From Albert Einstein’s notes to a record-breaking Frida Kahlo to a 6.6 million euro (US$6.79 million) triceratops — auction houses have lately seen a string of record-breaking items going under the hammer and through the roof.

Valuations are becoming hard to judge.

On Wednesday, the Einstein manuscript went for 11.3 million euros in Paris, five times its expected price.

Photo: AFP

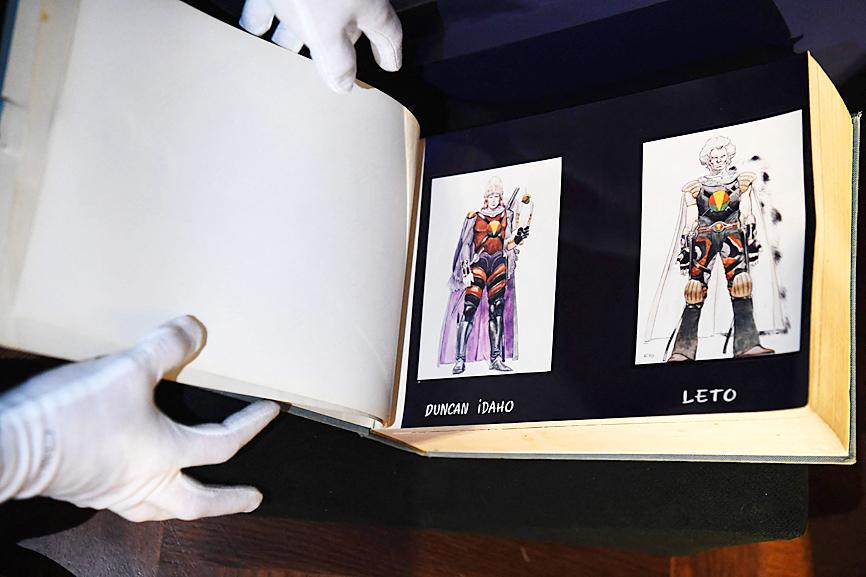

That came just days after a storyboard for the failed 1970s film version of Dune sparked a bidding war that pushed the price 100 times above the valuation to 2.7 million euros.

NEW INTEREST

Market watcher Artprice credits a transition to online sales for sparking new levels of interest, particularly in the US and Asia.

“The auction houses were very behind the times, but COVID forced them to modernize and the result is that online sales have been spectacular and have attracted a new audience,” Artprice founder Thierry Ehrmann said.

Many dynamics are changing, he said, giving the example of 30-somethings who prefer to collect art than buy their first home.

After an initial freeze as the COVID-19 pandemic took hold last year, online auctions exploded later in the year as millions hunted for new ways to kill time and spend money during lockdowns.

With stock markets soaring in the pandemic, the rich got significantly richer, while struggling to find ways to spend it. This has helped push the old masters to new heights. This month alone in New York, a Van Gogh went for US$71.3 million and a Kahlo self-portrait set a new record for the Mexican artist’s work at nearly US$35 million.

However, it has also created a hunger for almost anything collectable, from Michael Jordan sneakers (US$1.5 million), to an original copy of the US constitution (US$43 million) to an 800,000 euro bottle of Burgundy wine.

“At a time when many art fairs can’t happen in person and online viewing rooms are awful, auctions have become a predominant form of selling,” Anna Brady, art markets reporter for The Arts Newspaper, said on its podcast.

Brady highlighted the infusion of cash from a new source: crypto-millionaires. They have expanded from an initial focus on digital art — such as the mind-boggling US$69 million paid for a JPG file by one of its pioneers, Beeple, in March — into more traditional tastes.

Crypto “whale” Justin Sun has bought works by Pablo Picasso and Andy Warhol this year, and paid US$78.4 million for Alberto Giacometti’s The Nose sculpture this month.

Sun then triggered a lot of harrumphing among stuffed shirts of the art world by boasting about his purchase on Twitter — breaching their traditional codes of secrecy and discretion in a way that suggests an even more competitive market to come.

BUBBLE?

Is it all a bubble? It is a question that has been raised before, especially in the 1980s when the art market looked in danger of overheating under the pressure of a new generation of yuppies trying to flash their cash.

However, despite several cooling-off periods — including the 2008 financial crash and a sharp drop between 2015 and 2019 — the overall trend has been skyward.

Artprice says the contemporary art market has grown from US$103 million in 2000 to US$2.7 billion today.

“Buying and re-selling has become much more natural: to refine one’s collection, or following a divorce, or because our tastes have changed,” Ehrmann said.

Deloitte estimated last year that the uber-rich own US$1.45 trillion of art and collectables.

For these people, Ehrmann said, “there’s no longer a psychological barrier to paying more than a million dollars for something online.”

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) yesterday expressed a downbeat view about the prospects of humanoid robots, given high manufacturing costs and a lack of target customers. Despite rising demand and high expectations for humanoid robots, high research-and-development costs and uncertain profitability remain major concerns, Lam told reporters following the company’s annual shareholders’ meeting in Taoyuan. “Since it seems a bit unworthy to use such high-cost robots to do household chores, I believe robots designed for specific purposes would be more valuable and present a better business opportunity,” Lam said Instead of investing in humanoid robots, Quanta has opted to invest