Issues stemming from a global chip shortage are “very real,” US Vice President Kamala Harris said as she headed to Asia on a trip aimed at building trade relationships with countries seen as crucial to the supply chain.

Harris, who is visiting Singapore and Vietnam, where she is to emphasize the US’ role as a global leader, said on Friday that the country had an economic and security interest related to the region, and how dependent it is on its supply chains.

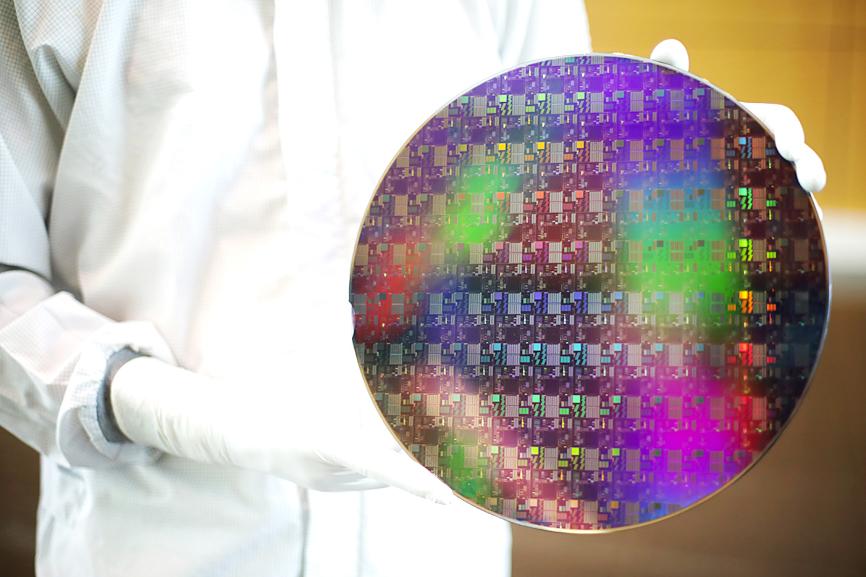

Her trip comes as a global semiconductor shortage continues to cause production delays for the auto and consumer electronics industries in the US.

Photo: Bloomberg

The administration of US President Joe Biden has for months engaged with industries and lawmakers on ways to alleviate the crisis, without much effect so far.

Harris yesterday landed in Singapore, which has sought to increase its chipmaking talent and manufacturing capability. US-based GlobalFoundries Inc recently said it planned to build a US$4 billion plant in the city-state, slated to start in 2023, and the facility is expected to primarily serve smartphone and auto demand.

Her second stop, tomorrow, would be Vietnam, which in particular plays an increasingly important role in many supply chains, as companies in the past few years moved operations there from China.

Intel Corp, one of the country’s biggest foreign investors, has spent 140 billion dong (US$6.1 million) in just one month to meet strict anti-COVID-19 mandates to ensure it can keep operations going in Ho Chi Minh City.

Harris said the semiconductor issue was also raised in a discussion with General Motors Co (GM) chief executive officer Mary Barra.

GM and other automakers have struggled to keep plants open due to shortfalls in chip supplies, which has forced them to limit production and see inventories dwindle.

This month, Barra told reporters that GM is working to prevent a recurrence of the shortfall and expressed confidence that the scramble for chips would ease — but did not provide any specific timeline.

Separately, German auto giant Volkswagen AG is to slash production at its main plant due to ongoing problems with the global supply of computer chips, a spokesman told Agence France-Presse on Friday.

Following the summer holidays for workers in Germany, work on the assembly line at the company’s facility in Wolfsburg would be “limited” and would have to “adapt to the supply situation,” the spokesman said.

Vehicles would only be produced during the early shift at the factory, while the rest of production would be halted, as shortages of semiconductors are set to continue, the automaker said.

The renewed scarcity is in part the result of “outbreaks of COVID-19, particularly in Malaysia, which have led to factory closures for semiconductor producers,” Volkswagen said.

Earlier last week, the Volkswagen-owned auto brand Audi also said that it would be delaying the resumption of production on some of its lines in Germany due to the “volatile” supply situation.

That came after Japanese company Toyota Motor Corp, the world’s largest automaker, on Thursday announced that it would be reducing production next month by 40 percent, in part due to a “parts shortage resulting from the spread of COVID-19 in Southeast Asia,” it said.

Additional reporting by AFP

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

HEADWINDS: Upfront investment is unavoidable in the merger, but cost savings would materialize over time, TS Financial Holding Co president Welch Lin said TS Financial Holding Co (台新新光金控) said it would take about two years before the benefits of its merger with Shin Kong Financial Holding Co (新光金控) become evident, as the group prioritizes the consolidation of its major subsidiaries. “The group’s priority is to complete the consolidation of different subsidiaries,” Welch Lin (林維俊), president of the nation’s fourth-largest financial conglomerate by assets, told reporters during its first earnings briefing since the merger took effect on July 24. The asset management units are scheduled to merge in November, followed by life insurance in January next year and securities operations in April, Lin said. Banking integration,

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known