European stocks slumped to their lowest in two months on Friday, as warnings from companies and factory activity data highlighted the economic headwinds from supply-chain constraints and elevated prices.

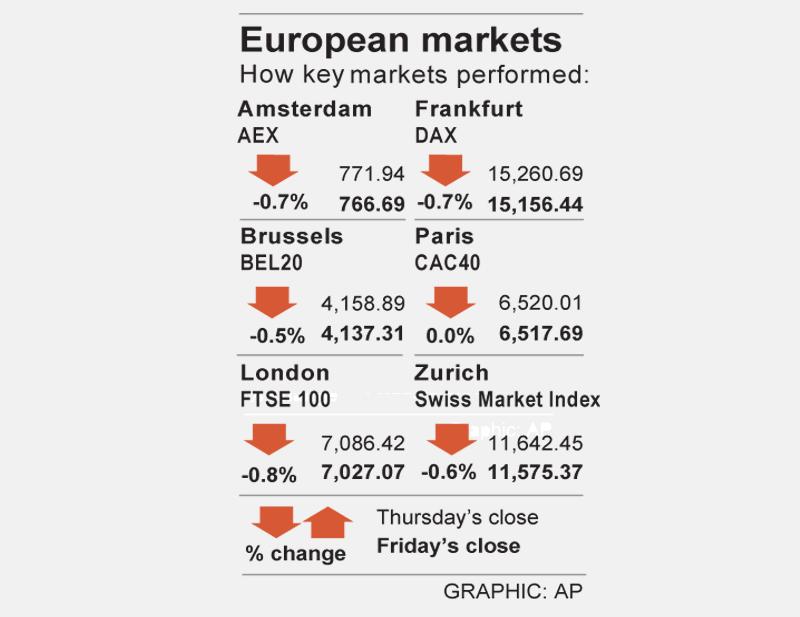

The Europe-wide STOXX 600 fell 0.4 percent in a weak start to October, which has traditionally been a rough month for equities, with technology, miners and banks leading broad declines.

The STOXX 600 ended the week down 2.2 percent.

Online electricals retailer AO World PLC tumbled 24.3 percent, saying that a shortage of delivery drivers in Britain and other disruptions in the global supply chain hit revenue growth in the first half of the year.

Meanwhile, a survey showed that eurozone manufacturing growth remained strong last month, but activity took a big hit from supply chain bottlenecks, which are likely to persist and keep inflationary pressures high.

“Just because it appears the ECB [European Central Bank] will maintain its policy for the foreseeable future, doesn’t mean that higher inflation should be ignored,” Equiti Capital UK Ltd market analyst David Madden said.

Underwhelming figures from Asian factories and overnight losses on Wall Street dented the global mood as investors awaited a report that is expected to show eurozone inflation surged to a 13-year high.

With government bond yields surging to multimonth highs and concerns about inflation coming to the fore, the benchmark STOXX 600 closed last month 3.4 percent lower in its worst monthly showing in almost a year.

“For equities, this combination of slowing growth — albeit at a high level of demand — rising inflation and higher bond yields has meant slightly higher volatility, lower market returns and a rotation beneath the surface,” Goldman Sachs strategist Sharon Bell said in a note. “It hasn’t helped that earnings revisions have also started to slow from their frenetic pace earlier in the year.”

Bank of America Global Research cut its outlook for European stocks, predicting a decline of nearly 10 percent by year-end given a shift in the macro backdrop toward “anti-goldilocks,” where slowing growth is accompanied by higher discount rates.

BMW AG rose 1.3 percent after lifting its annual profit margin forecast as higher prices for new and used vehicles outweighed the effect of supply-chain issues.

French state-owned utility EDF SA and energy group Engie SA rose 5.9 percent and 2.5 percent respectively, with traders pointing to relief that electricity tariffs were untouched by the French government in its plan to check further price rises.

France’s biggest telecoms group Orange SA fell 0.8 percent after it said it would buy insurer Groupama’s 21.7 percent stake in Orange Bank, its online banking unit.

ISSUES: Gogoro has been struggling with ballooning losses and was recently embroiled in alleged subsidy fraud, using Chinese-made components instead of locally made parts Gogoro Inc (睿能創意), the nation’s biggest electric scooter maker, yesterday said that its chairman and CEO Horace Luke (陸學森) has resigned amid chronic losses and probes into the company’s alleged involvement in subsidy fraud. The board of directors nominated Reuntex Group (潤泰集團) general counsel Tamon Tseng (曾夢達) as the company’s new chairman, Gogoro said in a statement. Ruentex is Gogoro’s biggest stakeholder. Gogoro Taiwan general manager Henry Chiang (姜家煒) is to serve as acting CEO during the interim period, the statement said. Luke’s departure came as a bombshell yesterday. As a company founder, he has played a key role in pushing for the

China has claimed a breakthrough in developing homegrown chipmaking equipment, an important step in overcoming US sanctions designed to thwart Beijing’s semiconductor goals. State-linked organizations are advised to use a new laser-based immersion lithography machine with a resolution of 65 nanometers or better, the Chinese Ministry of Industry and Information Technology (MIIT) said in an announcement this month. Although the note does not specify the supplier, the spec marks a significant step up from the previous most advanced indigenous equipment — developed by Shanghai Micro Electronics Equipment Group Co (SMEE, 上海微電子) — which stood at about 90 nanometers. MIIT’s claimed advances last

EUROPE ON HOLD: Among a flurry of announcements, Intel said it would postpone new factories in Germany and Poland, but remains committed to its US expansion Intel Corp chief executive officer Pat Gelsinger has landed Amazon.com Inc’s Amazon Web Services (AWS) as a customer for the company’s manufacturing business, potentially bringing work to new plants under construction in the US and boosting his efforts to turn around the embattled chipmaker. Intel and AWS are to coinvest in a custom semiconductor for artificial intelligence computing — what is known as a fabric chip — in a “multiyear, multibillion-dollar framework,” Intel said in a statement on Monday. The work would rely on Intel’s 18A process, an advanced chipmaking technology. Intel shares rose more than 8 percent in late trading after the

GLOBAL ECONOMY: Policymakers have a choice of a small 25 basis-point cut or a bold cut of 50 basis points, which would help the labor market, but might reignite inflation The US Federal Reserve is gearing up to announce its first interest rate cut in more than four years on Wednesday, with policymakers expected to debate how big a move to make less than two months before the US presidential election. Senior officials at the US central bank including Fed Chairman Jerome Powell have in recent weeks indicated that a rate cut is coming this month, as inflation eases toward the bank’s long-term target of two percent, and the labor market continues to cool. The Fed, which has a dual mandate from the US Congress to act independently to ensure