With meat-processing workers falling victim to COVID-19, shuttering plants and slowing supply, Americans are starting to see poorly stocked aisles where once beef and pork were plentiful. At the same time, the link between industrial meat production and deadly human viruses has become more widely understood.

The global crisis, in other words, is turning into a big opportunity for the plant-based protein sector. Beyond Meat Inc, one of the bigger names in food technology, last month saw its shares jump 49 percent.

Meanwhile, venture capitalists have been pouring money into smaller companies, some focused on lab-grown meat analogues as well as plant-based substitutes. In the middle of last month, US sales of these products were double that of the same period last year.

Photo: Bloomberg

“The thesis of alternative proteins is strengthened by COVID-19,” said private equity veteran Jeremy Coller, a long-time vegan. “We see this as a massively growing and important sector.”

Coller, founder of Coller Capital, formed asset manager collaborative FAIRR to push companies toward greater food sustainability because of the risks — so clearly illustrated by the current recession — to the global financial system. Its members manage US$20.4 trillion.

The annual retail food market grew only 2.2 percent last year, according to industry trade groups. By comparison, plant-based foods were up 11.4 percent, as estimated by the Plant Based Foods Association.

Plant-based meats saw 18 percent retail growth, with refrigerated versions like Impossible Foods burgers, Beyond Meat sausages and Tofurkey deli slices making up the majority of the increase.

The big meat processors — Tyson Foods Inc, Smithfield Foods Inc, Hormel Foods Corp — were already investing in plant-based alternatives when the pandemic arrived.

Even as the administration of US President Donald Trump tries to keep traditional US meat plants open, the pandemic is providing a tremendous boost to consumer interest in alternative products.

In Europe, Barcelona, Spain-based Novameat is moving quickly to capitalize on the moment. It uses tissue engineering and bio-printing technologies to produce meat alternatives.

Founder and chief executive officer Giuseppe Scionti said that his company has pivoted to developing pork substitutes, given supply issues in the US and Brazil.

We “wanted to demonstrate that our technology is highly adaptable to work with a variety of ingredients, to mimic different types of plant-based meats,” he said.

With pork texture and appearance already sorted, Scionti said he expects “to have the taste hacked before this summer.”

However, nowhere is the potential for meat alternatives more significant than in China, the starting point of the pandemic.

It has seen its food supply hit by all manner of viruses, most recently African swine fever, an epidemic that devastated commercial hog farms starting in 2018. China feeds 20 percent of the world’s population on just 7 percent of the world’s farmland.

“Food security is an issue that is top of mind for the Chinese government,” said Bruce Friedrich, executive director of the Good Food Institute, a nonprofit that promotes meat, dairy and egg alternatives.

In China, plant-based dairy has long been a staple, along with the basic protein alternatives like tofu, but it has been slower to innovate in the faux or cell-based meat space.

However, in a post-coronavirus world, China could move more swiftly on this front, and US companies might be the ones helping propel it.

In February, PepsiCo Inc acquired Baicaowei (百草味), a Chinese snack company that launched a plant-based sausage made from soy and konjac, for US$705 million.

“Our investment activities haven’t slowed down” because of the pandemic, said Matilda Ho, founder and managing director of Bits x Bites, a food tech venture capital firm in Shanghai.

“We believe this recent uncertainty might just be a pivotal moment for the still nascent food-tech sector in China,” Ho said.

Vectr Ventures, a Hong Kong-based early venture fund, took colead on Plantible Foods Inc’s US$4.6 million seed round, which closed in late March.

Vectr partner Alan Chan (陳耀麟) said his US$1.6 million investment in the San Diego-based start-up was a way to “focus on Asia’s population growth, urban migration and food,” all weighty issues made more urgent by the pandemic.

“There has to be an efficient utilization of things we can grow to feed everyone,” Chan said.

Plantible is part of a new generation of US companies jumping into this space. It began raising funds in December last year to grow lemna, or duckweed — a small, aqueous plant that is almost 45 percent protein and regenerates its biomass every 48 hours. The final product is a flavorless protein that could eventually star in your next burger, as a dairy alternative or egg white substitute.

When scaled, it could enable a continuous production process that makes its supply chain “climate-change proof,” co-founder Tony Martens said.

Chris Kerr of New Crop Capital, a fund that focuses on replacing animals in the food system, has invested in Starfield Food and Science Technology Ltd (星期零食品科技有限), a Chinese developer of plant-based proteins.

He called plant-based foods “a mega-trend that will not go away.”

However, still, he remains cautious about which food tech companies should be funded.

“The biggest risk is funding a bridge to nowhere,” he said.

There are other investors who are holding back.

Leah Volger, principal at early-stage venture capital fund Manta Ray, said she does not “necessarily see a shift in our strategy.”

Nonetheless, Manta Ray has invested in Berkeley, California-based Climax Foods, founded by Oliver Zahn, an astrophysicist who worked for Impossible Foods and Google. Zahn plans to use computer science to comb through the plant kingdom looking for better, cheaper food combinations.

Several other food tech companies have been successful in raising money during the first quarter. They include Seattle-based Rebellyous Foods, which in March raised US$6 million in a funding round led by Fifty Years, a San Francisco-based seed fund.

Rebellyous makes plant-based chicken nuggets as proof-of-concept for what it touts as a cheaper, more efficient manufacturing process.

Live Kindly, a collective of food-based brands, in March closed a venture round for US$200 million. Israel-based InnovoPro, a maker of chickpea protein, raised US$15 million in a recent series B.

In the long run, the pandemic “will cause way more capital to flow into the space, as the world wakes up to the very real threat of zoonotic diseases,” Fifty Years founding partner Seth Bannon said.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

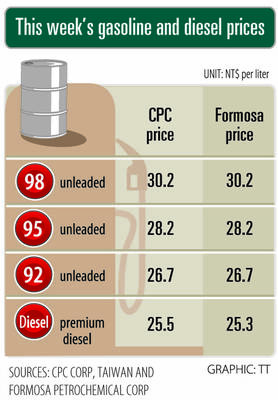

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01