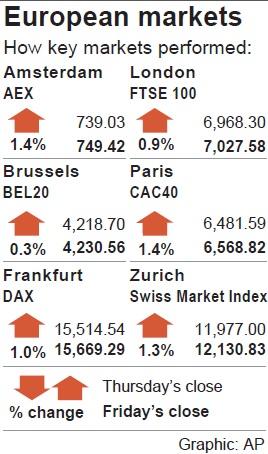

European stocks closed the week higher on Friday as optimism about the earnings season and the European Central Bank’s (ECB) pledge of continued monetary support outweighed risks of a resurgence in COVID-19 cases.

The pan-European STOXX 600 rose 1.09 percent and gained 1.49 percent for the week.

Automakers were the top gainers in morning trade.

Mercedes-Benz maker Daimler AG gained 3.1 percent after Kepler Cheuvreux upgraded its stock to “buy,” saying its growth is not properly reflected in the share price.

French auto parts maker Valeo SA jumped 8 percent after it posted higher first-half sales and profit, and said it expected the shortage of key technology chips to ease.

Peers Faurecia SE and Continental AG rose more than 4 percent each.

A bout of selling hit financial markets on Monday as investors grew nervous about the fast-spreading Delta variant of SARS-CoV-2 hampering a global economic recovery.

However, strong earnings reports and the ECB’s commitment keep interest rates at record lows for even longer helped push the benchmark STOXX 600 to less than 0.5 percent below its all-time highs.

“For now, markets seem unconcerned about either with Delta or inflation, keeping the buy-everything music playing,” Oanda Corp senior market analyst Jeffrey Halley wrote in a morning note.

Rafale jets maker Dassault Aviation SA climbed 5.5 percent on reporting higher sales and profits in the first half of the year, while UK mobile operator Vodafone Group PLC rose 2.3 percent after reporting a better-than-expected 3.3 percent rise in first-quarter service revenue.

Chip equipment maker ASML Holding NV hit a fresh record high as strong earnings forecast earlier this week prompted brokerages to hike their price target.

Eurozone business activity this month expanded at its fastest monthly pace in more than two decades, IHS Markit’s flash survey showed, but fears of another wave of infections hit business confidence.

German purchasing managers’ index (PMI) hit its highest level in nearly a quarter of a century, creating inflationary bottlenecks.

Danske Bank A/S slid 3.5 percent as it second-quarter return on equity declined to 6.5 percent, down from 7.5 percent in the first quarter and well below the level of its Nordic peers.

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.

MediaTek Inc (聯發科) shares yesterday notched their best two-day rally on record, as investors flock to the Taiwanese chip designer on excitement over its tie-up with Google. The Taipei-listed stock jumped 8.59 percent, capping a two-session surge of 19 percent and closing at a fresh all-time high of NT$1,770. That extended a two-month rally on growing awareness of MediaTek’s work on Google’s tensor processing units (TPUs), which are chips used in artificial intelligence (AI) applications. It also highlights how fund managers faced with single-stock limits on their holding of market titan Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are diversifying into other AI-related firms.