Texas Instruments Inc on Wednesday gave a revenue forecast for the current period that disappointed some investors, raising concerns that a jump in chip demand caused by the COVID-19 pandemic would be short-lived. The stock fell in extended trading.

The company projected sales of US$4.4 billion to US$4.76 billion for the period ending in September, and profit of US$1.87 to US$2.13 a share, it said in a statement.

On average, analysts predicted sales of US$4.59 billion and profit of US$1.97 a share, data compiled by Bloomberg showed.

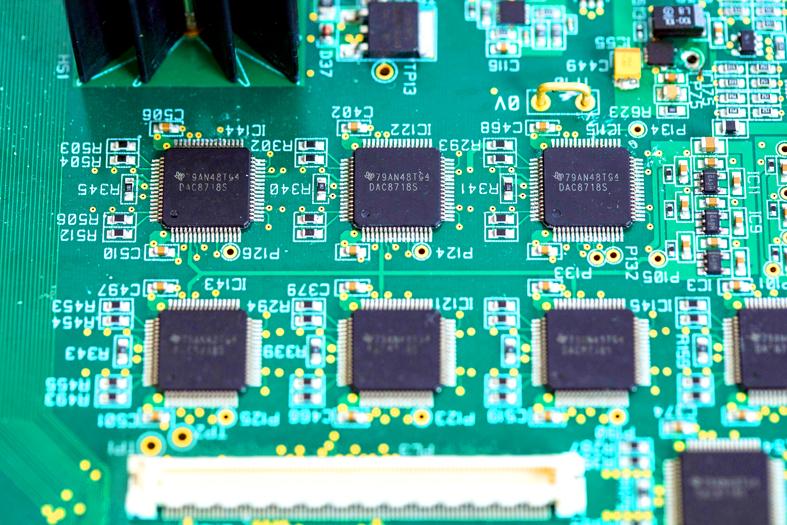

Photo: Bloomberg

Like other chipmakers, Texas Instruments has posted multiple quarters of double-digit percentage sales growth, boosted by demand for a wide variety of devices that contain its tiny components.

The rapid run-up has caused speculation among analysts and investors that some of the orders reflect panic buying by customers who have grown anxious they would not be able get enough supply. Such behavior in the past has caused crashes.

The Dallas, Texas-based company has tens of thousands of products and more than 100,000 customers that make everything from phones to military hardware. That reach as the largest manufacturer of analogue and embedded processing chips makes the company a bellwether for electronics demand. A large chunk of its products go into industrial machinery.

Texas Instruments’ management said the amount of in-house inventory fell to 111 days in the quarter, well short of the 130 to 190 days the company likes to have on hand. Lead times have stretched for an increasing number of products.

Despite numerous questions on a conference call with analysts, management declined to say whether it thought demand is peaking or whether growth at the current levels is sustainable.

“Our job isn’t to predict the future, it’s to prepare the company so we can handle anything and we’ve done that,” chief financial officer Rafael Lizardi said in an interview. “Some would argue that this time it’s different, but that’s a dangerous argument.”

Lizardi added that Texas Instruments’ high level of in-house manufacturing made the company more nimble in responding to the increase in demand.

When competitors cut production last year, the company increased output and built inventory. Many chipmakers outsource large amounts of their manufacturing, and some have never owned a plant of their own. Texas Instruments has factories that provide about 80 percent of its own needs.

In the second quarter, net income rose to US$1.93 billion, or US$2.05 per share, from US$1.38 billion, or US$1.48 a share, a year earlier. Revenue increased 41 percent to US$4.58 billion.

Analysts, on average, estimated US$4.36 billion.

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It