US stocks rose on Friday and the Dow Jones Industrial Average scored its biggest weekly percentage gain since June, as Goldman Sachs Group Inc rounded out a week of strong quarterly earnings for the big banks.

Goldman Sachs shares jumped 3.8 percent and gave the Dow its biggest boost, as a record wave of dealmaking activity drove a surge in the bank’s quarterly profit.

Goldman’s report followed strong results from Bank of America and others this week. Banks were among the biggest positives for the S&P 500 on the day, and the index’s bank index climbed 2.1 percent.

Photo: AP

Results from big financial institutions provided a strong start to third-quarter US earnings, although investors would still watch in coming weeks for signs of impacts from supply chain disruptions and higher costs, especially for energy.

Forecasts now call for third-quarter S&P 500 earnings to show a 32 percent rise from a year earlier. The latest forecast, based on results from 41 S&P 500 companies and estimates for the rest, is up from 29.4 percent at the start of this month, according to IBES data from Refinitiv.

“We’re starting to get into an earnings-driven rally here that I hope lasts. We’ll really see the results in the next couple of weeks as a great bulk of companies in all sectors report,” said Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia.

Alcoa Corp shares surged 15.2 percent after the aluminum producer reported stronger-than-expected results, announced a US$500 million buyback program and initiated a quarterly cash dividend.

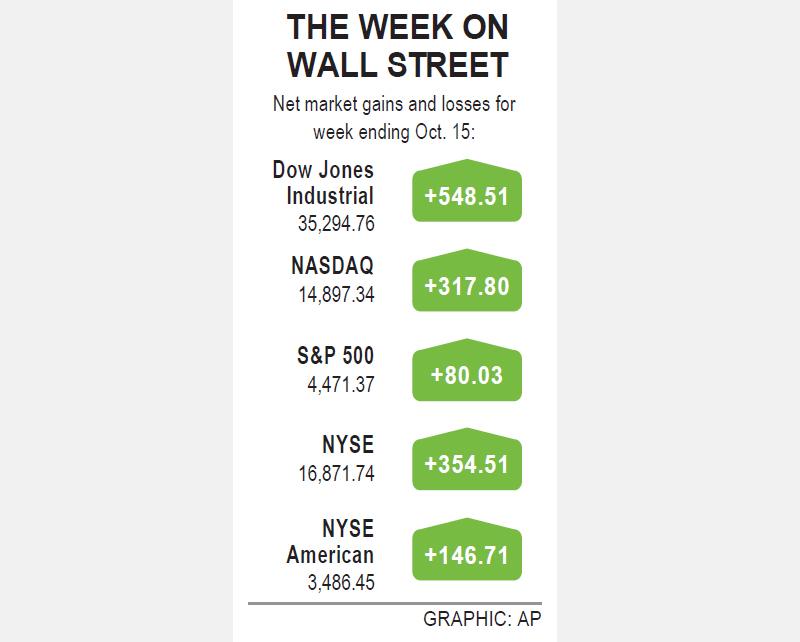

The Dow Jones Industrial Average rose 382.2 points, or 1.09 percent, to 35,294.76, the S&P 500 gained 33.11 points, or 0.75 percent, to 4,471.37 and the NASDAQ Composite added 73.91 points, or 0.5 percent, to 14,897.34.

The Dow jumped 1.6 percent for the week, its biggest weekly percentage gain since June 25. The S&P 500 had its strongest weekly advance since July 23, gaining 1.8 percent.

The NASDAQ added 2.2 percent for the week.

The US Department of Commerce reported a surprise rise in retail sales last month, although investors still worried that supply constraints could disrupt the holiday shopping season. A preliminary reading for consumer sentiment this month came in slightly below expectations.

Moderna Inc shares fell 2.3 percent. A Wall Street Journal report, citing people familiar with the matter, said the US Food and Drug Administration (FDA) is delaying its decision on authorizing Moderna’s COVID-19 vaccine for adolescents to check if the shot could increase the risk of heart inflammation.

On Thursday, Moderna shares jumped when an FDA panel voted to recommend booster shots of its COVID-19 vaccine for Americans aged 65 or older and high-risk people.

Shares of cryptocurrency and blockchain-related firms gained as bitcoin hit US$60,000 for the first time since April. Riot Blockchain Inc ended up 6.6 percent.

Advancing issues outnumbered declining ones on the New York Stock Exchange by a 1.12-to-1 ratio; on NASDAQ, a 1.24-to-1 ratio favored decliners.

The S&P 500 posted 57 new 52-week highs and no new lows; the NASDAQ Composite recorded 124 new highs and 59 new lows.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address