The election of board directors yesterday at Tatung Co (大同) sparked controversy after the company blocked some institutional and individual shareholders from participating in the general shareholders’ meeting, prompting the Financial Supervisory Commission (FSC) to announce that the vote would be investigated.

Lin Kuo Wen-yen (林郭文艷) was re-elected as chairwoman of the household-appliance maker’s nine-member board, but prior to the vote she announced that several shareholders would not have voting rights.

They were being denied a vote because they had contravened the Business Mergers and Acquisitions Act (企業併購法), and the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (兩岸人民關係條例), Lin Kuo said.

Photo: Peter Lo, Taipei Times

The company had previously alleged that some investors have received financial backing from Chinese investors.

Tatung management won six director seats and three independent director seats, leaving minority shareholders led by Shanyuan Group (三圓建設) chairman Wang Kuang-hsiang (王光祥) empty-handed.

Tatung’s move took many people by surprise. It was the first time a publicly listed company in Taiwan has blocked shareholders’ voting rights.

Securities and Futures Bureau Deputy Director-General Tsai Li-ling (蔡麗玲) told a news conference in New Taipei City later in the day that the commission would have Taiwan Depository and Clearing Corp (TDCC, 台灣集中保管結算所) investigate whether Tatung had violated shareholders’ rights.

“Only the government has the right to decide whether shareholders have contravened any regulations, not listed companies. Tatung cannot use this as an excuse to take away shareholders’ voting rights,” Tsai said.

If TDCC concludes that Tatung did contravene the Regulations Governing the Administration of Shareholder Services of Public Companies (公開發行股票公司股務處理準則), it would be barred from holding board elections on its own, among other shareholder services, and would have to have such elections run by a third-party, Tsai said.

The Taiwan Stock Exchange has also asked Tatung to explain its decision, Tsai said.

If its explanation is found wanting, the exchange could fine the firm up to NT$5 million (US$168,577) or delist it, she said.

Tatung’s attorney Lai Chung-chiang (賴中強) told an evening news conference that the firm barred 27 shareholders from exercising their voting rights, including eight foreign investors and three firms belonging to Shanyuan Group and an investor surnamed Cheng (鄭), although they together owned a 53 percent stake in the company.

“We took away their rights, as some investors own more than a 10 percent stake, contravening the Business Mergers and Acquisitions Act, and as they aimed to acquire Tatung, but did not provide true information to the government,” Lai said.

The company revoked Cheng’s voting rights after prosecutors questioned whether he helped Chinese investors buy Tatung shares, which would contravene the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area, Lai said.

Many of Tatung’s units, including solar-power generation, construction and publications, are not allowed to accept investment from Chinese investors, so it was important that the firm blocked questionable investors, he said.

“Disputes regarding voting rights should be part of a firm’s self-governance. If an investor cannot accept our move, they can file a lawsuit,” Lai said.

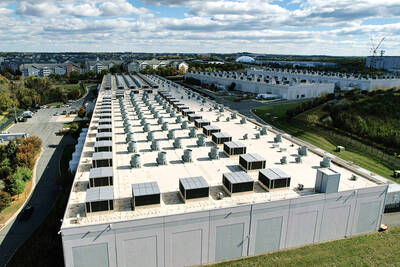

The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines. Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom. One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Netflix on Friday faced fierce criticism over its blockbuster deal to acquire Warner Bros Discovery. The streaming giant is already viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices. As Netflix emerged as the likely winning bidder for Warner Bros — the studio behind Casablanca, the Harry Potter movies and Friends — Hollywood’s elite launched an aggressive campaign against the acquisition. Titanic director James Cameron called the buyout a “disaster,” while a group of prominent producers are lobbying US Congress to oppose the deal,

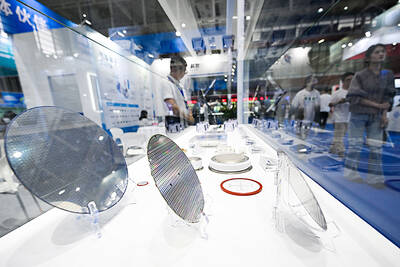

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia