The head of the Indian central bank yesterday said he is concerned that cryptocurrencies might affect financial stability in Asia’s third-largest economy, a view that could shape regulations on the asset that is breaking price records around the world.

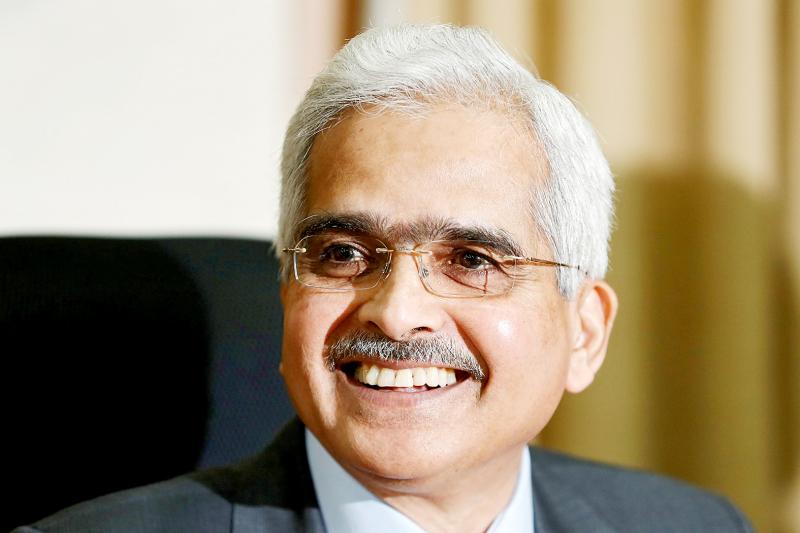

The monetary authority has conveyed these “major concerns” to the Indian government, Reserve Bank of India Governor Shaktikanta Das said in an interview with CNBC TV-18.

Indian Prime Minister Narendra Modi’s administration is proposing to prohibit all private cryptocurrencies in the country and create a framework for an official digital currency.

Photo: Francis Mascarenhas, Reuters

While Das did not elaborate, the bank has expressed concerns on digital currencies related to issues ranging from money laundering to funding terrorists.

The central bank had banned banks and other regulated entities from supporting cryptocurrency transactions in 2018 after digital currencies were used for fraud following Modi’s landmark demonetization program that replaced India’s cash with new bills.

The Indian Supreme Court cut the curbs last year in response to a petition by cryptocurrency exchanges.

The central bank is “very much in the game” in getting ready to launch its own digital currency, Das said, joining other central banks, including China’s electronic yuan.

While there was no set date for roll out, the project is “receiving our full attention,” while the Reserve Bank of India is working on the technology and procedural aspects, and is tying up several loose ends, Das added.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.