New Samoan Prime Minister Fiame Naomi Mataafa has confirmed she would cancel a China-backed port project, but has not closed the door to China as she navigates a path for the Pacific nation against a backdrop of intensifying regional competition between Beijing and Washington.

Mataafa indicated she would only approve investments that had clear benefits for her country, as she expressed doubts about the upside for the Pacific in being a pawn in a geopolitical tussle between the two superpowers.

Mataafa said China’s interest in the Pacific had grown as the US effectively “moved out” of the region.

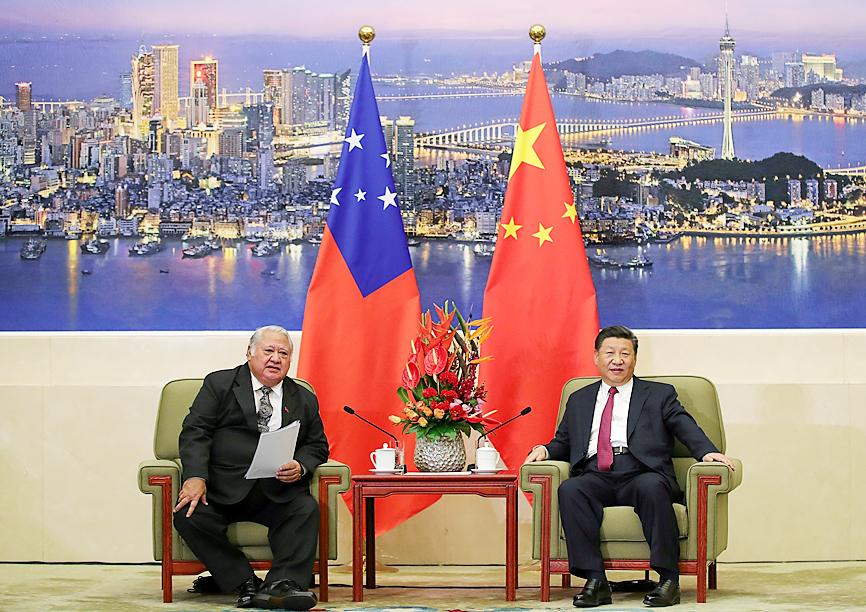

Photo: Reuters

“There seems to be a renewed interest in the Pacific, which may be a good thing, but not necessarily,” Mataafa said in an interview over Zoom on Wednesday, days after her election was confirmed, ending a months-long political crisis.

Samoa, an island nation of about 200,000 reliant on subsistence farming, along with tourism, fish, coconut product exports and foreign remittance, has found itself exposed to external geopolitical jostling, as Washington and its allies respond to a more assertive Beijing in Pacific waters that have been largely uncontested since World War II.

Any foreign involvement in critical infrastructure, such as ports and airstrips, are particularly sensitive, and China’s proposed construction of a wharf in Vaiusu Bay had played a part in April elections.

Former Samoan prime minister Tuilaepa Sailele Malielegaoi promised to build the port with Chinese help for US$100 million, after a similar project was deemed economically unviable by the Asian Development Bank.

Mataafa said in May, after her election, but before taking office, as Malielegaoi disputed the poll result, that she would scrap the project, calling it excessive for a small nation already heavily indebted to China.

China is the single largest creditor in Samoa, accounting for about 40 percent, or about US$160 million, of its external debt.

“We’ve indicated that would not be a priority for us at this time and that there would be other areas that we would be more interested in,” Mataafa said in the interview.

“I’m pleased the outgoing government had not reached a level of agreement with China where that is set in place,” she said.

The Chinese Ministry of Foreign Affairs said in a statement yesterday that Beijing held preliminary discussions with Samoa on the feasibility of building the port at the request of the former government.

“China always adheres to the principle of mutual respect and consultation on an equal footing in conducting foreign cooperation,” the statement said.

“We will continue to strengthen friendly exchanges and mutually beneficial cooperation in various fields with the new Samoan government in accordance with the above principles to benefit the two countries and peoples,” it said.

Mataafa said China had been a long-term partner and her government would assess the relationship in the same way it evaluates all of its bilateral relations.

“I think as a new administration coming in we will do that for China and any other partner that we have,” she said.

“China just takes the forefront because of the nature of the work that’s being funded. There’s a lot of infrastructure, mostly building infrastructure which other donors don’t do,” she said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known

UNCERTAINTY: A final ruling against the president’s tariffs would upend his trade deals and force the government to content with billions of dollars in refunds The legal fight over US President Donald Trump’s global tariffs is deepening after a federal appeals court ruled the levies were issued illegally under an emergency law, extending the chaos in global trade. A 7-4 decision by a panel of judges on Friday was a major setback for Trump, even as it gives both sides something to boast about. The majority upheld a May ruling by the Court of International Trade that the tariffs were illegal. However, the judges left the levies intact while the case proceeds, as Trump had requested, and suggested that any injunction could potentially be narrowed to apply