Rising bond yields on Friday dragged European stocks lower, although major bourses were set for weekly gains as stimulus and vaccination programs spurred hopes of a solid economic recovery.

The pan-European STOXX 600 index fell 0.26 percent to 423.08 after a four-session winning streak drove it to pre-COVID-19 pandemic highs a day earlier. The index posted a weekly gain of 3.52 percent, its best performance since November last year.

Tame US inflation data and signs from the European Central Bank (ECB) that it is ready to accelerate money printing to keep a lid on borrowing costs helped boost risk appetite this week.

“It’s not quite the end to the week that investors had hoped,” AJ Bell investment director Russ Mould said. “However, markets are still ahead on the week, and the recent sell-off in tech stocks looks like it has stabilized, which is important for investor sentiment.”

With government bond yields in the US and Europe rising again on Friday, investors took some money off the table.

“On one hand, we had the ECB that tried to talk down yields, but at the same time we had the final approval of the big [US President Joe] Biden stimulus package that drove US yields somewhat higher again,” said Bert Colijn, senior eurozone economist at ING Group NV.

Biden signed a US$1.9 trillion stimulus bill into law on Thursday. While the stimulus is expected to give a boost to the US economy, it has also raised worries about a spike in inflation that could push central banks to tighten monetary policy.

The tech sector fell the most in Europe, down 2.1 percent, while automakers and miners also weighed.

Dutch tech investor Prosus NV, which holds a third of Chinese tech giant Tencent Holdings Ltd (騰訊), dropped 6.7 percent as China’s market regulator fined 12 companies, including Tencent, related to deals that demonstrated illegal monopolistic behavior.

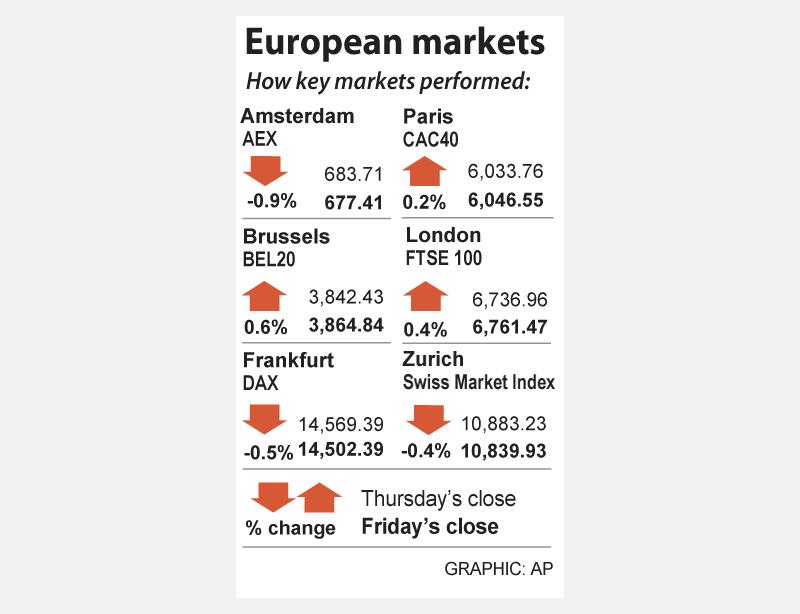

In London, the FTSE 100 reversed course and ended a strong week on an upbeat note, with banks and consumer staples leading gains, while data showed the British economy had shrunk by less than feared in January.

The blue-chip FTSE 100 index ended 0.36 percent higher at 6,761.47, and rose 1.97 over the week, as investors bet on a gradual easing of COVID-19 restrictions and a steady vaccination program to eventually spur growth.

Britain’s economy contracted by 2.9 percent in January from December last year as the country went back into a lockdown, and is likely to shrink by 4 percent in the first quarter of this year, official data showed.

“The big message that investors will take from today’s GDP figures isn’t that there was a fall in January, but that the fall was far less steep than most economists had predicted,” AJ Bell analyst Danni Hewson said.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.