European stocks fell on Friday, as worries about troubled property developer China Evergrande Group (恆大集團) and weak German business confidence data prompted investors to book some profits after a mid-week rally.

European sportswear makers Adidas AG, Puma SE and JD Sports Fashion PLC fell about 3 percent each after US rival Nike Inc cut its fiscal 2022 sales expectations and predicted delays during the holiday shopping season due to a supply chain crunch.

Retail stocks were the top decliners in Europe, down 1.7 percent, while the region-wide STOXX 600 fell 0.9 percent to 463.29, but a three-day rally put the index 0.31 percent higher for the week.

“Equities have rallied to take a pause early this morning faced with the likely default of Evergrande,” Nordea Asset Management senior macro strategist Sebastien Galy said.

Meanwhile, a survey by Ifo Institute showed German business morale this month fell for a third straight month, hit by supply chain woes that are causing a “bottleneck recession” for manufacturers in Europe’s largest economy.

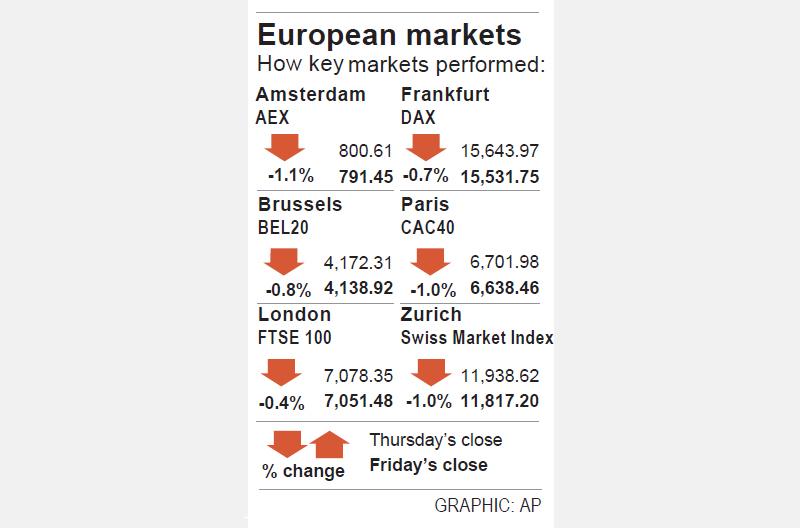

Germany’s DAX fell 0.72 percent to 15,531.75, up 0.27 percent from a week earlier, heading into the weekend when the country votes to elect German Chancellor Angela Merkel’s successor.

“Some of the hesitancy in European markets could also be put down to the German elections, which promise to be the most interesting in some time,” IG chief market analyst Chris Beauchamp said.

“Markets are facing a change of direction in Germany unlike anything seen in the past decade or more, and the end of Merkel’s tenure promises to be a watershed moment for the EU and global investors alike,” Beauchamp added.

The benchmark STOXX 600 is on course to end the month in the red after seven consecutive months of gains, as rising energy prices and supply-chain bottlenecks fed into fears of inflation, while major central banks plan to cut COVID-19 stimulus.

However, European Central Bank President Christine Lagarde said in an interview aired on CNBC that many of the drivers of a recent spike in eurozone inflation are temporary and could fade in the next year.

London’s FTSE 100 ended lower as concerns about a slowdown in global economic growth outweighed gains in healthcare and energy stocks.

It eased 0.38 percent to 7,051.48, but posted a weekly increase of 1.26 percent, snapping a three-week losing streak.

Retailers, industrial miners and life insurers were the top losers.

The FTSE 100 has gained nearly 9.5 percent so far this year on higher energy prices and accommodative central bank policies.

However, it has significantly underperformed a 17 percent rise among its European peers.

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)