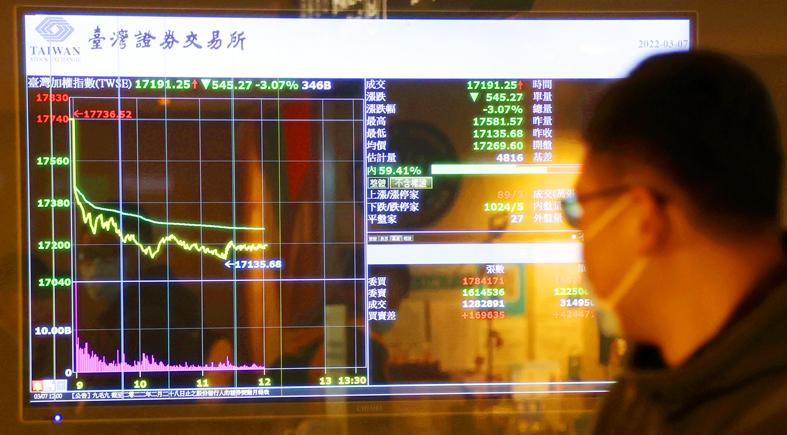

The TAIEX yesterday tumbled 3.15 percent, or 557.83 points, to 17,178.69, while the New Taiwan dollar fell 0.48 percent against the US dollar to NT$28.25, an 11-month low, dragged by capital flight as the US threatened more drastic sanctions against Russia and oil prices skyrocketed, traders said.

Turnover on the main board was NT$456.783 billion (US$16.17 billion), the highest in more than seven months, Taiwan Stock Exchange (TWSE) data showed, while transaction volume hit a 13-year-high of US$2.533 billion on the Taipei Forex Inc during the session.

Minister of Finance Su Jain-rong (蘇建榮) and TWSE officials called for calm amid escalating tensions between Russia and Ukraine, saying that the local board, although pummeled by panic sell-offs, remained healthy in light of active trading and strong economic bellwethers.

Photo: CNA

The ministry is today to release trade data for last month and exports are expected to have grown, despite Lunar New Year holiday disruptions, Su said.

The state-run National Stabilization Fund is closely monitoring the local board and would intervene whenever it sees fit, Su said.

He dismissed claims that the NT$500 billion fund would stay on the sidelines unless the TAIEX slumps below the 10-year moving average.

“There is no need for preconditions to activate the fund,” Su said.

Foreign investors continued to move funds out of Taiwan yesterday, with portfolio managers cutting holdings in local shares by NT$82.24 billion, the second-largest in history and compared with net sales of NT$63.44 billion last week, TWSE data showed.

Mutual funds increased net positions by NT$7.63 billion yesterday, while proprietary traders offloaded NT$3.68 billion of shares, exchange data showed.

Technology heavyweights were again hit by concerns over energy sanctions, with contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) coming into focus as investors unloaded liquid stocks with relatively high valuations.

TSMC lost 3.19 percent to close at NT$576. TSMC’s downturn contributed more than 150 points to the TAIEX’s decline yesterday, and led the electronics sector to drop 3.49 percent and the semiconductor sub-index to lose 3.65 percent.

Amid rising crude prices, Formosa Petrochemical Corp (台塑石化) appeared resilient compared with tech stocks, ending the day unchanged at NT$100.5, while stocks in the steel industry performed better than expected, which traders attributed to expectations that the Western sanctions on Russia would reduce the global steel supply and improve the pricing power of suppliers elsewhere.

The financial sector faced heavy selling, falling 2.74 percent to add pressure to the broader market, traders said.

State-run First Securities Investment Trust Co (第一金投信) said the TAIEX would remain weak in next three months, as it has fallen below the yearly moving average.

The latest panic sell-offs came after the US threatened to impose an oil embargo on Russia and international crude prices soared to near US$140 per barrel, fueling concerns that inflation would erode corporate profits, First Securities said.

Technology shares bore the brunt, as they have higher price evaluations and could be further affected by shortages of component raw materials, a significant portion of which is controlled by Russia, First Securities said.

Investors tend to seek safety in the US dollar in times of global turmoil, dealers said.

TWSE said that the war in Ukraine has little bearing on Taiwan, whose economy is expected to grow by more than 4 percent this year on top of a 6.28 percent pickup last year.

Listed companies in January reported an 8.92 percent increase in cumulative revenue, and would soon distribute cash and stock dividends in line with last year’s impressive earnings, the exchange said.

Additional reporting by CNA

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their