The S&P 500 and Dow on Friday rose in a broad-based rally with technology, healthcare and financial stocks providing the biggest lift as investors bet on a recovery that is expected to deliver the fastest economic growth since 1984.

The S&P 500 and the Dow ended a seesaw week higher as investors rebalancing their portfolios at the quarter’s end continued to buy stocks that stand to benefit from a growing economy, while they added some beaten-down technology shares.

The NASDAQ also ended higher as less popular tech shares advanced, but posted its second weekly decline in a row.

Wall Street surged in the last half hour of trading, lifting all three indicies more than 1 percent. The S&P 500 and Dow eked out record closing highs.

The Russell 1000 value index, which includes energy, banks and industrial stocks, has gained more than 10 percent this year, outperforming its counterpart the Russell 1000 growth index, which is just above break-even for the year.

Some of the tech heavyweights slid, such as Tesla Inc and Google parent Alphabet Inc, but Microsoft Corp and Facebook Inc bucked the trend, helping lift the S&P 500 and NASDAQ higher.

“It is less a move out of technology than a move that evidences a broader appetite for equities to include both growth and value,” said John Stoltzfus, chief investment strategist at Oppenheimer Asset Management in New York.

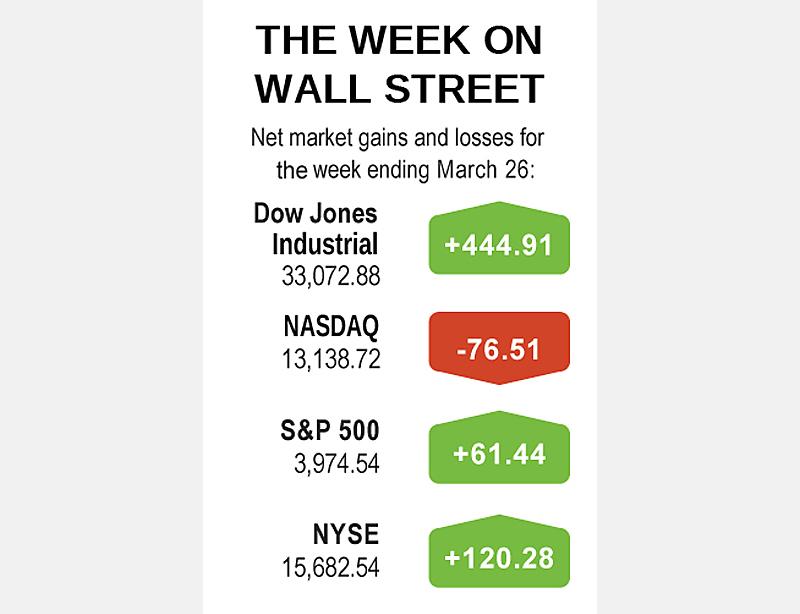

The Dow Jones Industrial Average rose 453.4 points, or 1.39 percent, to 33,072.88. The S&P 500 gained 65.02 points, or 1.66 percent, to 3,974.54 and the NASDAQ Composite added 161.05 points, or 1.24 percent, to 13,138.72.

For the week, the S&P rose 1.57 percent and the Dow 1.36 percent, while the NASDAQ slipped 0.58 percent.

Volume on US exchanges was 12.23 billion shares, compared with the 13.67 billion average for the full session over the past 20 trading days.

The US Federal Reserve last week raised its GDP estimate for 2021 to 6.5 percent from 4.2 percent and many economists expect still faster growth, which has spurred fears the economy could run too hot and force the Fed to raise interest rates.

“It has been hard to restrain our US growth forecast in recent months. We’ve been upgrading our estimates almost as fast as we lowered them a year ago,” Carl Tannenbaum, chief economist at Northern Trust, told the Reuters Global Markets Forum.

Bank stocks gained 1.9 percent as the Fed said it would lift income-based restrictions on bank dividends and share buybacks for “most firms” in June after its next round of stress tests.

The yield on benchmark 10-year US Treasury notes rose to 1.66 percent, lower than a spike last week to 1.75 percent that sparked a sell-off on inflation fears and a potential Fed rate hike — something the Fed has pledged not to do.

The market is concerned that all of a sudden the Fed is forced to tighten against its repeated mantra that it will not, State Street Global Markets senior global macro strategist Marvin Loh said.

“The real concern is that things overheat and the Fed might be forced to change its mind,” he said.

Energy stocks jumped 2.6 percent, tracking a boost in crude prices after a giant container ship blocking the Suez Canal spurred fears of a supply squeeze.

Ten of the 11 major S&P sectors rose, with only the communication services index in the red.

Advancing issues outnumbered declining ones on the NYSE by a 3.3-to-1 ratio; on NASDAQ, a 1.81-to-1 ratio favored advancers.

The S&P 500 posted 65 new 52-week highs and no new lows; the NASDAQ Composite recorded 82 new highs and 51 new lows.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.