Stocks on Friday sank around the globe again as investors braced for more economic pain from the COVID-19 epidemic, sending US markets to their worst weekly finish since the 2008 financial crisis.

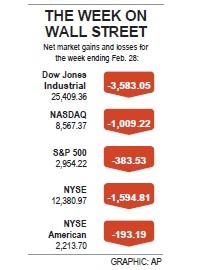

The damage from the week of relentless selling was eye-popping: The Dow Jones Industrial Average plunged. Microsoft Corp and Apple Inc, the two most valuable companies on the S&P 500, lost a combined US$300 billion.

In a sign of the severity of the concern about the possible economic blow, the price of oil sank 16 percent.

The market’s losses moderated on Friday after the US Federal Reserve released a statement saying that it stood ready to help the economy if needed.

Investors increasingly expect the Fed to cut rates at its next policy meeting in the middle of this month.

The Dow Jones Industrial Average on Friday swung back from an early slide of more than 1,000 points to close down 357.28 points, or 1.4 percent, at 25,409.36, plummeting 12.4 percent from a close of 28,992.41 on Feb. 21.

The S&P 500 on Friday fell 24.54 points, or 0.8 percent, to 2,954.22, a plunge of 11.5 percent from 3,337.75 a week earlier and down 13 percent since hitting a record high just 10 days earlier.

The latest losses have wiped out the S&P 500’s gains going back to October last year. The benchmark index is still up 6.1 percent over the past 12 months, not including dividends. Its weekly loss was the biggest since an 18.2 percent drop in the week ending Oct. 10, 2008.

The NASDAQ Composite on Friday reversed an early decline to finish flat at 8,567.37, but still dropped 10.5 percent from a close of 9,576.5 a week earlier.

The Russell 2000 index of smaller company stocks on Friday lost 21.44 points, or 1.4 percent, to close at 1,476.43, also plunging 12 percent from 1,678.61 on Feb. 21.

Global financial markets have been rattled by the virus epidemic, which has been shutting down industrial centers, emptying shops and severely crimping travel all over the world.

More companies are warning investors that their finances would take a hit because of disruptions to supply chains and sales. Governments are taking increasingly drastic measures as they scramble to contain the virus.

The rout has knocked every major index into what market watchers call a “correction,” or a fall of 10 percent or more from a peak. The last time that occurred was in late 2018, as a tariff war between the US and China was escalating.

Market watchers have said for months that stocks were overpriced and long overdue for another pullback.

Bond prices soared again as investors sought safety and became more pessimistic about the US economy’s prospects. That pushed yields to more record lows.

The yield on the 10-year US Treasury note fell sharply from 1.3 percent late on Thursday to 1.14 percent, a record low, TradeWeb Markets Inc said.

That yield is a benchmark for home mortgages and many other kinds of loans.

“All this says to us is that there are still a lot of worries in the market,” Cetera Financial Group Inc chief investment officer Gene Goldman said. “We need the Fed to come out and say: ‘basically guys, we got your back.’”

Traders have been growing more certain that the Fed will be forced to cut interest rates to protect the US economy, and soon.

The Fed’s lack of action amounts to a tightening of rates compared with other nations and their actions to offset the effects of the coronavirus, Goldman said.

Investors now widely expect the Fed to cut interest rates by a half-point at its meeting that ends on March 18.

The expectations for a half-point cut jumped from 47 percent just before the Fed’s statement was released to 60 percent by the close of trading, the Chicago Mercantile Exchange’s Fedwatch tool showed.

The sell-off follows months of uncertainty about the spread of the virus, which hit China in December last year and shut down large swaths of the country by January.

Uncertainty turned into fear as the virus started jumping to places outside of the epicenter and dashed hopes for containment.

“Fear is a stronger emotion than hope,” Wells Fargo Asset Management head of active equity Ann Miletti said. “This is what we’re seeing today and this week and over the past seven days.”

Airlines have suffered some of the worst hits as flight routes are canceled, along with travel plans.

Big names like Apple and Budweiser brewer Anheuser-Busch InBev SA/NV are part of a growing list of companies expecting financial pain from the virus.

Dell Inc and athletic wear company Columbia Sportswear Co are the latest companies expecting negative effects on their bottom lines.

Cruise operators have also been hard hit, with shares sinking 30 percent or more as shipboard infections increased.

However, those companies were having a far better day on Friday, with some on Wall Street believing that the sell-off was overdone. Shares of Royal Caribbean Cruises Ltd rose 4.4 percent, while Norwegian Cruise Line Holdings Ltd gained 7.3 percent. Carnival Corp’s shares climbed 5.1 percent.

A big concern investors have is that the stock market rout could have a psychological effect on consumers, making them reluctant to spend money and go to crowded places like stores, restaurants and movie theaters.

For instance, a late-2018 stock market plunge derailed holiday sales that year. Now, analysts are worried that the latest stock swoon could cause consumer spending — which makes up about 70 percent of the US economy and has played a huge role in keeping the expansion going — to contract again.

Craig Johnson, president of Customer Growth Partners, a consumer consultancy, said that he had expected annual retail sales to rise 4.1 percent, but added that they could now increase just 2.2 percent if the effects of the virus persist beyond next month.

“This is a moving target right now,”’ he said. “There is a lot of uncertainty.”

Many companies face the prospect of crimped financial results with their stocks already trading at high levels relative to their earnings. Before the virus worries exploded, investors had been pushing stocks higher on expectations that strong profit growth was set to resume for companies after declining for most of last year.

Additional reporting by staff writer

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

An earnings report from semiconductor giant and artificial intelligence (AI) bellwether Nvidia Corp takes center stage for Wall Street this week, as stocks hit a speed bump of worries over US federal deficits driving up Treasury yields. US equities pulled back last week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s US$36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023. Stocks were dealt another blow on Friday when US President Donald

UNCERTAINTY: Investors remain worried that trade negotiations with Washington could go poorly, given Trump’s inconsistency on tariffs in his second term, experts said The consumer confidence index this month fell for a ninth consecutive month to its lowest level in 13 months, as global trade uncertainties and tariff risks cloud Taiwan’s economic outlook, a survey released yesterday by National Central University found. The biggest decline came from the timing for stock investments, which plunged 11.82 points to 26.82, underscoring bleak investor confidence, it said. “Although the TAIEX reclaimed the 21,000-point mark after the US and China agreed to bury the hatchet for 90 days, investors remain worried that the situation would turn sour later,” said Dachrahn Wu (吳大任), director of the university’s Research Center for