Taiwan would emerge unscathed from China’s retaliatory actions to protest US House of Representatives Speaker Nancy Pelosi’s visit to Taipei, top monetary and financial officials said yesterday.

Central bank Governor Yang Chin-long (楊金龍) shrugged off unease over potential instability in the foreign exchange and stock markets after foreign portfolio funds trimmed their holdings of local shares for two straight days amid Beijing’s threats of retaliation.

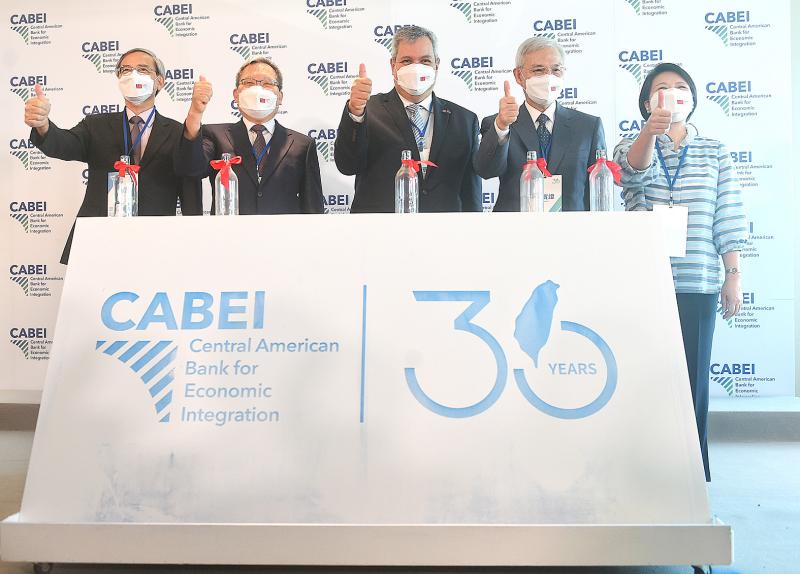

“There is no need to worry,” Yang said on the sidelines of an event to celebrate the first anniversary of the opening of Central American Bank for Economic Integration’s (CABEI) Taipei office and the 30th anniversary of Taiwan becoming a member of CABEI.

Photo: Chang Chia-ming, Taipei Times

Taiwan has sufficient foreign exchange reserves to rein in unexpected and abnormal developments, Yang said when asked to comment on the currency market.

The New Taiwan dollar yesterday closed up 0.06 percent at NT$29.990 versus the US dollar in Taipei trading amid a normal trading volume of US$926 million.

Yang said the recent selling of local shares by foreign institutional players was “typical” for this time of the year.

Foreign portfolio managers tend to wire cash dividends abroad in August, putting depreciation pressure on the NT dollar.

Minister of Finance Su Jain-rong (蘇建榮) said China’s ban on imports of citrus fruit and two types of fish from Taiwan would have a very limited effect on the nation’s overall export figures.

China’s customs agency on Monday night imposed temporary import bans on more than 100 Taiwanese food brands, including I-Mei Foods Co (義美食品), Wei Chuan Foods Corp (味全食品) and Kuo Yuan Ye Foods Co (郭元益食品).

China and Hong Kong accounted for 25 percent of processed food exports in the first six months of this year, down from 43 percent in previous years, as local suppliers expanded export markets, Su told reporters at the CABEI event.

Processed food bound for the two markets amounted to US$240 million a year, or only 0.1 percent of total exports, Su said.

Similarly, China’s suspension of natural sand exports to Taiwan would cause little inconvenience, as local construction projects rely mostly on domestically sourced sand, Su said, adding that most China-sourced sand is sea sand that cannot be used in construction projects.

The American Chamber of Commerce in Taiwan said in a statement that it appreciated the extra support and interest from US officials in backing Taiwan.

While official visits carry important symbolic meaning, the chamber’s 71-year history has demonstrated how the peaceful pursuit of commerce contributes to prosperity and innovation on a regional and global level, the chamber said.

“We believe that further investment in the US-Taiwan economic relationship remains the best course to ensure the continuation of this progress,” it said.

The US and Taiwan are uniquely equipped to tackle challenges and opportunities, from public health, semiconductors, digital, and supply chain resilience to the development of sustainable sources of energy and talent, it said.

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”