New Zealand film director Peter Jackson yesterday announced the sale of his Oscar-winning Weta Digital special effects business to a US software firm intent on using it to develop the virtual-reality “metaverse.”

San Francisco-based Unity Software Inc said the US$1.6 billion acquisition would “shape the future of the metaverse,” an immersive 3D version of the Internet tipped to transform workplaces and online interactions.

Unity said Weta’s technology — used in blockbusters such as The Lord of the Rings trilogy and Avatar — would allow its subscribers to create their own ultra-realistic corner of a virtual world.

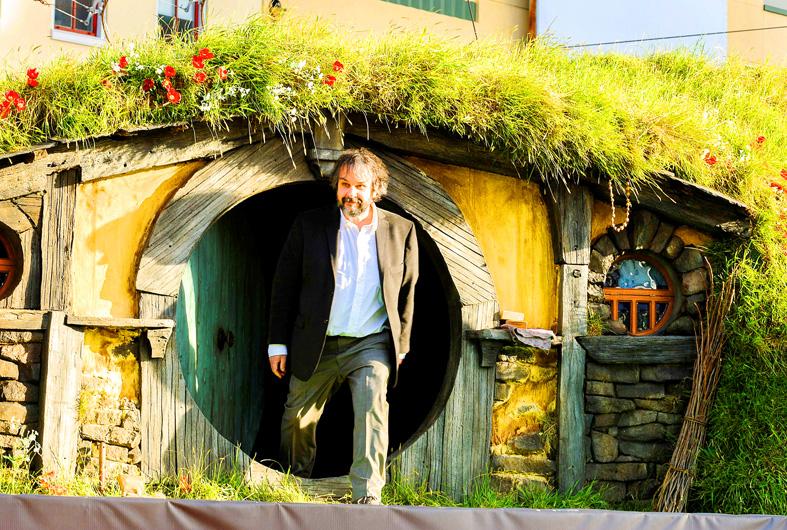

Photo: Reuters

“We are thrilled to democratize these industry-leading tools and bring the genius of Sir Peter Jackson and Weta’s amazing engineering talent to life for artists everywhere,” Unity president John Riccitiello said in a statement.

Under the deal, Unity takes over Wellington-based Weta Digital’s technology and engineering assets while Jackson retains majority ownership of a standalone film effects company called WetaFX.

Jackson said the opportunity to use Weta’s ground-breaking programs was a “game-changer” for those working in creative industries.

“Together, Unity and Weta Digital can create a pathway for any artist, from any industry, to be able to leverage these incredibly creative and powerful tools,” he said.

The metaverse is expected to develop into an online platform that makes virtual experiences, such as chatting with a friend or attending a concert, feel face-to-face.

It grabbed headlines last month when Facebook Inc changed its parent company name to “Meta Platforms Inc” to reflect founder Mark Zuckerberg’s commitment to the concept.

Zuckerberg’s firm has announced plans to hire 10,000 people in the EU to build the metaverse, but other tech players are also scrambling to stake a claim in the online world.

The technology might, for example, allow someone to don virtual-reality glasses that make it feel as if they are face-to-face with a friend — when in fact they are thousands of miles apart and connected via the Internet.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to

PRESSURE EXPECTED: The appreciation of the NT dollar reflected expectations that Washington would press Taiwan to boost its currency against the US dollar, dealers said Taiwan’s export-oriented semiconductor and auto part manufacturers are expecting their margins to be affected by large foreign exchange losses as the New Taiwan dollar continued to appreciate sharply against the US dollar yesterday. Among major semiconductor manufacturers, ASE Technology Holding Co (日月光), the world’s largest integrated circuit (IC) packaging and testing services provider, said that whenever the NT dollar rises NT$1 against the greenback, its gross margin is cut by about 1.5 percent. The NT dollar traded as strong as NT$29.59 per US dollar before trimming gains to close NT$0.919, or 2.96 percent, higher at NT$30.145 yesterday in Taipei trading