E Ink Holdings Inc (元太科技), the world’s biggest e-paper display supplier, yesterday said revenue would continue to grow on an annual basis in the first half of the year, as large-scale retailers such as Walmart Inc are accelerating their adoption of electronic shelf labels (ESLs).

E ink said it is seeing rapidly growing demand for ESLs from hypermarkets in Europe, as retailers are motivated to push for store digitalization due to rising labor costs and a shortage of labor.

“We think higher inflation will boost ESL demand. We are seeing stronger demand and more companies are talking about installing ESLs in stores to cope with workforce reductions. Labor costs go up with inflation,” E Ink chairman Johnson Lee (李政昊) told an online investors’ conference in Taipei.

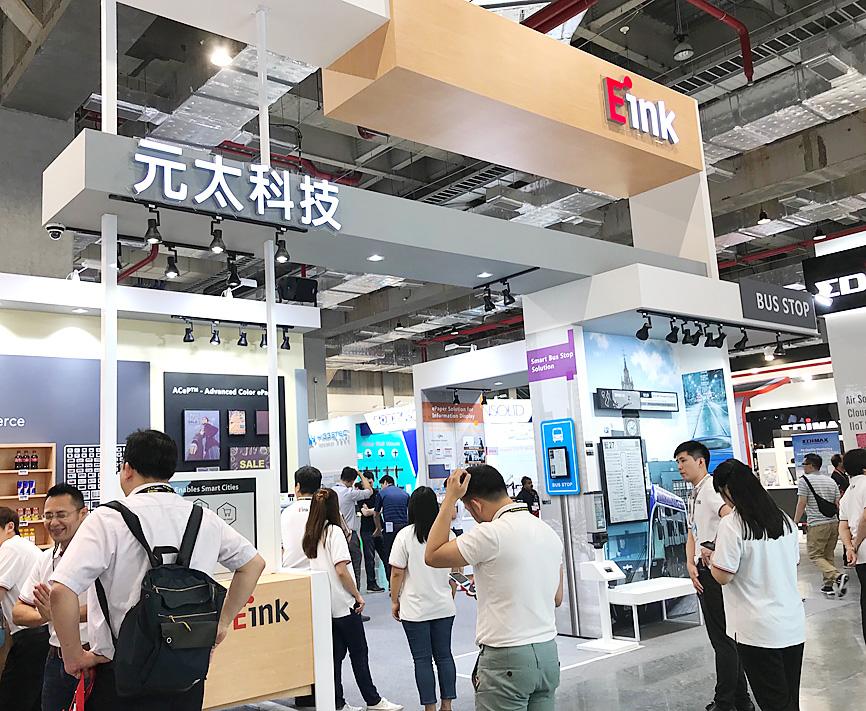

Photo: Chen Mei-ying, Taipei Times

SES-imagotag, an E Ink customer, earlier this month said that it has partnered with Walmart to digitize store shelves in all of the retailer’s outlets.

The company does not expect high inflation to reduce e-reader sales, Lee said, adding that inflation would likely stimulate sales as reading is a relatively inexpensive leisure activity.

“Demand is stronger than we would have imagined,” Lee said. “Demand is not our concern now. Our challenge is to increase the pace at which we’re expanding capacity.”

Revenue in the first two quarters of this year is expected to be higher than the NT$8.49 billion (US$297.36 million) recorded in the same period last year, E Ink chief financial officer Lloyd Chen (陳樂群) said.

Gross margin is also likely to rise in the January-to-June period, as a shortage of key components, such as chips and LCD displays, improved and they became cheaper, Chen said.

Gross margin stood at 45.58 percent in the first half of last year, company data showed.

To handle robust demand, E Ink said it would double capital expenditure to between NT$5 billion and NT$6 billion this year.

E Ink said it would this year launch four new production lines, which would increase capacity by 1.3 to 1.5 times.

The expansion is constrained by longer-than-expected lead times on equipment, it said.

E Ink said it is also in talks with its module partners to study the feasibility of building module assembly lines outside China, because revenue last month fell 5.42 percent year-on-year as COVID-19 restrictions in China closed its factory and its partners’ factories.

To fund capacity expansion, E Ink said it lowered its cash payout ratio this year to about 71 percent from 85 percent last year.

The company’s board of directors has approved the distribution of a cash dividend of NT$3.2 per common share.

E Ink’s earnings per share jumped about 43 percent to NT$4.53 last year, up from NT$3.18 in 2020.

Net profit for the whole of last year increased to NT$5.15 billion from NT$3.6 billion a year earlier.

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)