The US is pushing the Netherlands to ban ASML Holding NV from selling chipmaking technology to China, as it expands its campaign to curb China’s rise, people familiar with the matter have said.

Washington’s proposed restriction would expand an existing moratorium on the sale of the most advanced systems to China, in an attempt to thwart its plans to become a world leader in chip production.

If the Netherlands agrees, it would significantly broaden the range and class of chipmaking gear that is forbidden from heading to China, potentially dealing a serious blow to Chinese chipmakers from Semiconductor Manufacturing International Corp (SMIC, 中芯國際) to Hua Hong Semiconductor Ltd (華虹半導體).

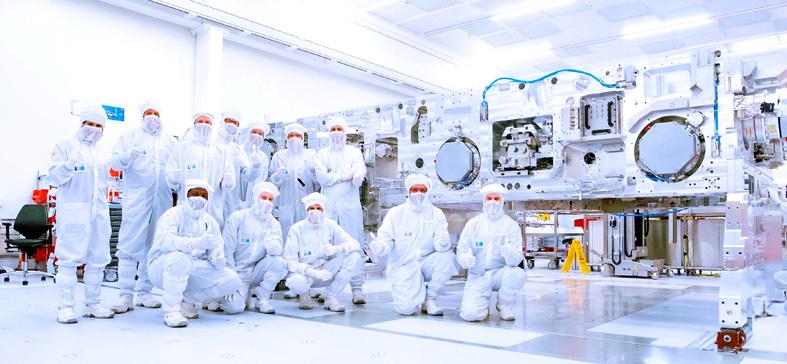

Photo: REUTERS / ASML

US officials are lobbying their Dutch counterparts to bar ASML from selling some of its older deep ultraviolet (DUV) lithography systems, the people said.

These machines are a generation behind cutting-edge, but still the most common method in making certain less advanced chips required by vehicles, smartphones, computers and robots.

The issue arose during US Deputy Secretary of Commerce Don Graves’ visit to the Netherlands and Belgium in late May and early last month to discuss supply chain issues, said the people, who asked not to be identified because the discussions were private.

Photo: REUTERS

During that trip, Graves also visited ASML’s headquarters in Veldhoven and met chief executive officer Peter Wennink.

The Dutch government has yet to agree to any additional restrictions on ASML’s exports to Chinese chipmakers, which could hurt the country’s trade ties with China, the people said.

ASML is unable to ship its most advanced extreme ultraviolet (EUV) lithography systems, which cost about 160 million euros (US$163 million) per unit, to China as it cannot obtain an export license from the Dutch government.

The US Department of Commerce and the Dutch Ministry of Foreign Affairs declined to comment.

“The discussion is not new. No decisions have been made, and we do not want to speculate or comment on rumors,” an ASML spokeswoman said.

ASML is the world’s top maker of lithography systems, machines that perform a crucial step in the process of creating semiconductors. ASML’s dominance of the market for that type of equipment means that further cutting China off from access to its products would undermine its ambitions to make itself more self-sufficient in production of the crucial electronic components.

“China’s share of the global chip equipment market is negligible,” said Alex Capri, a research fellow at the Asia-based Hinrich Foundation, characterizing chip production as “a choke point” in China’s plans to bulk up its semiconductor muscle.

The older-generation DUV machinery is less capable than more advanced EUV equipment, but remains indispensable in manufacturing many of the types of chips that are currently experiencing acute shortages.

Washington is focused on banning sales of the most advanced type of DUV technology, immersion lithography machines, the people said.

US officials are also trying to exert pressure on Japan to stop shipping the same technology to Chinese chipmakers, one of the people said.

Japan’s Nikon Corp competes with ASML in this area.

Immersion lithography is also known as argon fluoride immersion.

China-based Founder Securities Co (方正證券) said that ASML sold 81 such systems last year, compared with four from Nikon, giving the Dutch firm a 95 percent market share.

“We have no information regarding this matter,” a Nikon spokeswoman said.

Dutch Prime Minister Mark Rutte last month said he is against reconsidering trade relations with China and called for the EU to develop its own policies toward Beijing.

China is the Netherlands’ third-biggest trade partner after Germany and Belgium.

ASML opposes a ban on sales of DUV equipment to China because it is already a mature technology, Wennink said earlier this year.

Chinese-based facilities, run by either domestic or foreign companies, accounted for 14.7 percent of ASML’s total revenue last year, according to company disclosures and data compiled by Bloomberg.

ASML is also accusing a Chinese tech firm supported by the country’s government of intellectual property infringement.

Major US chip equipment makers including Applied Materials Inc and Lam Research Corp are already banned from selling certain advanced products to SMIC due to national security concerns. The potential DUV ban could further hit SMIC and its Chinese peers.

“Lithography equipment is the most difficult equipment for China to replace when it comes to semiconductor production,” said Johnson Wang (王忠慶), an analyst at the Taiwan Institute of Economic Research (台灣經濟研究院). “Without access to foreign DUV lithography equipment, the progress of China’s chip industry could come to a halt.”

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It