Micron Technology Inc, the biggest maker of computer memory chips in the US, said that the growing crisis in Ukraine highlighted the complexity and vulnerability of the semiconductor supply chain.

Some of the gases used in the production of chips come from the country, which the US says Russia is invading.

“For Micron, we have a small part of our noble gases coming from Ukraine and, of course, we carry large inventory, but more importantly have multiple sources of supply,” Micron chief executive officer Sanjay Mehrotra said, referring to a group of nonreactive gases such as neon. “While we continue to monitor the situation carefully and certainly hope the situation will de-escalate, we believe, based on current analysis, that our supply chain of noble gases is in reasonable shape.”

Shortages of electronic components, caused by a surge in demand and limited increases in production, have made the semiconductor industry particularly vulnerable to shifts in geopolitics. The COVID-19 pandemic and a series of human-made and natural hazards have also highlighted the fragility of a supply chain that spans the globe.

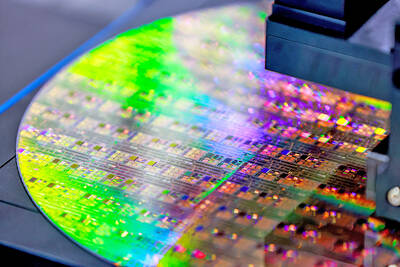

Manufacturing a semiconductor, which takes three to four months from start to finish, is a complex photolithographic process that requires many steps to build the tiny circuits on sheets of silicon. It is dependent on the supply of rare chemicals, and even when manufacturing is complete, chips are often moved to other parts of the world to be packaged, tested and installed in the devices that depend on them.

Mehrotra said that the shortages, which have reduced shipments of everything from home appliances to smartphones and vehicles, are improving in some respects, but have not made hoped-for progress in others.

Shipments of smartphones and computers, the two biggest product categories that use Micron’s memory chips, have been held back by shortages of basic analogue chips. That in turn has led PC makers to pare orders to companies such as Micron.

“We are coming into the year certainly expecting the supply chain shortages to improve for the non-memory components we procure from other suppliers,” Mehrotra said, adding that the rate of improvement for the shortages “is behind what we were hoping for.”

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the