European equities on Friday posted their biggest weekly gain since early last month, capping a roller-coaster week, with Altice Europe NV and Aryzta AG jumping on takeover news.

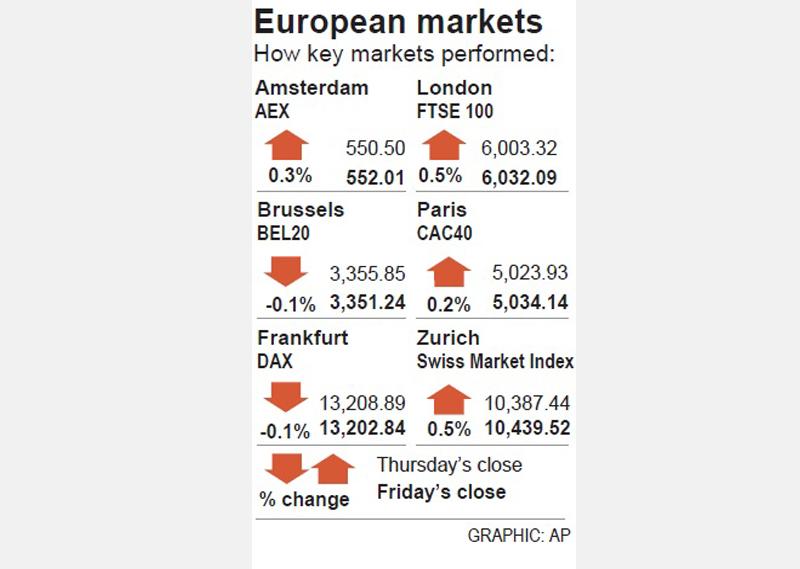

The STOXX Europe 600 Index ended the session up 0.13 percent at 367.96, with a slump in banks and travel shares offset by a surge in mining stocks. The benchmark rose 1.67 percent on the week.

Deals were in focus after Next Private BV agreed to buy Altice, sending the shares 24 percent higher, while Aryzta said that it was in advanced talks with Elliott Management Corp about a potential takeover, with its shares rising more than 12 percent.

European stocks have been stuck in a narrow range since mid-June. The rising euro has acted as a headwind for their relative performance to global shares, and the currency resumed its surge against the US dollar after the European Central Bank (ECB) on Thursday said there was no need to intervene.

“The market remains highly sensitive in the short term and prone to unexpected and negative news,” Donner & Reuschel Privatbank technical analyst Martin Utschneider said. “This was also the case with yesterday’s ECB press conference. Hedges — stop loss or profit-taking — should therefore continue to be strictly maintained or adjusted.”

Meanwhile, London’s FTSE 100 ended Friday higher on gains in mining heavyweight Rio Tinto Group, and marked its best week in more than three months as a weaker pound benefited the exporter-heavy index.

The blue-chip FTSE 100 closed the day 0.48 percent higher at 6,032.09 and added 4.02 percent for the week, breaking a three-week losing streak.

Insurer Aviva PLC was the best performing blue-chip for the week after it said it would sell its Singapore business for S$2.7 billion (US$1.97 billion).

“The FTSE 100 has international horizons and the resulting weakness in the pound [from hard Brexit fears] has boosted the relative value of constituents’ overseas earnings,” AJ Bell investment director Russ Mould said.

Rio Tinto was the biggest boost to the index for the day after giving in to shareholder pressure to replace its chief executive over the destruction of two significant Aboriginal rockshelters.

Major miners rose on weakness in the pound and higher metal prices. The pound has come under pressure from increasing bets on a no-deal British exit from the EU.

Still, British stocks have lagged their peers in the developed world as middling economic data and an uptrend in local COVID-19 cases pushed them into a tight trading range since May.

A recent rout in US stock markets also extended to local equities, pressuring the FTSE 100 in particular.

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) yesterday expressed a downbeat view about the prospects of humanoid robots, given high manufacturing costs and a lack of target customers. Despite rising demand and high expectations for humanoid robots, high research-and-development costs and uncertain profitability remain major concerns, Lam told reporters following the company’s annual shareholders’ meeting in Taoyuan. “Since it seems a bit unworthy to use such high-cost robots to do household chores, I believe robots designed for specific purposes would be more valuable and present a better business opportunity,” Lam said Instead of investing in humanoid robots, Quanta has opted to invest