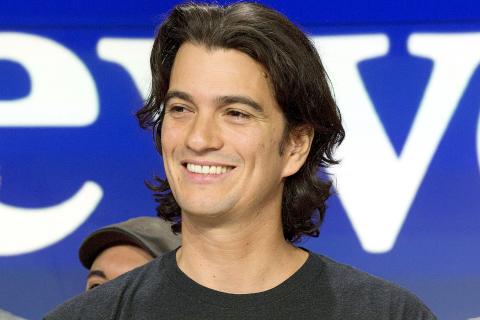

Adam Neumann, who cofounded WeWork and turned it into one of the world’s most valuable start-ups, on Tuesday stepped down as chief executive officer under pressure from the board.

He takes a new role as non-executive chairman and forfeits his control over management decisions.

The move is designed to salvage an initial public offering (IPO), which had been met with immediate scorn from public investors. A litany of apparent conflicts of interest and Neumann’s propensity to burn through capital were chief concerns.

Photo: AP

“In recent weeks, the scrutiny directed toward me has become a significant distraction,” Neumann, 40, said in a statement. “I have decided that it is in the best interest of the company to step down as chief executive.”

Two senior WeWork executives, Sebastian Gunningham and Artie Minson, were appointed as co-CEOs.

WeWork’s parent company, We Co, still intends to go public at some point, but people briefed on the deliberations said it is unlikely to take place as soon as next month, as was planned.

The new CEOs said in a statement that they would be “evaluating the optimal timing for an IPO.”

We Co is under a tight deadline to go public.

It must do so by the end of the year to secure a US$6 billion debt financing contingent on a successful stock offering.

The company, which is deeply unprofitable, will need to find an alternative source of capital next year if this year’s IPO falls through.

Gunningham and Minson “anticipate difficult decisions ahead” to protect the company’s “long-term interests and health,” they wrote in an e-mail to staff reviewed by Bloomberg.

Over the past nine years, WeWork raised more than US$12 billion to set up coworking spaces around the world, where people rent desks and conference rooms.

Neumann and his cofounder, Miguel McKelvey, have long promoted a higher mission for the company than being a commercial real-estate landlord.

Neumann’s We-powered rocket ship hit turbulence early this year. Softbank Group Corp, its largest investor, called off a plan to buy a controlling stake in the business for US$16 billion.

The Japanese conglomerate put in US$2 billion instead, and Neumann embarked on a flight to the stock market for additional capital.

WeWork published its IPO prospectus last month and investors were aghast. The company had never turned a profit and failed to make a convincing case it could do so. The company had lent Neumann money as it paid him rent on buildings he owned. WeWork paid him about US$6 million for a trademark to the name “We.” The board is composed entirely of men.

Neumann, his board and their financial advisers were wholly unprepared for the reaction from public investors. They took steps to address these issues, but some directors decided they would need to go further. Softbank founder Masayoshi Son pushed for Neumann’s resignation as an apparent way to satisfy prospective investors in WeWork and in his own ventures, which are in many ways tied to the fortunes of WeWork.

The management changes show would-be investors that WeWork is trying to tackle corporate governance concerns. The new chiefs convened WeWork employees on Tuesday for an all-hands meeting to discuss the changes.

Although Neumann was notably absent, Gunningham and Minson were joined onstage by two investors and maintained an upbeat tone, according to two people who watched the presentation.

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

Popular vape brands such as Geek Bar might get more expensive in the US — if you can find them at all. Shipments of vapes from China to the US ground to a near halt last month from a year ago, official data showed, hit by US President Donald Trump’s tariffs and a crackdown on unauthorized e-cigarettes in the world’s biggest market for smoking alternatives. That includes Geek Bar, a brand of flavored vapes that is not authorized to sell in the US, but which had been widely available due to porous import controls. One retailer, who asked not to be named, because

CHIP DUTIES: TSMC said it voiced its concerns to Washington about tariffs, telling the US commerce department that it wants ‘fair treatment’ to protect its competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reiterated robust business prospects for this year as strong artificial intelligence (AI) chip demand from Nvidia Corp and other customers would absorb the impacts of US tariffs. “The impact of tariffs would be indirect, as the custom tax is the importers’ responsibility, not the exporters,” TSMC chairman and chief executive officer C.C. Wei (魏哲家) said at the chipmaker’s annual shareholders’ meeting in Hsinchu City. TSMC’s business could be affected if people become reluctant to buy electronics due to inflated prices, Wei said. In addition, the chipmaker has voiced its concern to the US Department of Commerce

STILL LOADED: Last year’s richest person, Quanta Computer Inc chairman Barry Lam, dropped to second place despite an 8 percent increase in his wealth to US$12.6 billion Staff writer, with CNA Daniel Tsai (蔡明忠) and Richard Tsai (蔡明興), the brothers who run Fubon Group (富邦集團), topped the Forbes list of Taiwan’s 50 richest people this year, released on Wednesday in New York. The magazine said that a stronger New Taiwan dollar pushed the combined wealth of Taiwan’s 50 richest people up 13 percent, from US$174 billion to US$197 billion, with 36 of the people on the list seeing their wealth increase. That came as Taiwan’s economy grew 4.6 percent last year, its fastest pace in three years, driven by the strong performance of the semiconductor industry, the magazine said. The Tsai