LCD panel maker AU Optronics Corp (AUO, 友達光電) expects value-added panels and new service solutions to account for as much as 20 percent of its overall revenue in 2023 as its transformation efforts begin to bear fruit, the company said yesterday.

AUO has been pushing for fundamental changes for about eight years, aiming to eschew the panel industry’s boom-and-bust cycles by investing in capacity for value-added panels and expanding its business scope to vertical industries in the past three years.

The Hsinchu-based firm said that it is selling value, not hardware.

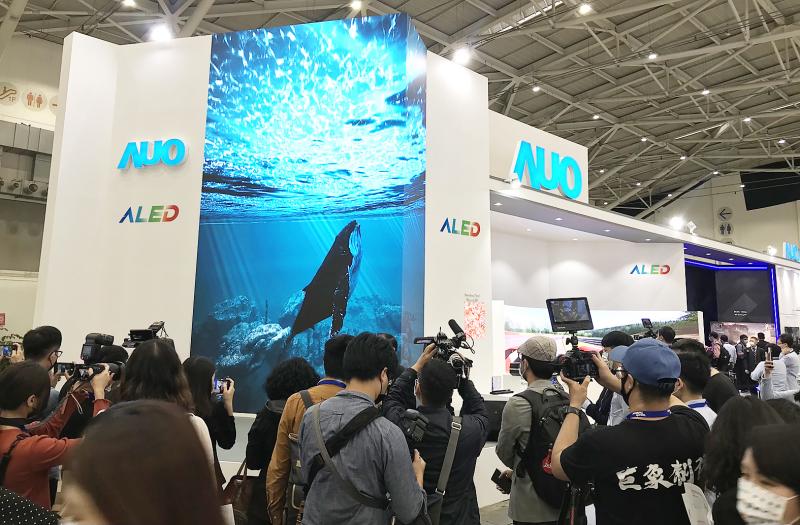

Photo: Chen Mei-ying, Taipei Times

“AUO ... aims to become more comparative in terms of product value, rather than [capacity] scale. We want to make sure we can sell our products at better prices,” AUO chairman Paul Peng (彭双浪) told a media briefing at the Touch Taiwan trade show at the Taipei Nangang Exhibition Center’s Hall 1.

The company’s strategy is to “go premium” and “go vertical,” Peng said. “AUO aims to be a company that can earn stable profits.”

AUO is expanding its business scope downstream to five major areas beyond the panel industry: the smart retailing, smart medical care, smart transportation, smart entertainment and smart manufacturing segments, he said.

AUO aims to maximize its average selling price by adding services and total solutions, coupled with its flat panels, he said.

To do this, the company has been creating its own ecosystem by investing in companies in different supply chains, such as facial recognition technology developer SkyREC Inc and industrial computer maker Adlink Technology Inc (凌華科技).

The company has hired more than 1,000 artificial intelligence experts to provide smart manufacturing services, Peng said.

“Our goal is to generate revenue of between 15 percent and 20 percent from premium products [combined with services revenue] in 2023,” AUO president Frank Ko (柯富仁) said. “We are no longer a pure panel supplier.”

Premium panels, such as those used in high-end gaming notebooks and 85-inch displays with no bezel, contributed about 10 percent, or about NT$30 billion (US$1.07 billion), to AUO’s revenue in the final quarter of last year, Ko said.

AUO’s revenue rose to NT$270.99 billion last year.

Also attending the trade show, rival Innoux Corp (群創) yesterday said that the LCD industry is experiencing major structural change as the COVID-19 pandemic stimulates demand for panels and upends traditional supply-demand dynamics due to work-from-home and remote-learning trends.

Tight supply of chips and other key components continues to be a choke point for flat-panel industry supply chains, as pandemic-driven demand has greatly surpassed existing capacity, Innolux president James Yang (楊柱祥) told reporters.

The company has been running its factories at full capacity and trying to squeeze extra production by optimizing product lineups, but it still cannot meet customer demand, Yang said.

“We continue to be optimistic about this year’s business outlook, given the strong demand. Every company in the industry is making a profit. This industry’s development is very healthy,” he said.

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan