Stocks on Wall Street closed near break-even on Friday as investors sold technology shares that have rallied through the COVID-19 pandemic and rotated into cyclical stocks set to benefit from pent-up demand once the pandemic is subdued.

Industrials led rising sectors in the S&P 500, spurred by a 9.9 percent surge in Deere & Co and Caterpillar Inc’s 5 percent gain to an all-time peak of US$211.40 a share.

Financials, materials and energy, along with industrials, rose more than 1 percent.

Photo: Reuters

The S&P 1500 airlines index jumped 3.5 percent, with post-pandemic travel in focus.

The stay-at-home winners, including Microsoft Corp, Facebook Inc, Alphabet Inc’s Google and Netflix Inc, fell in a trend seen for most of the week.

Amazon.com Inc also fell, as investors sold the leaders in the big rally since March last year.

Value stocks rose 0.6 percent, while growth fell 0.6 percent. Advancing stocks led declining shares by about a ratio of two to one.

A battle continues between tech-led growth stocks and cyclicals, companies that are heavily affected by economic conditions, said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York.

“When the economy is roaring, they’re roaring. When the economy is weakening, they’re weakening,” Ghriskey said of cyclicals. “The economy will roar, at least for a period of time. There’s huge pent-up demand, whether just for travel or going back to work.”

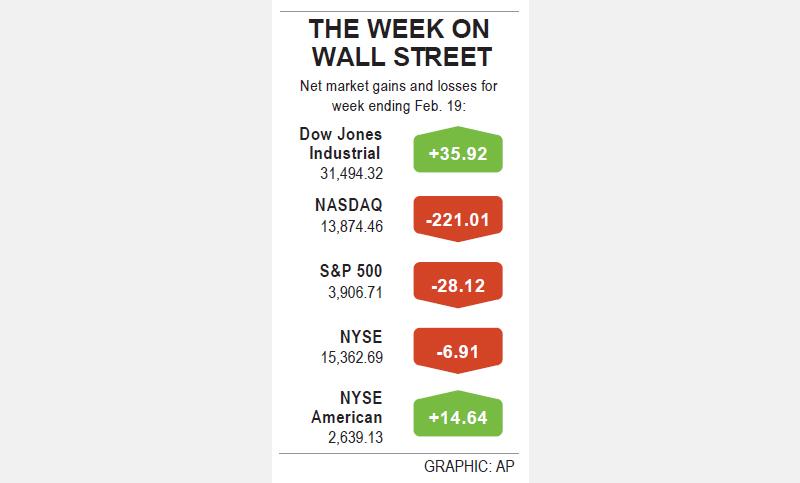

The Dow Jones Industrial Average edged up 0.98 points, or 0 percent, to 31,494.32 and the NASDAQ Composite added 9.11 points, or 0.07 percent, to 13,874.46. The S&P 500 dropped 7.26 points, or 0.19 percent, to 3,906.71.

Volume on US exchanges was 13.47 billion shares.

Healthy earnings, progress in COVID-19 vaccination rollouts and hopes of a US$1.9 trillion federal coronavirus relief package helped US stock indices hit record highs at the beginning of the week.

The Dow Jones hit an all-time intraday peak, led by Caterpillar, after Deere raised its earnings forecast for this year.

Deere reported that profit more than doubled in the first quarter on rising demand for farm and construction machinery.

The benchmark S&P 500 and the tech-heavy NASDAQ posted their first weekly declines this month on concerns over higher stock market valuations, and expectations of rising inflation led to fears of a short-term pullback in equities.

For the week, the Dow rose 0.11 percent, while the S&P 500 fell 0.71 percent and the NASDAQ slid 1.57 percent as big tech sold off.

Bank of America expects a more than 10 percent pullback in stocks, which are trading at more than 22 times 12-month forward earnings, the most expensive since the dot-com bubble of the late 1990s.

“What we saw [this week] represents a market that is tired and may not do very much. So we are headed for some sort of a pullback, but I don’t think we’re there just yet,” said Peter Cardillo, chief market economist at Spartan Capital Securities in New York.

On the economic front, data showed that IHS Markit’s flash US composite purchasing manager’s index, which tracks the manufacturing and services sectors, inched up to 58.8 in this month.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two