Taiwan would emerge unscathed from China’s retaliatory actions to protest US House of Representatives Speaker Nancy Pelosi’s visit to Taipei, top monetary and financial officials said yesterday.

Central bank Governor Yang Chin-long (楊金龍) shrugged off unease over potential instability in the foreign exchange and stock markets after foreign portfolio funds trimmed their holdings of local shares for two straight days amid Beijing’s threats of retaliation.

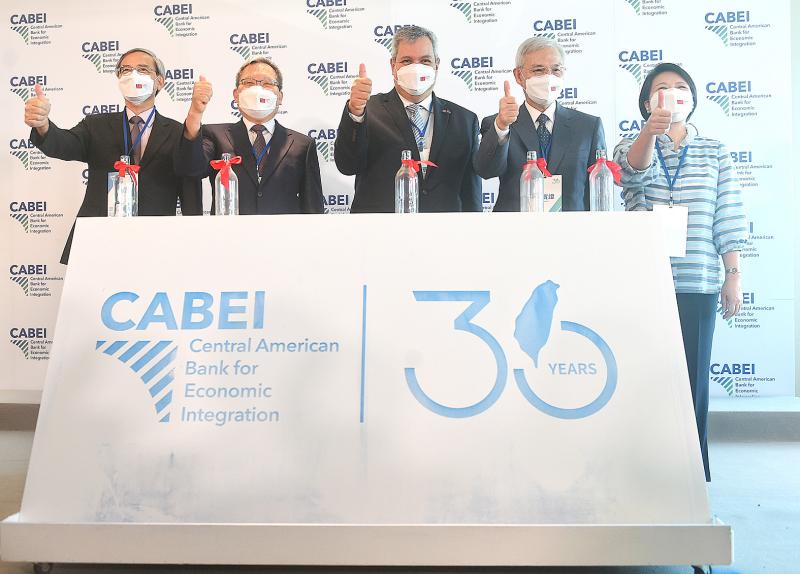

“There is no need to worry,” Yang said on the sidelines of an event to celebrate the first anniversary of the opening of Central American Bank for Economic Integration’s (CABEI) Taipei office and the 30th anniversary of Taiwan becoming a member of CABEI.

Photo: Chang Chia-ming, Taipei Times

Taiwan has sufficient foreign exchange reserves to rein in unexpected and abnormal developments, Yang said when asked to comment on the currency market.

The New Taiwan dollar yesterday closed up 0.06 percent at NT$29.990 versus the US dollar in Taipei trading amid a normal trading volume of US$926 million.

Yang said the recent selling of local shares by foreign institutional players was “typical” for this time of the year.

Foreign portfolio managers tend to wire cash dividends abroad in August, putting depreciation pressure on the NT dollar.

Minister of Finance Su Jain-rong (蘇建榮) said China’s ban on imports of citrus fruit and two types of fish from Taiwan would have a very limited effect on the nation’s overall export figures.

China’s customs agency on Monday night imposed temporary import bans on more than 100 Taiwanese food brands, including I-Mei Foods Co (義美食品), Wei Chuan Foods Corp (味全食品) and Kuo Yuan Ye Foods Co (郭元益食品).

China and Hong Kong accounted for 25 percent of processed food exports in the first six months of this year, down from 43 percent in previous years, as local suppliers expanded export markets, Su told reporters at the CABEI event.

Processed food bound for the two markets amounted to US$240 million a year, or only 0.1 percent of total exports, Su said.

Similarly, China’s suspension of natural sand exports to Taiwan would cause little inconvenience, as local construction projects rely mostly on domestically sourced sand, Su said, adding that most China-sourced sand is sea sand that cannot be used in construction projects.

The American Chamber of Commerce in Taiwan said in a statement that it appreciated the extra support and interest from US officials in backing Taiwan.

While official visits carry important symbolic meaning, the chamber’s 71-year history has demonstrated how the peaceful pursuit of commerce contributes to prosperity and innovation on a regional and global level, the chamber said.

“We believe that further investment in the US-Taiwan economic relationship remains the best course to ensure the continuation of this progress,” it said.

The US and Taiwan are uniquely equipped to tackle challenges and opportunities, from public health, semiconductors, digital, and supply chain resilience to the development of sustainable sources of energy and talent, it said.

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Taiwan has enough crude oil reserves for more than 100 days and sufficient natural gas reserves for more than 11 days, both above the regulatory safety requirement, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday, adding that the government would prioritize domestic price stability as conflicts in the Middle East continue. Overall, energy supply for this month is secure, and the government is continuing efforts to ensure sufficient supply for next month, Kung told reporters after meeting with representatives from business groups at the ministry in Taipei. The ministry has been holding daily cross-ministry meetings at the Executive Yuan to ensure

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing