal to the site.”

Energy supplier STEAG GmbH has also said that it would bring into operation two coal-fired plants from its reserve.

It has targeted November as a possible restart date, but it also noted that current rules require sites to have coal supplies for 30 days — something that would be unachievable “given the current tight logistics situation on rail transport.”

In a bid to unblock the jam, Berlin on Wednesday said it would prioritize coal and oil cargo over passenger travel this winter.

With an approval rating of just two percent, Peruvian President Dina Boluarte might be the world’s most unpopular leader, according to pollsters. Protests greeted her rise to power 29 months ago, and have marked her entire term — joined by assorted scandals, investigations, controversies and a surge in gang violence. The 63-year-old is the target of a dozen probes, including for her alleged failure to declare gifts of luxury jewels and watches, a scandal inevitably dubbed “Rolexgate.” She is also under the microscope for a two-week undeclared absence for nose surgery — which she insists was medical, not cosmetic — and is

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

Nintendo Co hopes to match the runaway success of the Switch when its leveled-up new console hits shelves on Thursday, with strong early sales expected despite the gadget’s high price. Featuring a bigger screen and more processing power, the Switch 2 is an upgrade to its predecessor, which has sold 152 million units since launching in 2017 — making it the third-best-selling video game console of all time. However, despite buzz among fans and robust demand for pre-orders, headwinds for Nintendo include uncertainty over US trade tariffs and whether enough people are willing to shell out. The Switch 2 “is priced relatively high”