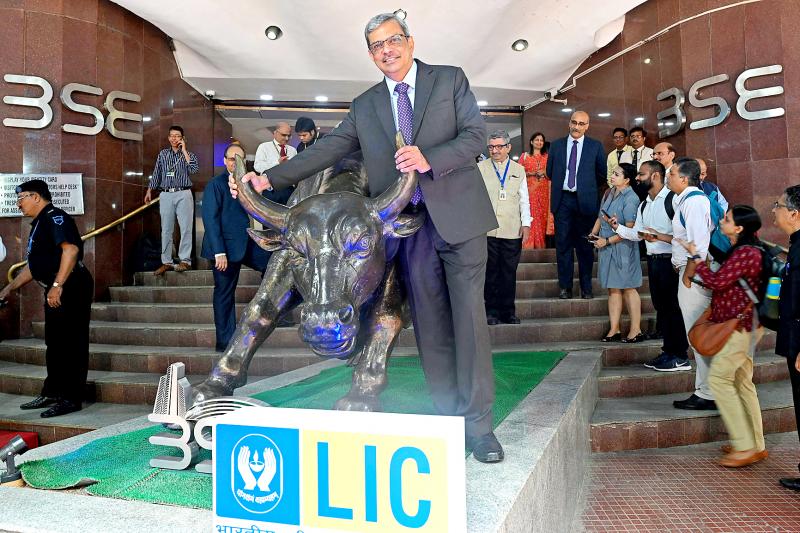

State-owned Life Insurance Corp of India (LIC) slumped on its market debut yesterday following the country’s biggest-ever initial public offering (IPO), opening 7 percent below the offer price.

Indian Prime Minister Narendra Modi’s government raised US$2.7 billion by selling 3.5 percent of LIC as his administration seeks to privatize state assets to plug a gaping budget deficit.

However, it was forced to cut back the offer from a planned 5 percent after markets turned volatile following Russia’s invasion of Ukraine and China’s COVID-19 lockdowns.

Photo: AFP

The offer price of 949 rupees had valued LIC at US$77 billion, but it opened yesterday on Mumbai’s exchange trading 7 percent lower. The share price fall expanded to 9.4 percent before recovering slightly.

The muted debut could test the appetite of new shareholders for further flotations of nationalized companies as Modi seeks to sell off state assets to plug an estimated 16.6 trillion rupee (US$213.5 billion) fiscal deficit.

The IPO saw enthusiastic participation from small investors and was oversubscribed nearly three times during the six-day application period.

However, foreign investors have withdrawn a net 1.71 trillion rupees from Indian equities so far this year, stock exchange data showed, as the US monetary policy tightening further roiled sentiment.

Founded in 1956 by nationalizing and combining more than 240 firms, LIC was for decades synonymous with life insurance in post-independence India, until the entry of private companies in 2000.

It continues to lead the pack with a 61 percent share of the market in India, with its army of 1.3 million “LIC agents” giving it huge reach, particularly in remote rural areas.

However, LIC’s market share has slid steadily in the face of competition from net-savvy private insurers offering specialized products.

The firm said in its regulatory filing that “there can be no assurance that our corporation will not lose further market share” to private companies.

The IPO followed a years-long effort by bankers and bureaucrats to appraise the mammoth insurer and prepare it for listing.

LIC is also India’s largest asset manager, with 39.55 trillion rupees under management as of Sept. 30, including significant stakes in Indian blue chips such as Reliance and Infosys.

LIC’s real-estate assets include vast offices at prime urban sites, including a 15-story office in Chennai that was once the country’s tallest building.

The firm is also believed to own a large collection of rare and valuable artwork that includes paintings by MF Husain — known as the Pablo Picasso of India — although the value of these holdings has not been made public.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the