Largan Precision Co (大立光), which supplies camera lenses to Apple Inc, yesterday posted record-high net profit of NT$28.26 billion (US$941.75 million) for last year, thanks to robust customer demand and a higher gross margin.

The company’s net profit increased 16 percent year-on-year from NT$24.37 billion in 2018. Earnings per share last year climbed to NT$210.69 from NT$181.67 in 2018.

Cumulative revenue reached NT$60.75 billion, up 22 percent from NT$49.95 billion in 2018, while gross margin inched up to 69.04 percent from 68.76 percent in 2018.

Net profit in the fourth quarter of last year grew 24.91 percent year-on-year to NT$8.09 billion, or earnings per share of NT$60.32, while fourth-quarter gross margin rose to 71.13 percent from 69.12 percent in the third quarter, thanks to an improved product mix, the company said.

Sales last quarter increased 47.69 percent year-on-year to NT$18.36 billion, but declined 0.68 percent on a quarterly basis, a company financial statement showed.

Revenue this month is expected to fall somewhat from last month due to the Lunar New Year holiday, but revenue next month should trend upward, Largan CEO Adam Lin (林恩平) told investors in an earnings conference.

“The proportion of high-end products shipped increased last quarter,” Lin said, attributing last year’s strong growth to higher shipments of eight-piece plastic lenses, which allow larger apertures and higher resolutions.

Orders of high-end lenses are expected to remain high this year, Lin said, adding that the company has started to design nine-piece lenses to accommodate customer demand.

Largan is still developing glass-and-plastic periscope lenses, a solution to overheating in plastic lenses.

The company still outsources the production of glass components, but is mulling manufacturing the components in-house, Lin said.

Production capacity at the company’s existing plants could still be increased, Lin said, addressing investors’ concerns.

“Our new plant will be ready by 2023, as construction is to begin this year,” Lin added.

The company has searched far and wide, but been unable to find a plot of land that is suitable for production expansion, Lin said when pressed by investors about capacity, adding that the company might rent a facility.

Investors raised concerns over an apparent shortage of raw materials this quarter, but Lin reassured them, although he admitted that suppliers could use more time to expand production.

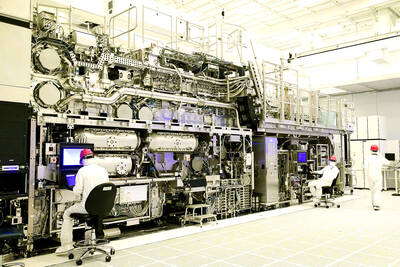

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt

Quanta Computer Inc (廣達), which makes servers and laptop computers on a contract basis, yesterday said it expects artificial intelligence (AI) devices to bring explosive growth to Taiwan’s electronics industry, as AI applications are starting to run on edge devices such as AI PCs. Taiwanese electronics manufacturers such as chipmakers, component suppliers and hardware assemblers are likely to benefit from a rapid uptake of AI applications, Mike Yang (楊麒令), president of Quanta Cloud Technology Inc (雲達科技), a server manufacturing arm of Quanta, told reporters on the sidelines of a technology forum in Taipei yesterday. “I believe the growth potential is promising once

RETALIATION: Beijing is investigating Taiwan, the EU, the US and Japan for dumping, following probes of its market, as well as tariff hikes on its imports The Chinese Ministry of Commerce yesterday said it had launched a dumping investigation into imports of an important engineering chemical from Taiwan, the EU, the US and Japan. It would probe imports of polyoxymethylene copolymer, a thermoplastic used in many precision parts used in phones, auto parts and medical equipment, the Chinese commerce ministry said. The ministry is reviewing materials provided by six Chinese companies that applied for assistance on behalf of the industry on April 22, it said. The probe will target polyformaldehyde copolymer imported from suppliers in the EU, the US, Taiwan and Japan last year, and will assess any damage