Intel Corp is buying transportation planning service Moovit Inc for US$900 million as the world’s largest computer chipmaker moves further down the road in its effort to build self-driving vehicles.

The deal announced on Monday gives Intel another tool to use in its push to become a major player in the race to create the technology needed to build fleets of taxis that would be able to transport passengers without a human driver behind the wheel.

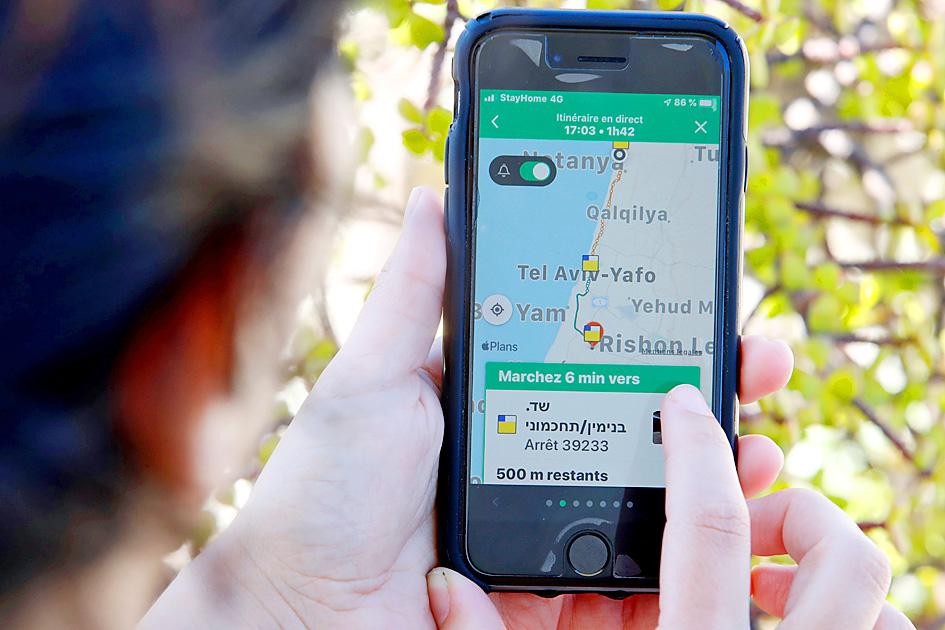

Moovit, an eight-year-old company based in Israel, makes an app that compiles data from public transit systems, ride-hailing services and other resources to help its 800 million users plan the best ways to get around.

Photo: AFP

Intel plans to combine Moovit with Mobileye, a self-driving vehicle specialist that Intel bought for about US$15 billion in 2017.

Since that deal, Mobileye’s revenue has ballooned from US$210 million in 2017 to US$879 million last year. That is a reflection of the big bets being placed on automated driving by both major technology companies, such as Google spinoff Waymo and Apple Inc, and automakers such as General Motors Co and Toyota Motor Corp.

“Intel’s purpose is to create world-changing technology that enriches the lives of every person on Earth,” Intel chief executive officer Bob Swan said.

Despite its rapid growth, Mobileye still only accounts for a sliver of Intel’s annual revenue of US$72 billion.

Intel, which is based in Santa Clara, California, is upping its ante on self-driving vehicles at a time when many other companies are bracing for an extended economic downturn that already has thrust more than 30 million Americans into the unemployment lines.

However, the stay-at-home orders imposed as part of the coronavirus pandemic have only made people more aware of how dependent they are on technology, including the Intel chips inside PCs and a wide range of other devices.

While the recession would take a bite out of the technology industry too, the long-term picture for the biggest companies still looks bright.

Deep-pocketed companies, such as Intel, which is sitting on US$11.4 billion cash, are expected to forge ahead with their investments in fields they believe would turn into gold mines.

Intel already acquired a stake in Moovit in 2018 when it was among a group of investors who injected US$50 million into the start-up. Since its inception, Moovit had raised more than US$130 million from venture capitalists and other investors.

After Intel invested in Moovit, Mobileye chief executive officer Amnon Shashua joined the start-up’s board of directors as an observer.

Shashua would oversee Moovit’s roughly 200 employees, including its cofounder and chief executive officer Nir Erez, who would become an executive vice president within the Mobileye group.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to