Wall Street’s major indices tumbled more than 2 percent on Friday as several US states imposed business restrictions in response to a surge in COVID-19 cases.

Some US states that were spared the brunt of the initial coronavirus outbreak or moved early to lift restrictions are seeing a resurgence in new infections. On Friday, Texas and Florida ordered bars to close down again.

“You’re seeing a pretty dramatic increase in cases,” said Kevin Grogan, managing director of investment strategy at Buckingham Strategic Wealth in St Louis. “If people start feeling again like it’s not safe to eat out or go shopping, that could have a really negative impact on the stock market.”

A Wall Street Journal report that the “phase one” US-China trade deal could be at risk placed additional pressure on US stocks.

According to that report, Chinese officials said that “meddling” in Taiwan and Hong Kong could lead Beijing to back away from its commitment to purchase US farm goods.

“It added another log into the risk-aversion fire,” Oanda Corp senior market analyst Edward Moya said in New York.

Among sectors, financial, communication services and energy shares outpaced the broader S&P 500 in declines. S&P 500 bank shares plummeted 6.1 percent after the US Federal Reserve limited dividend payments and barred share repurchases until at least the fourth quarter following its annual stress test.

Renewed concerns over the pandemic has threatened to derail a strong rally for Wall Street that has erased much of the S&P 500’s steep losses from March.

The benchmark index ended below its 200-day moving average, an indicator of long-term momentum.

The uptick in coronavirus cases likely triggered a test of that technical level, said Jim Paulsen, chief investment strategist at the Leuthold Group LLC in Minneapolis.

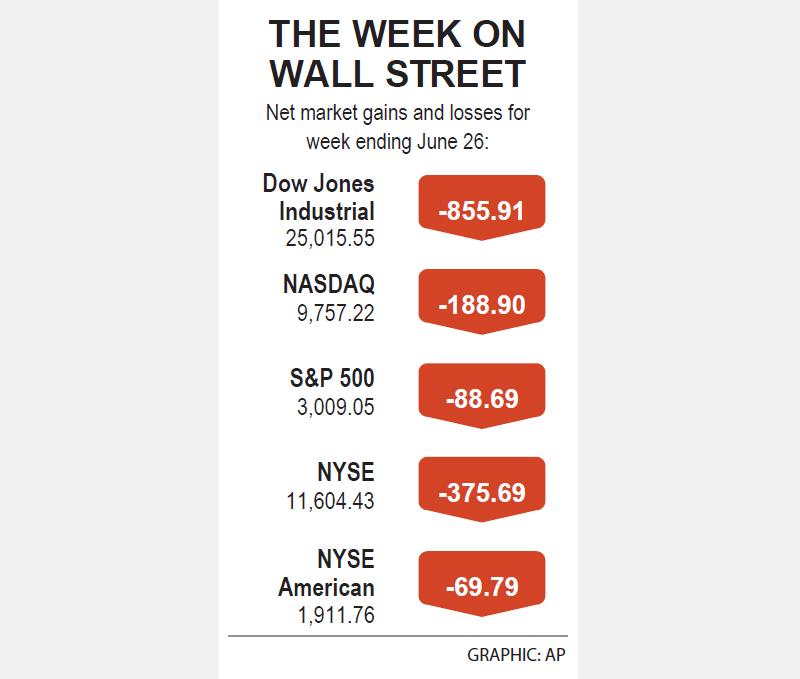

The Dow Jones Industrial Average fell 730.05 points, or 2.84 percent, to 25,015.55, the S&P 500 lost 74.71 points, or 2.42 percent, to 3,009.05 and the NASDAQ Composite dropped 259.78 points, or 2.59 percent, to 9,757.22.

For the week, the S&P 500 fell 2.87 percent, the Dow lost 3.31 percent, and the NASDAQ shed 1.87 percent.

Facebook Inc shares shed 8.3 percent, weighing the most on the S&P 500, after Unilever PLC and Verizon Communications Inc joined an advertising boycott that called out the social media giant for not doing enough to stop hate speech on its platforms.

Nike Inc shares dropped 7.6 percent as the footwear maker, hurt by store closures due to the pandemic, posted a surprise quarterly loss.

Gap Inc shares surged 18.8 percent after the retail chain entered a 10-year deal with rapper and fashion designer Kanye West to create a line of clothing under his Yeezy brand.

Friday also marked the reconstitution of the FTSE Russell indexes, including the large-cap Russell 1000 and small-cap Russell 2000.

Daily trading volume is often among its highest levels of the year during the reconstitution, though volume this year has spiked on several occasions amid steep market sell-offs.

Volume on US exchanges was 16.43 billion shares on Friday, compared with the 13.44 billion average for the full session over the past 20 trading days.

Declining issues outnumbered advancing ones on the New York Stock Exchange by a 3.99-to-1 ratio; on NASDAQ, a 3.57-to-1 ratio favored decliners.

The S&P 500 posted five new 52-week highs and no new lows; the NASDAQ Composite recorded 59 new highs and 28 new lows.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his