European stocks on Friday closed lower, ending three weeks of gains as investors booked profits in technology and commodity-linked shares due to concerns over rising inflation and interest rates on the back of a jump in bond yields.

The benchmark STOXX 600 fell 1.64 percent to 404.99 and shed 2.38 percent for the week — its first weekly loss this month — with technology stocks losing the most as they continued to retreat from 20-year highs.

On the day, resource stocks were the softest-performing European sectors, tumbling 4.2 percent from a near 10-year high in their worst session in five months.

“Equity markets across the US and Europe are quite expensive now, and with bond yields constantly rising, the fixed income market is proving to be more attractive than the riskier equity market,” Societe Generale SA strategist Roland Kaloyan said. “Investors are actually looking at the pace at which yields drop and the current speed is quite concerning for equity markets.”

US and eurozone bond yields retreated slightly, but stayed close to highs hit this week as investors positioned for higher inflation this year. Yields were also set for large monthly gains.

BETTER RETURNS

Sectors such as utilities, healthcare and other staples — usually seen as proxies for government debt due to their similar yields — lagged their European peers for the month as investors sought better returns from actual debt.

Still, the STOXX 600 has gained this month, helped by a rotation into energy, banking and mining stocks on expectations of a pickup in business activity following COVID-19 vaccine rollouts.

Travel and leisure was the strongest sector this month as investors bet on an economic reopening boom. Banks also outperformed their peers thanks to higher bond yields.

Better-than-expected fourth-quarter earnings have also reinforced optimism about a quicker corporate rebound this year.

Of the 194 companies in the STOXX 600 that have reported quarterly earnings so far, 68 percent have beaten analysts’ estimates, according to Refinitiv.

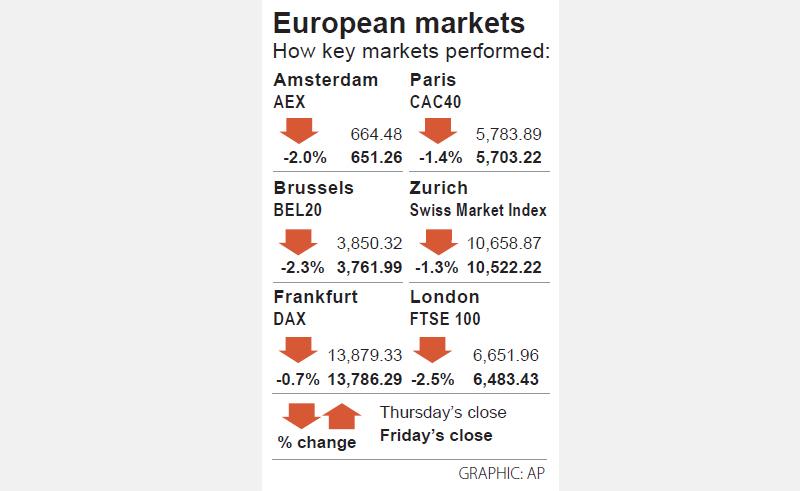

In London, the export-heavy FTSE 100 marked its weakest session since late October last year, snapping three straight weeks of gains.

MINING STOCKS DOWN

The FTSE 100 slipped 2.53 percent to 6,483.43, declining 2.12 percent from a week earlier.

Mining stocks, including Rio Tinto Group, Anglo American PLC and BHP, were the biggest drags on the index, while oil heavyweights BP PLC and Royal Dutch Shell fell, tracking a decline in oil and metal prices.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received

FORTUNES REVERSED: The new 15 percent levies left countries with a 10 percent tariff worse off and stripped away the advantage of those with a 15 percent rate In a swift reversal of fortunes, countries that had been hardest hit by US President Donald Trump’s tariffs have emerged as the biggest winners from the US Supreme Court’s decision to strike down his emergency levies. China, India and Brazil are among those now seeing lower tariff rates for shipments to the US after the court ruled Trump’s use of the International Emergency Economic Powers Act to impose duties was illegal. While Trump subsequently announced plans for a 15 percent global rate, Bloomberg Economics said that would mean an average effective tariff rate of about 12 percent — the lowest since