The Industrial Technology Research Institute (ITRI, 工研院) yesterday raised its growth forecast for Taiwan’s semiconductor industry, expecting production value to expand about 19.4 percent to NT$4.88 trillion (US$164.24 billion) this year, primarily aided by stronger growth from foundry companies amid a chip crunch.

That means the output of Taiwan’s semiconductor industry would again outpace that of its global peers, which collectively are expected to grow 10.4 percent this year, ITRI said.

The institute three months ago estimated that the production value of the nation’s semiconductor industry would grow 17.7 percent annually to NT$4.81 trillion this year, compared with NT$4.08 trillion last year.

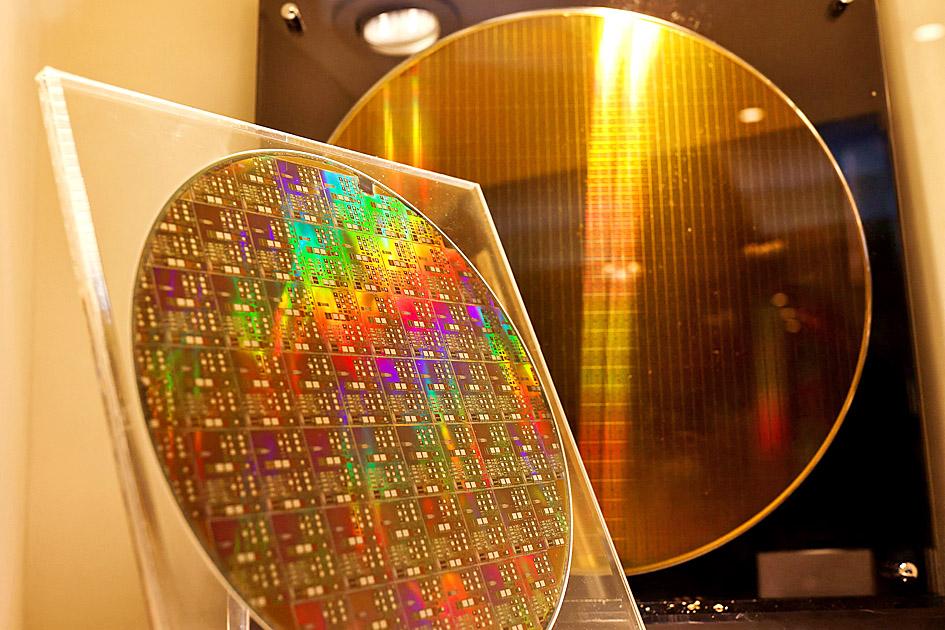

Photo: Ann Wang, Reuters

The production value of the foundry sector, the biggest contributor to the industry, is expected to grow 28 percent to top NT$2.49 trillion this year, compared with an earlier estimate of 24 percent expansion, the institute said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest foundry service provider, yesterday posted record revenue of NT$172.56 billion for last month, surging 55 percent annually and up 0.3 percent monthly.

That brought TSMC’s revenue in the first four months of this year to NT$663.64 billion, soaring 40.1 percent from NT$473.73 billion in the same period last year.

Powerchip Semiconductor Manufacturing Corp (力積電), which primarily makes display driver and power management ICs, reported revenue last month surged about 48 percent year-on-year to a record NT$7.33 billion, with cumulative revenue in the first four months jumping 54.14 percent to NT$28.04 billion.

Production value at chip designers, the second-biggest contributor to the nation’s semiconductor industry, are expected to climb 14 percent annually to NT$1.38 trillion this year, the institute said.

Handset chip designer MediaTek Inc (聯發科) reported that revenue increased 43.89 percent annually to NT$52.63 billion last month, the second-largest monthly level in the firm’s history.

Revenue in the four-month period totaled NT$195.34 billion, up 35.08 percent year-on-year, the company said.

ITRI said that local chip testers’ production value would grow 9.6 percent annually to NT$222.5 billion this year, higher than its February estimate of an 8.4 percent rise to NT$220 billion.

However, memorychip makers’ production value would rise 7.6 percent to NT$309.8 billion this year, a downward revision from its February prediction of a 10.7 percent increase to NT$318.8 billion, it said.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at