Wall Street should have seen the GameStop Corp saga coming. Easier access to information, the proliferation of trading apps, zero-fee commissions, the ability to buy fractional shares, and US government stimulus checks to individuals have all led us to this moment. Let us not forget the actions by the US Federal Reserve and government during the early days of the COVID-19 pandemic that not only supported financial markets, but made everyone forget that investing does carry potential risks.

The rise and newfound clout of retail investors has been evident for all to see if they just opened their eyes.

First, this cohort of investors embarrassed Warren Buffett after he sold his airline stocks in May last year and “wished them well.”

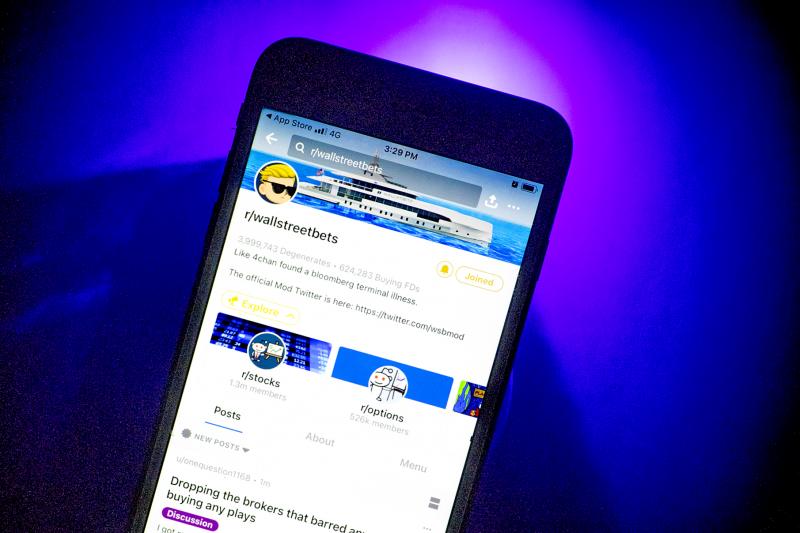

Photo: Bloomberg

Led by Dave “Davey Day Trader” Portnoy, airline stocks almost doubled the next month and are still well above the levels when Buffett exited his positions. The retail investor tugged on Superman’s cape and won. Which is why Buffett should understand what is happening.

Stuck at home, retail investors recognized trends were changing and found a way to profit. They opened brokerage accounts by the millions last year to buy the risky stocks that professional money managers avoided because they believed they were overvalued. These stocks are not in the broad market indices that popular exchange-traded funds mimic. These stocks went on to double and triple in price, with some gaining by even more. The brokers and money managers should understand.

Now it is the retail trader’s turn to take center stage. This crowd is a little different from those the retail investors highlighted above. They are like the professional trader in that they look for opportunities to game the system, hopefully legally.

As we now know, they traffic on Reddit’s WallStreetBets investing forum, which at last count had more than 7.5 million members. There is some very smart analysis in this forum, just like on Wall Street. They also have many “follow the crowd” chasers, also just like on Wall Street. They use screen names like “roaringkitty,” “stonksflyingup” and “veryforestgreen.” That is not very Wall Street-like.

As early as October last year, these and other Redditors were detailing how the “Masters of the Universe” were making an egregious error in GameStop. The number of GameStop shares that were sold short exceeded the amount available for trading, or the “float.” It was the most shorted stock on the New York Stock Exchange. They even singled out hedge fund Melvin Capital, which had shorted most of the shares, as particularly vulnerable.

A massive “squeeze” was possible, but like a good trader they waited for a catalyst. This came in the middle of last month when a surge in the buying of puts preceded a report from Citron Research recommending going short the shares of GameStop. This meant the short squeeze potential was now at its maximum. The Redditors struck with the execution rivaling any of the greatest traders in Wall Street history, and many lawyers say it all looks legal. The “masters” never saw it coming.

Selling more than 100 percent of the float of a stock is what is known as a “naked short,” or selling stock with no intention of delivering the shares. Such activity is illegal under US Securities and Exchange Commission (SEC) rules and stopping it was a principal reason the SEC was created in 1933.

As the investigation into the GameStop saga gets under way, the SEC might want to start with why it failed its own basic mission. The SEC’s job is to see these things coming and it failed.

However, even more disturbing is Wall Street itself. Plenty of smart people must have known that this big a short position put the masters in a position of vulnerability.

However, they did not believe the situation was dangerous, because it was unlikely that any large institution would take advantage of it and attempt a massive short squeeze. Self-regulation keeps the entire financial system honest, but it seems to have gone missing here and in many other corners of Wall Street.

Questions about why these masters were not called out by other masters need to be asked. Is this just “the way the game is played” on Wall Street? In other words, collusion? Rushing to bail out Melvin Capital is consistent with this idea.

The masters did not see the many thousands of retail traders banding together as a large enough force to halt their best-laid plans. As a result, a big new player with lots of money and sophistication has entered the game and is probably not going away. They are outsiders who use the masters’ own practices to change the rules and win.

So many on Wall Street and elsewhere could not, or did not, want to see this coming. They have a vested interest in the “status quo” that clouds their judgement. Many of those same people are now saying that there is elevated risk in the markets due to the rising power and participation of retail investors. The truth is that they might be looking at the wrong risks and at the wrong players.

Jim Bianco is the president and founder of Bianco Research, a provider of data-driven insights into the global economy and financial markets. He might have a stake in the areas he writes about.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the