Silicon wafer supplier Formosa SUMCO Technology Corp (台勝科) yesterday said that wafer prices are likely to hold steady for long-term supply contracts this quarter from last quarter, driven by robust demand for 8-inch wafers for power management ICs and driver ICs for displays.

Growth momentum for 8-inch wafers is expected to extend to the end of this year, the company said.

The forecast largely matches the guidance from rival GlobalWafers Co (環球晶圓). GlobalWafers expects revenue to grow modestly in the second half of this year from the first half, thanks to resilient wafer demand.

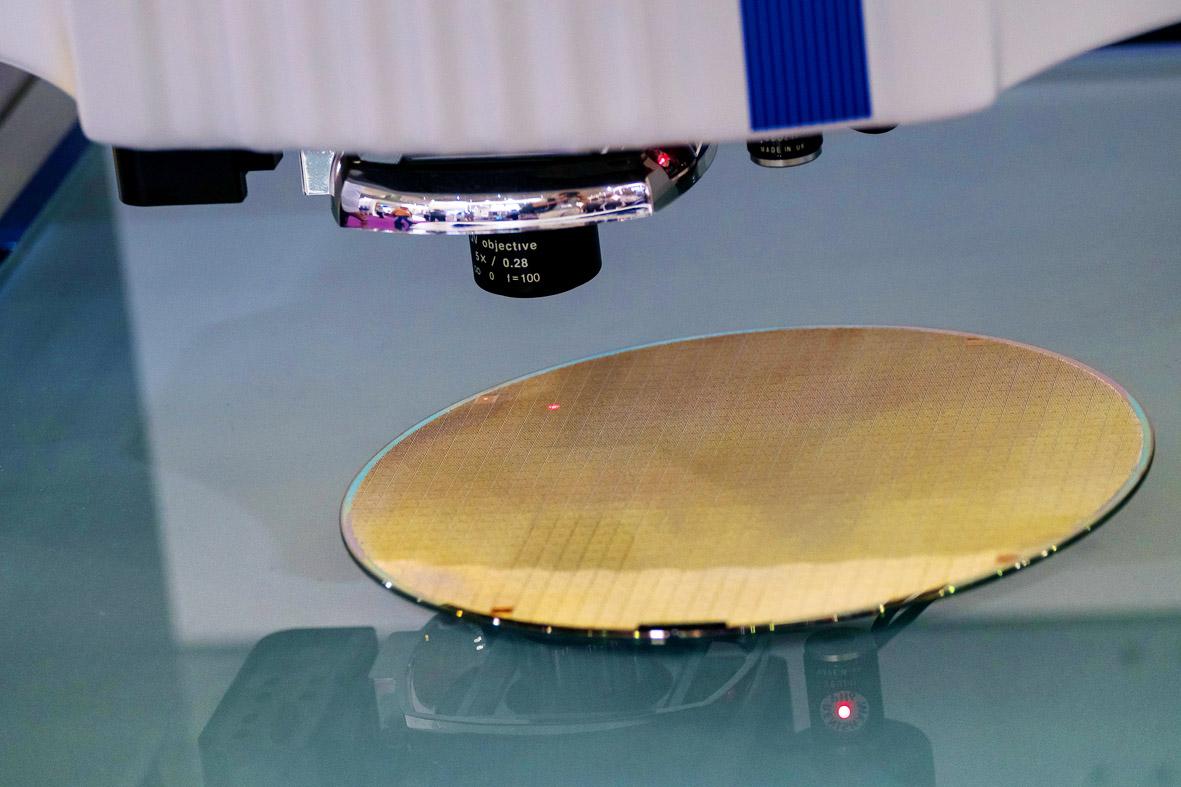

Photo: Billy H.C. Kwok, Bloomberg

Formosa SUMCO said customers also showed strong demand for 12-inch wafers, according to presentation material posted on the company’s Web site yesterday.

Demand from memorychip makers is stabilizing, Formosa SUMCO said in the material.

Its factory utilization rate is approaching 100 percent, it said.

Formosa SUMCO said wafer demand would continue to grow, benefiting from COVID-19-induced trends of remote working and broader adoption of 5G applications.

Those trends are fueling demand for end devices, particularly PCs, tablets and data centers, the company said.

Net profit last quarter shrank 5.44 percent to NT$271.15 million (US$9.41 million), compared with NT$286.76 million in the third quarter of last year, after the company booked a foreign exchange loss of NT$104.4 million, it said in a financial statement.

On a quarterly basis, net profit plunged 20.6 percent from NT$341.33 million.

That translated into earnings per share of NT$0.70 last quarter, down from NT$0.74 a year earlier and NT$0.88 the previous quarter.

Gross margin improved to about 19.4 percent last quarter, from 18.7 percent a year earlier.

During the first three quarters of this year, Formosa SUMCO’s net profit nearly halved to NT$1.07 billion, compared with NT$1.95 billion in the same period last year. Earnings per share plunged to NT$2.60 from NT$5.02 over the period.

Revenue was little changed at NT$8.98 billion in the first nine months of this year, compared with NT$8.9 billion in the same period last year.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to

PRESSURE EXPECTED: The appreciation of the NT dollar reflected expectations that Washington would press Taiwan to boost its currency against the US dollar, dealers said Taiwan’s export-oriented semiconductor and auto part manufacturers are expecting their margins to be affected by large foreign exchange losses as the New Taiwan dollar continued to appreciate sharply against the US dollar yesterday. Among major semiconductor manufacturers, ASE Technology Holding Co (日月光), the world’s largest integrated circuit (IC) packaging and testing services provider, said that whenever the NT dollar rises NT$1 against the greenback, its gross margin is cut by about 1.5 percent. The NT dollar traded as strong as NT$29.59 per US dollar before trimming gains to close NT$0.919, or 2.96 percent, higher at NT$30.145 yesterday in Taipei trading