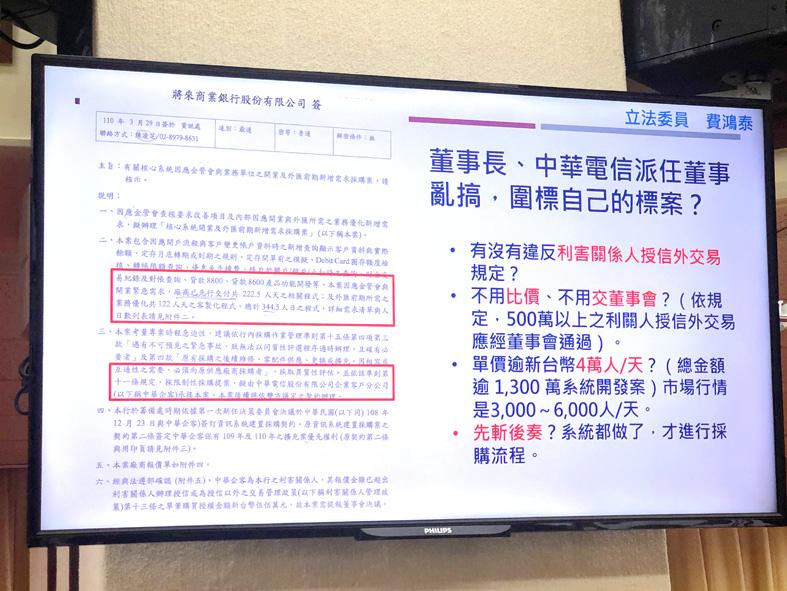

Next Bank (將來銀行) has allegedly acquired an overpriced IT system developed by its biggest shareholder, Chunghwa Telecom Co (中華電信), despite the doubts of former general manager Liu I-cheng (劉奕成) and the bank’s compliance and financial departments, Chinese Nationalist Party (KMT) Legislator Alex Fai (費鴻泰) said yesterday.

Liu on March 18 resigned over the deal, Fai told a meeting of the legislature’s Finance Committee in Taipei, citing a source at the Web-only bank who objected to the purchase.

Chunghwa Telecom, which holds a 41.9 percent stake in Next Bank, has appointed five directors to the bank’s board, including the telecom’s business group president Wu Li-show (吳麗秀), Fai said.

Photo: Kelson Wang, Taipei Times

Wu allegedly urged the bank to buy a NT$13.78 million (US$484,614) IT system developed by the telecom to address flaws in the bank’s system, Fai said.

The project’s development time totaled 344.5 worker days, priced at NT$40,021 per day, he said.

“That is almost the market price in the US. In Taiwan, the usual price per worker day is NT$3,000 to NT$6,000,” Fai said.

Following an on-site inspection, the Financial Supervisory Commission (FSC) mandated an update to the bank’s system.

However, Next Bank has not opened a public tender, nor has it formally employed the telecom for the task, Fai said, adding that it was unreasoanble for Wu to urge the bank to buy from the telecom.

The bank’s internal rules stipulate that purchases of more than NT$5 million require approval by the board, Fai said, adding that the board did not discuss the matter.

Liu, as well as the bank’s compliance and finance departments, disapproved the deal, but chairman Chung Fu-kuei (鍾福貴) asked to “find ways to address the deal,” Fai said, adding that Chung previously worked for the telecom as president of data communication.

Liu aimed to review the then-proposed purchase at a board meeting in early February, where directors appointed by the telecom and one director appointed by Mega International Commercial Bank (兆豐銀行) pressured Liu to resign, Fai said.

Fai urged the FSC to investigate the matter, saying that his source inside the bank might need protection, “as the bank is already trying to find out who the whistle-blowers are.”

FSC Chairman Thomas Huang (黃天牧) said that the commission received reports from the same source, and that it would investigate whether Next Bank or the telecom have breached regulations or internal controls.

However, Liu said in a statement that he was not pressured to step down, nor did he know of an IT purchase from the telecom.

“The board meeting in February did not discuss the matter,” Liu said.

Next Bank said in a statement that it is still in the procurement process for the improvement of its IT system, adding that it would proceed in line with internal control requirements.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received