Accumulated exports from the IC sector in the first eight months of the year were US$76.022 billion, up 21.6 percent from a year earlier and a record high for the period, Ministry of Finance data released yesterday showed.

The total value of the nation’s exports over the eight-month period reached US$217.38 billion, up 1.5 percent from last year, making Taiwan one of the few economies to retain growth momentum amid the COVID-19 pandemic, the ministry said.

The increase in overall export value was driven by strong growth in exports of electronic components and information and communication products, propelled by solid demand for emerging 5G technologies and work-from-home devices.

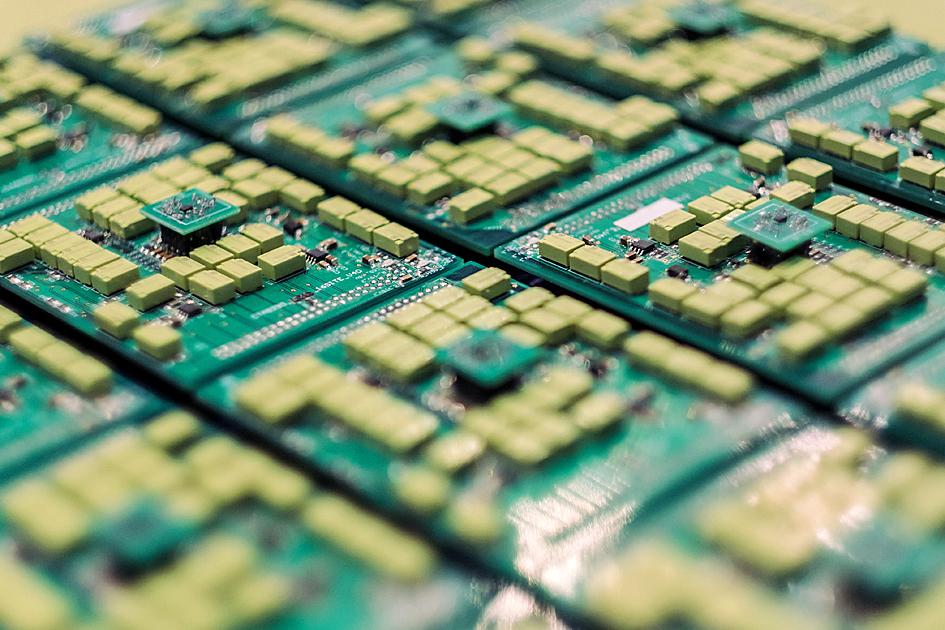

Photo: Billy HC Kwok, Bloomberg

This was offset by a decline in exports of some major products, the ministry said.

In the electronic components industry, the IC sector recorded US$11.285 billion in exports in August, up 20.4 percent from a year earlier, and a record single-month high, due mainly to rush shipments to Huawei Technologies Co (華為) ahead of new US sanctions against the Chinese tech giant.

In August, IC products made up 36.2 percent of Taiwan’s total exports.

Over the first eight months, the IC sector accounted for 35 percent of Taiwan’s total exports, also a record high, the data showed.

The strong growth in IC exports and the sector’s contribution to overall exports was due to strong demand for technology products and a steep fall in the export of old-economy products, such as plastics, minerals and machinery products as a result of the pandemic, ministry officials said.

The value of semiconductor equipment imports in August was US$1.9 billion, up 26.1 percent from a year earlier, the data showed.

For the first eight months, accumulated semiconductor equipment imports hit a record-high US$14.28 billion for the period, up 9.3 percent year-on-year, the data showed.

The nation’s semiconductor industry is expected to step up imports of equipment later this year, particularly high-end equipment from Japan and Europe, to improve its competitiveness, ministry officials said.

This trend has been spurred by US-China technology disputes, which has increased business opportunities in emerging technologies and for Taiwanese companies moving production back to Taiwan.

The anticipated increase in the purchase of semiconductor equipment is likely to boost Taiwan’s overall imports and cause greater exports, ministry officials said.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)