In the race to develop medication, test kits and vaccines aimed at COVID-19, Eternal Materials Co (長興材料), a company known for its chemical exports, has emerged as a dark horse.

Its rapid test kit for COVID-19 antibodies was one of the first to be manufactured in Taiwan, and it was used to test people linked to the largest cluster infection of COVID-19 seen in the country back in April.

Eternal Materials has now received formal approval to sell the product in Taiwan, as well as in the EU and several Southeast Asian countries, and it is applying for a permit in the US, company spokesman Liu Bing-cheng (劉秉誠) said.

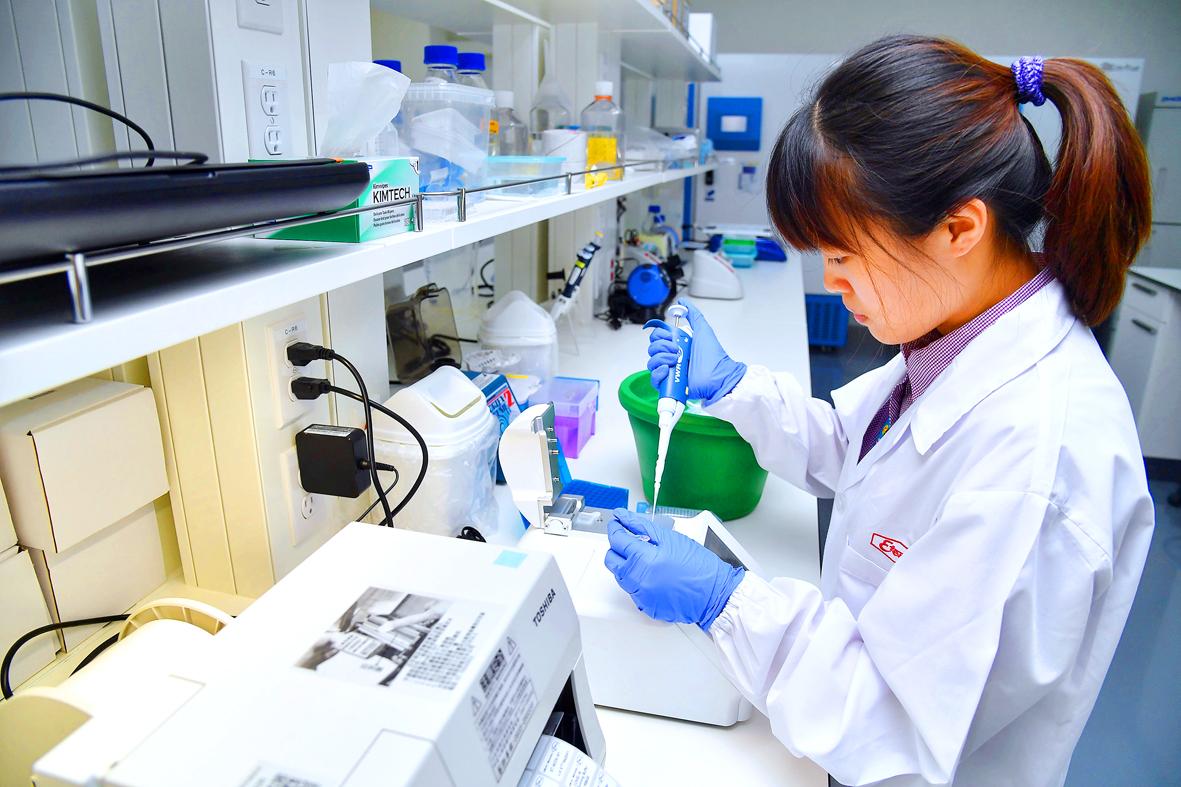

Photo: CNA

“Without our previous experience, we wouldn’t have had this opportunity,” chief operating officer Mao Hui-kuan (毛惠寬) said in a recent interview, referring to seven rocky years endured by Eternal Materials’ biomedical research team.

Founded in 1964, the company is one of the largest suppliers of synthetic resins and photoresist materials in Asia. It ventured into the biomedical field in 2013, with a focus on test kits.

Although some of its products have proved useful in disease prevention, such as a test kit for dengue fever that the company worked on with the Centers for Disease Control (CDC), none of them have been a commercial success.

Photo: CNA

“We’ve struggled a lot,” to the point where management has considered dismantling the department, Mao said.

Yet the team persevered, and the pandemic, despite its adverse impact on the company’s business earlier this year, proved to be an opportunity for its research and development staff to put their expertise to good use.

In March, the CDC contacted Eternal Materials to see if it could develop a rapid test for detecting COVID-19 antibodies. Within 10 days, it had a prototype ready to go.

“We just kept trying and trying and trying,” Eternal Materials chief researcher Wang Hsi-kai (王璽凱) said.

The prototype was just the beginning; researchers at Eternal Materials continued to revise and improve the test kit over the following months.

It was used by the Central Epidemic Command Center in late April to test for antibodies when a cluster infection linked to a navy flotilla emerged.

Five months after the development process officially began, the team settled on a finalized version of the kit and called it the Eternal COVIDual COVID-19 IgM/IgG Rapid Test.

That same month, it became the third COVID-19 antibody test in Taiwan to receive emergency use authorization from the Food and Drug Administration.

Results can be seen in 15 minutes, and can indicate whether a person was infected recently or in the more distant past, with an accuracy rate of 98 percent, the company said.

However, other countries started manufacturing antibody rapid test kits months ago, raising questions whether Taiwan might be too late to the game to have an impact in the global market.

Chen Wen-ching (陳玟瑾), a manager in the company’s development department, acknowledges the challenges of being a late entrant, but sees other factors at play, especially quality and reliability.

The market was awash with test kits from China in April and May, but Taiwanese products are popular globally and quality remains the deciding factor whether a product is bought, she said.

“Even though we are a bit late, our products are good,” she said.

The company has already begun selling the test kits in small quantities overseas as it scales up production, hoping to increase its monthly output to 1 million kits by the end of the year, Chen said.

The goal is to produce 3 million test kits a month by March next year, and 11 million per month by the end of next year, she said.

That timetable suggests it might be a while before profits start to roll in, but Mao is not worried.

“It’s still exciting to be able to contribute to society, and be a part of the ‘national team’ that is fighting the disease,” he said.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong