Taiwan’s market share in advanced industries relative to its size is more than double the world average, driven almost solely by its dominance in computers and electronics, a report issued on Wednesday by a Washington-based research institute showed.

The report by the Information Technology and Innovation Foundation measured the performance of 10 leading economies across seven key sectors in the years 1995, 2006 and 2018.

The sectors included pharmaceuticals; medicinal, chemical and botanical products; electrical equipment; machinery and equipment; motor vehicle equipment; other transport equipment; computer, electronic and optical products; and information technology and information services.

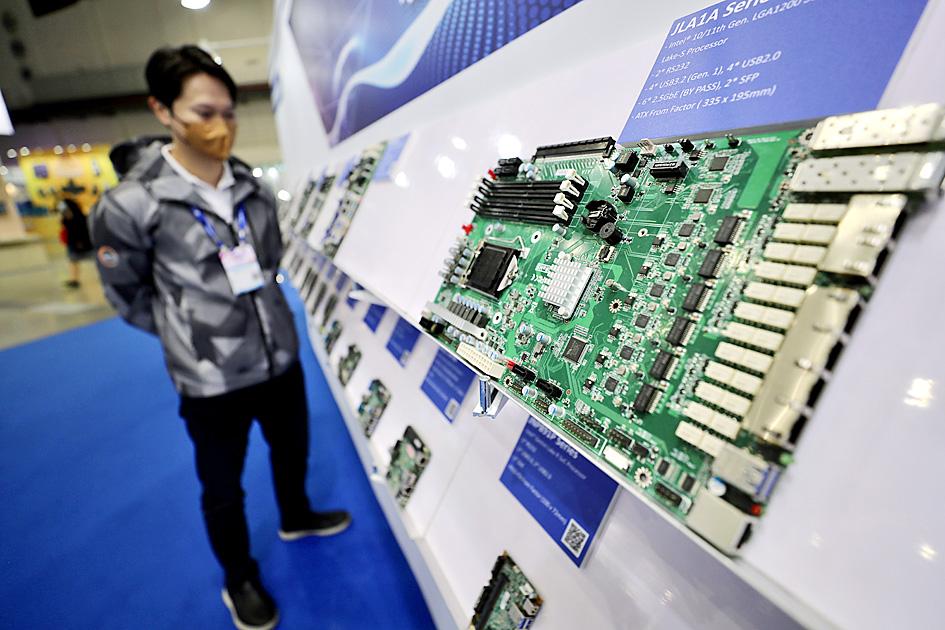

Photo: Ritchie B. Tongo, EPA-EFE

It found that in 2018, Taiwan’s market share in the industries relative to its size was 219 percent higher than the global average, followed by South Korea at 206 percent.

By contrast, Germany’s relative share of the global market in those sectors was 74 percent higher than the global average, Japan’s was 43 percent higher and China’s 34 percent higher, while the US finished below the global average.

In terms of performance, the report said that Taiwan’s global share of advanced industrial production sectors had declined slightly over the past 25 years, slipping in six of the seven industry categories.

However, in one industry category — computers, electronics and optics — Taiwan’s global share grew by 1.3 percentage points, largely due to the performance of companies such as Taiwan Semiconductor Manufacturing Co (台積電) and Hon Hai Precision Industry Co (鴻海精密).

Overall, Taiwan’s advanced industrial output was “the least diversified” of the countries in the study, with almost nine times more computer and electronics production as a share of its economy than the global average, the report said.

“Because of this, advanced industries make up more than twice the share of its economy as the global average,” despite Taiwan’s weakness in industries such as pharmaceuticals and automobiles, it said.

More broadly, the report aimed to highlight the US’ relatively weak position in a range of advanced industries that are strategically important for economic and national security.

Compared with China, whose share of global output in the industries grew from less than 4 percent in 1995 to 21.5 percent in 2018, the US’ market share fell from 24 percent to 22.5 percent, the report said.

Calling the findings “an urgent wake-up call,” it urged the US government to launch an economic “moon shot” initiative aimed at increasing its relative level of advanced industry concentration by 20 percentage points over the next decade.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the