Commerzbank AG said that Germany could face a slump similar to the contraction seen after the 2008 financial crisis if Russia were to cut off gas supplies.

A bellwether for Europe’s largest economy because it caters to Germany’s small and medium-sized companies, Commerzbank said it would expect to set aside another 500 million euros to 600 million euros (US$509 million to US$611 million) for bad loans as a result.

Last week, larger rival Deutsche Bank AG said that it would have to stash an additional 1 billion euros over two years in such a scenario.

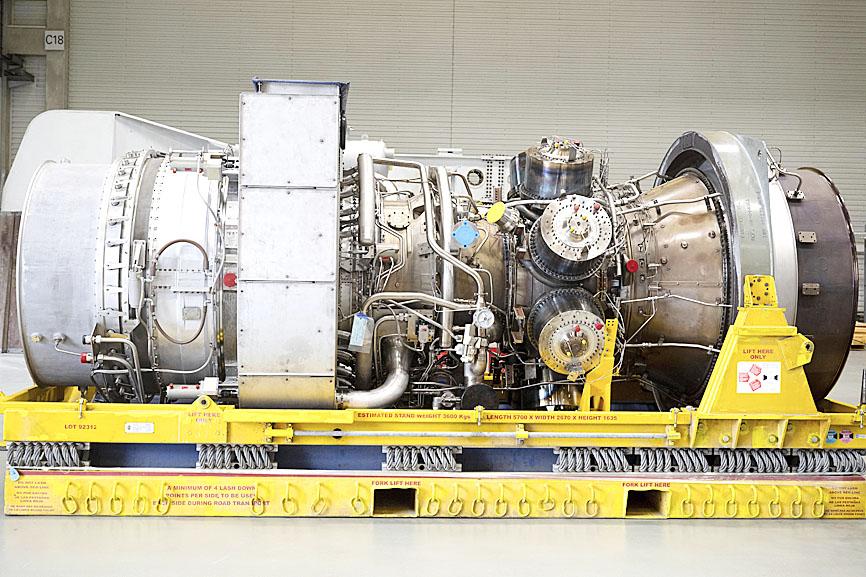

Photo: AP

Germany is among the countries most vulnerable to threats of a shutoff because it built up its reliance on cheap Russian fuel over the past decades. German Minister of Economy Robert Habeck has said Russia’s moves risked a collapse of energy markets and has drawn a parallel to the role of Lehman Brothers Holdings Inc in triggering the credit crunch.

For now, corporate clients “are still doing fine,” because they built up liquidity during the COVID-19 pandemic, Commerzbank chief financial officer Bettina Orlopp said in an interview with Bloomberg TV. “If there would be a complete gas stop, which is a likely scenario also still, then we believe we would see a recession in Germany.”

The potential additional provisions outlined by Commerzbank and Deutsche Bank are equivalent to about 20 basis points of their loan books, they said, though Commerzbank assumes government support in its worst-case scenario while Deutsche Bank does not.

“Every day, every week helps because people get prepared, companies get prepared, the government is preparing,” she said. “The third quarter will be relevant, because hopefully we will know even more, but it’s quite a volatile quarter to be expected.”

Commerzbank also said that it faces an increasingly uphill struggle to keep a lid on costs in the coming years because of rampant inflation.

“For this year, we think that we can really manage the inflation headwinds we see on the energy side, but also on the salary side,” Orlopp said. “Next years — 2023, 2024 — the story will be different, becoming more difficult.”

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

Australian singer Kylie Minogue says “nothing compares” to performing live, but becoming an international wine magnate in under six years has been quite a thrill for the Spinning Around star. Minogue launched her first own-label wine in 2020 in partnership with celebrity drinks expert Paul Schaafsma, starting with a basic rose but quickly expanding to include sparkling, no-alcohol and premium rose offerings. The actress and singer has since wracked up sales of around 25 million bottles, with her carefully branded products pitched at low-to mid-range prices in dozens of countries. Britain, Australia and the United States are the biggest markets. “Nothing compares to performing

AUSPICIOUS TIMING: Ostensibly looking to spike the guns of domestic rivals, ByteDance launched the upgrade to coincide with the Lunar New Year China’s ByteDance Ltd (字節跳動) has rolled out its Doubao 2.0 model, an upgrade of the country’s most widely used artificial-intelligence (AI) app, the company announced on Saturday. ByteDance is one of several Chinese firms hoping to generate overseas and domestic buzz around its new AI models during the Lunar New Year holiday, which began yesterday, when hundreds of millions of Chinese partake in family gatherings in their hometowns. The company, like rival Alibaba Group Holding Ltd (阿里巴巴), was caught off-guard by DeepSeek’s (深度求索) meteoric rise to global fame during last year’s Spring Festival, when Silicon Valley and investors worldwide were

It is not just people — in China, the robots are also getting ready to celebrate the Lunar New Year. Friday was dress rehearsal day for four cute humanoid robots, each about 95 centimeters tall, at a mall in western Beijing. Curious onlookers stopped to watch. Each robot got a colorful lion costume and within minutes the moves started: Bend the knees, up, to the left, to the right, shake the mask, and do it all again. Ahead of the Lunar New Year, and as part of different “fairs” and activities around Beijing, some venues have been busy setting up their stages and