Chip designer MediaTek Inc (聯發科) on Thursday released a new 5G smartphone chip that it hopes will be used in premium-priced Android smartphones, a market Qualcomm Inc currently dominates.

The Hsinchu-based company said its new Dimensity 9000 chip will be the world’s first to use its manufacturing partner Taiwan Semiconductor Manufacturing Co’s (台積電) “N4” chipmaking process, which helps makes chips that are smaller and faster. MediaTek said it would be the first smartphone chip to feature a powerful new computing core from Arm Ltd called the Cortex X2.

Along with Qualcomm and Samsung Electronics Co Ltd, MediaTek is one of only three firms in the world that makes 5G smartphone chips. The fourth major player — Huawei Technologies Co Ltd — was forced out of the market by US sanctions.

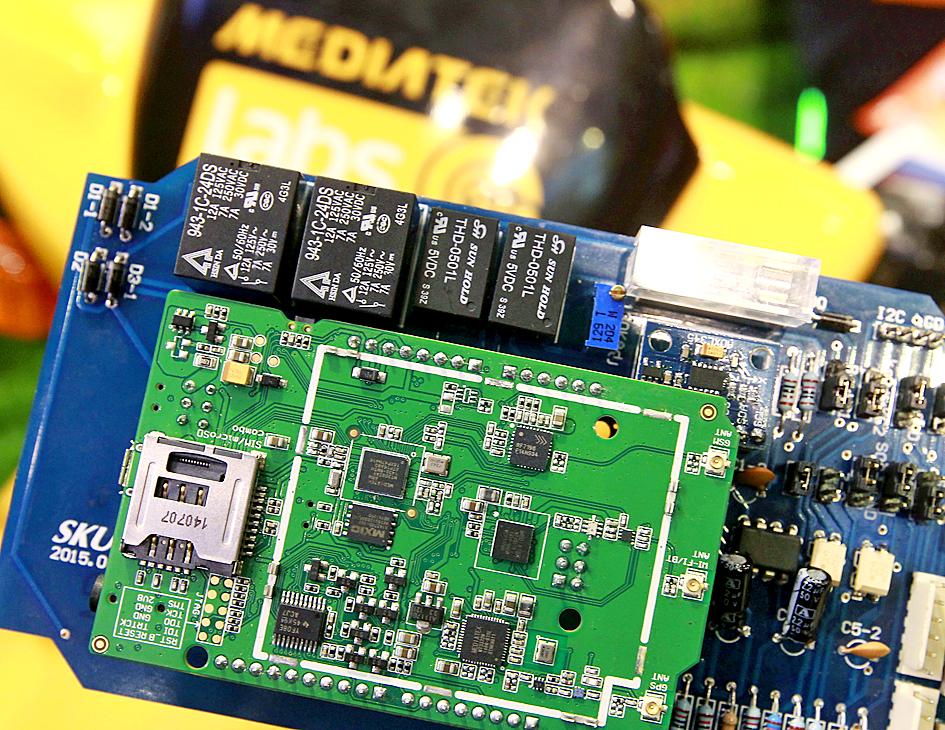

Photo: Reuters

Huawei’s exit set off a scramble by Android smartphone makers to capture market share vacated by the Chinese brand. MediaTek already counts many of the contenders for that market share, such as Xiaomi Corp, Oppo and Vivo as customers, but many of those brands use MediaTek for their low and mid-tier devices, and rely on Qualcomm for higher-end models.

Media-Tek chief financial officer David Ku (顧大為) said that the 9000 chip was the first in what is to be a series of chips aimed at persuading those customers to switch to using MediaTek in their flagship devices.

“We need to have a very strong army to march into the segment,” Ku said. “One product is not enough. This is our starting point.”

MediaTek hit US$10 billion in revenue for the first time last year, and Ku said it expects to hit US$17 billion this year, adding that 5G chips can sell for up to US$50.

“The No. 1 driving factor is really the much higher [average selling price] due to the 4G to 5G transition,” Ku said.

China has claimed a breakthrough in developing homegrown chipmaking equipment, an important step in overcoming US sanctions designed to thwart Beijing’s semiconductor goals. State-linked organizations are advised to use a new laser-based immersion lithography machine with a resolution of 65 nanometers or better, the Chinese Ministry of Industry and Information Technology (MIIT) said in an announcement this month. Although the note does not specify the supplier, the spec marks a significant step up from the previous most advanced indigenous equipment — developed by Shanghai Micro Electronics Equipment Group Co (SMEE, 上海微電子) — which stood at about 90 nanometers. MIIT’s claimed advances last

ISSUES: Gogoro has been struggling with ballooning losses and was recently embroiled in alleged subsidy fraud, using Chinese-made components instead of locally made parts Gogoro Inc (睿能創意), the nation’s biggest electric scooter maker, yesterday said that its chairman and CEO Horace Luke (陸學森) has resigned amid chronic losses and probes into the company’s alleged involvement in subsidy fraud. The board of directors nominated Reuntex Group (潤泰集團) general counsel Tamon Tseng (曾夢達) as the company’s new chairman, Gogoro said in a statement. Ruentex is Gogoro’s biggest stakeholder. Gogoro Taiwan general manager Henry Chiang (姜家煒) is to serve as acting CEO during the interim period, the statement said. Luke’s departure came as a bombshell yesterday. As a company founder, he has played a key role in pushing for the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) has appointed Rose Castanares, executive vice president of TSMC Arizona, as president of the subsidiary, which is responsible for carrying out massive investments by the Taiwanese tech giant in the US state, the company said in a statement yesterday. Castanares will succeed Brian Harrison as president of the Arizona subsidiary on Oct. 1 after the incumbent president steps down from the position with a transfer to the Arizona CEO office to serve as an advisor to TSMC Arizona’s chairman, the statement said. According to TSMC, Harrison is scheduled to retire on Dec. 31. Castanares joined TSMC in

EUROPE ON HOLD: Among a flurry of announcements, Intel said it would postpone new factories in Germany and Poland, but remains committed to its US expansion Intel Corp chief executive officer Pat Gelsinger has landed Amazon.com Inc’s Amazon Web Services (AWS) as a customer for the company’s manufacturing business, potentially bringing work to new plants under construction in the US and boosting his efforts to turn around the embattled chipmaker. Intel and AWS are to coinvest in a custom semiconductor for artificial intelligence computing — what is known as a fabric chip — in a “multiyear, multibillion-dollar framework,” Intel said in a statement on Monday. The work would rely on Intel’s 18A process, an advanced chipmaking technology. Intel shares rose more than 8 percent in late trading after the