Rakuten International Commercial Bank (樂天國際商銀) plans to launch a pilot for its Web-only operations by the end of next month, company chairman Chien Ming-jen (簡明仁) said on Monday.

Initially, the bank plans to provide services to its 100 employees, as well as 3,500 staff at its shareholders IBF Financial Holdings Co (國票金控) and Japanese e-commerce firm Rakuten Inc’s local unit, Chien said.

In the first phase, the bank would focus on its information systems, he said, without revealing when formal operations would begin.

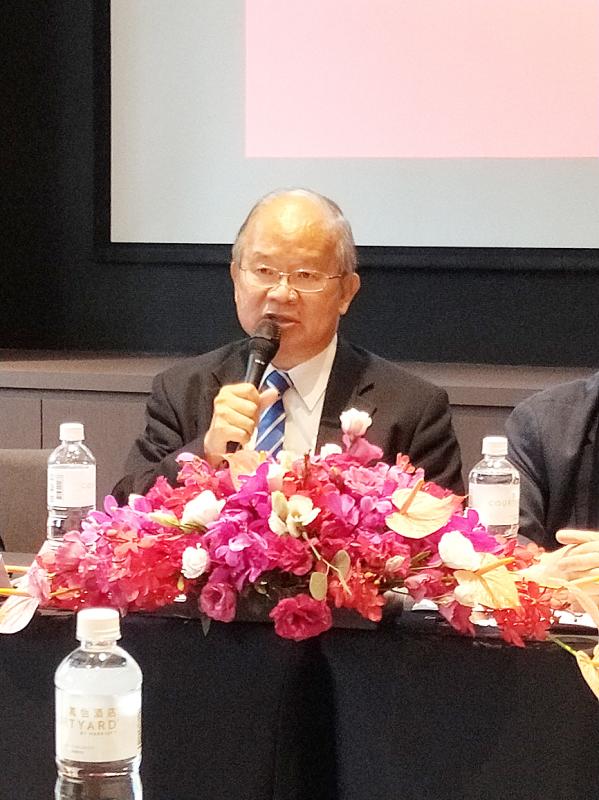

Photo: Lee Chin-hui, Taipei Times

“We will have a killer business strategy and we will not initiate a price war, which the Financial Supervisory Commission [FSC] has urged us to avoid,” Chien told reporters on the sidelines of a ceremony in Taipei, at which Rakuten Bank signed a deal with Central Deposit Insurance Corp (中央存保) to become its 400th insured entity and the first that is a Web-only bank.

Rakuten Bank received an operating license from the commission earlier this month, ahead of two peers, Next Bank (將來銀行) and Line Bank (連線商業銀行).

Traditional banks must have been operating for at least six months before applying to join Central Deposit Insurance, but the FSC has asked Web-only banks to immediately apply upon obtaining an operating license, as they are to offer 24-hour services, meaning that consumers need greater protection, Banking Bureau Deputy Director-General Lin Chih-chi (林志吉) said.

The corporation would ask virtual banks to upload their data via application programming interface (API) solutions to save time and reduce human error, and if the new approach works, it would consider adopting more API suitors, Central Deposit Insurance chairman Michael Lin (林銘寬) said.

In related news, Lin Chih-chi said that operating licenses for Next Bank and Line Bank might be delayed.

Next Bank has not delivered an improvement plan after the commission found problems during a recent on-site inspection, he said.

The commission would speak with Line Bank, as its affiliate messaging app Line Corp this month launched a service that enabled the bank to collect consumers’ data even though Line Bank has not received an operating license, he said.

The commission would take the issue into account when reviewing the bank’s application, FSC Chairman Thomas Huang (黃天牧) said this month.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

STILL UNCLEAR: Several aspects of the policy still need to be clarified, such as whether the exemptions would expand to related products, PwC Taiwan warned The TAIEX surged yesterday, led by gains in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), after US President Donald Trump announced a sweeping 100 percent tariff on imported semiconductors — while exempting companies operating or building plants in the US, which includes TSMC. The benchmark index jumped 556.41 points, or 2.37 percent, to close at 24,003.77, breaching the 24,000-point level and hitting its highest close this year, Taiwan Stock Exchange (TWSE) data showed. TSMC rose NT$55, or 4.89 percent, to close at a record NT$1,180, as the company is already investing heavily in a multibillion-dollar plant in Arizona that led investors to assume

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,