A global chip supply crunch is expected to ease next year, following a series of capacity expansions by foundry service providers over a three-year period to next year, the Market Intelligence and Consulting Institute (MIC, 產業情報研究所) said on Wednesday.

The world’s foundry services providers led by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are to boost capacity by 10 percent this year and 7 percent next year, after experiencing 10 percent annual growth last year, the Taipei-based institute said.

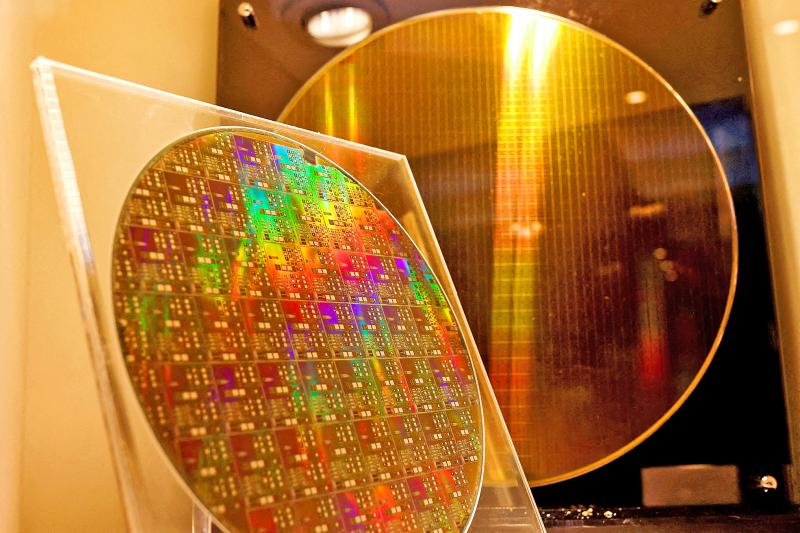

The global output of 8-inch wafers is to increase to 10 million units per month next year, up about 25 percent from fewer than 8 million units in 2020, it forecast.

Photo: Reuters

The imbalance in chip supply and demand became evident last year as the stay-at-home economy, driven by the COVID-19 pandemic, boosted demand for notebook computers, coupled with demand for smartphones and vehicles, MIC senior analyst Cheng Kai-an (鄭凱安) said at a virtual technology forum.

“As global foundry service providers continue expanding capacity, we expect semiconductor supply to become stable gradually in 2023,” Cheng said.

With slowing demand for PCs and consumer electronics this year due to high inflation, and the economic effects from COVID-19 and Russia’s invasion of Ukraine, chip supply surplus may return in 2024, he said.

Chipmakers should carefully adjust their capacity increases to cope with short-term oversupply, he added.

Chip designers started to feel the pinch of slumping demand for smartphones and consumer electronics in the first half of this year, leading to falling demand for display driver ICs used in smartphones and TVs, Cheng said.

Chip designers are scaling back orders with their foundry partners as a result, but supply of power management ICs and microcontrollers remains insufficient, he said.

In the long term, 5G-related devices, high-performance computing applications and automotive electronics are expected to continue driving semiconductor demand and growth, Cheng said.

Chinese chipmakers are boosting capacity faster than their global peers, benefiting from Chinese government funding, as Beijing seeks to reach 70 percent of chip self-sufficiency by 2025, the institute said.

However, that target is impractical, as China is expected to boost chip supply within the country to 19.4 percent in 2025, from 15.9 percent in 2020, Cheng said, citing data from semiconductor market research firm IC Insights.

Rapid capacity expansion boosted China’s ranking to No. 1 in the world’s foundry industry last year, with a market share of 22.6 percent, the MIC said.

Taiwan was No. 2 with an 18.9 percent share, followed by South Korea with 17.3 percent, MIC data showed.

Local semiconductor companies’ production value is expected to grow 17.5 percent annually to NT$4.37 trillion this year, outpacing the world semiconductor industry’s 10.4 percent growth, the MIC said.

RUN IT BACK: A succesful first project working with hyperscalers to design chips encouraged MediaTek to start a second project, aiming to hit stride in 2028 MediaTek Inc (聯發科), the world’s biggest smartphone chip supplier, yesterday said it is engaging a second hyperscaler to help design artificial intelligence (AI) accelerators used in data centers following a similar project expected to generate revenue streams soon. The first AI accelerator project is to bring in US$1 billion revenue next year and several billion US dollars more in 2027, MediaTek chief executive officer Rick Tsai (蔡力行) told a virtual investor conference yesterday. The second AI accelerator project is expected to contribute to revenue beginning in 2028, Tsai said. MediaTek yesterday raised its revenue forecast for the global AI accelerator used

TEMPORARY TRUCE: China has made concessions to ease rare earth trade controls, among others, while Washington holds fire on a 100% tariff on all Chinese goods China is effectively suspending implementation of additional export controls on rare earth metals and terminating investigations targeting US companies in the semiconductor supply chain, the White House announced. The White House on Saturday issued a fact sheet outlining some details of the trade pact agreed to earlier in the week by US President Donald Trump and Chinese President Xi Jinping (習近平) that aimed to ease tensions between the world’s two largest economies. Under the deal, China is to issue general licenses valid for exports of rare earths, gallium, germanium, antimony and graphite “for the benefit of US end users and their suppliers

Dutch chipmaker Nexperia BV’s China unit yesterday said that it had established sufficient inventories of finished goods and works-in-progress, and that its supply chain remained secure and stable after its parent halted wafer supplies. The Dutch company suspended supplies of wafers to its Chinese assembly plant a week ago, calling it “a direct consequence of the local management’s recent failure to comply with the agreed contractual payment terms,” Reuters reported on Friday last week. Its China unit called Nexperia’s suspension “unilateral” and “extremely irresponsible,” adding that the Dutch parent’s claim about contractual payment was “misleading and highly deceptive,” according to a statement

Artificial intelligence (AI) giant Nvidia Corp’s most advanced chips would be reserved for US companies and kept out of China and other countries, US President Donald Trump said. During an interview that aired on Sunday on CBS’ 60 Minutes program and in comments to reporters aboard Air Force One, Trump said only US customers should have access to the top-end Blackwell chips offered by Nvidia, the world’s most valuable company by market capitalization. “The most advanced, we will not let anybody have them other than the United States,” he told CBS, echoing remarks made earlier to reporters as he returned to Washington