Business sentiment of Asian companies sank to an 11-year low in the second quarter, a Thomson Reuters/INSEAD survey found, with about two-thirds of the firms surveyed flagging a worsening COVID-19 pandemic as the biggest risk over the next six months.

While the pandemic’s initial impact was reflected in the March survey, confidence during this quarter fell by a third to 35, only the second time that the Thomson Reuters/INSEAD Asian Business Sentiment Index has slumped below 50 since the survey began in the second quarter of 2009.

A reading above 50 indicates a positive outlook.

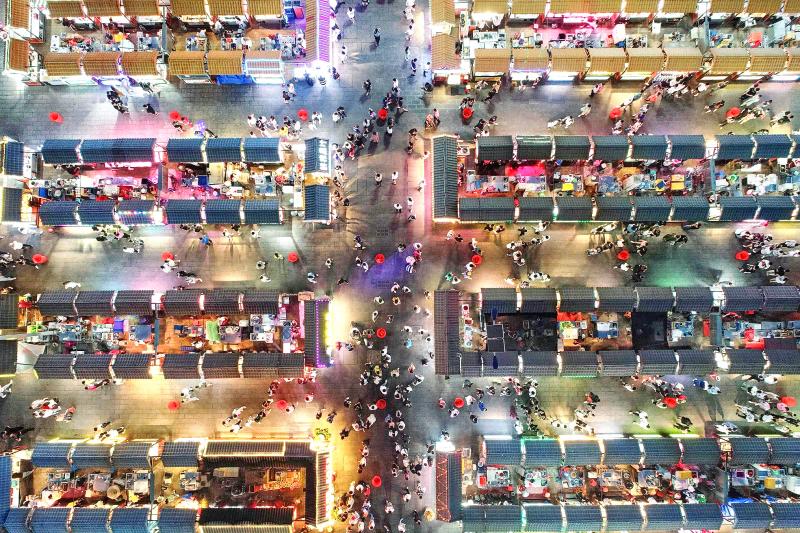

Photo: AFP

The last time the index showed a reading below that was in its debut quarter, when it hit 45.

About 16 percent of the 93 companies surveyed also said that a deepening recession was a key risk for the next six months, with more than half expecting staffing levels and business volumes to decline.

“We ran this survey right at the edge when things were getting really bad,” Antonio Fatas, a Singapore-based economics professor at the global business school INSEAD, said of the survey conducted between May 29 and Friday last week.

“We can see this complete pessimism which is spread across sectors and countries in a way that we haven’t seen before,” he said.

Many nations are easing COVID-19-related lockdowns, but worries have mounted that another wave of infections could hurt economies that have been battered from weeks of curbs on travel and movement.

Coronavirus cases globally have crossed 8 million.

After weeks with almost no new COVID-19 infections, China recorded dozens of new cases this week, roiling fragile equity markets. South Korea also faces an uptick after early successful containment.

Companies from 11 Asia-Pacific nations responded to the Thomson Reuters/INSEAD survey.

Participants included Taiwanese contract manufacturer Wistron Corp (緯創), Thai hospitality group Minor International PCL (MINT), Japanese automaker Suzuki Motor Corp and Australia-listed Oil Search Ltd.

China, where COVID-19 was first detected, reported that industrial output quickened for a second straight month last month, but a weaker-than-expected gain suggested that the recovery remains fragile.

“It tells us that the recovery will take time and it won’t be a V-shaped recovery,” said Jeff Ng, senior treasury strategist at HL Bank Singapore (豐隆銀行).

Governments have rolled out stimulus measures to support ailing economies. Singapore and Hong Kong, among the most open economies in Asia, have backed sectors such as airlines that are bearing the brunt of travel restrictions.

The US Federal Reserve last week said that it would likely hold its benchmark interest rate near zero through 2022, signaling it expects a long road to recovery.

However, recessions in most major economies are still expected to be more severe this year than forecast, Reuters polls of more than 250 economists published late last month showed.

Chaiyapat Paitoon, chief strategy officer at Bangkok-based MINT — which operates brands such as Marriott and Four Seasons, and gets the bulk of its revenue from Europe — said that the company had taken several cost-saving measures to minimize the impact on its profits.

“MINT’s main priorities are to survive, stabilize and grow,” Paitoon said.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or