PCA Life Assurance Co Ltd (保誠人壽) is likely to face an uphill climb in the Taiwanese market, despite the company’s advertising blitz trying to improve its corporate image, industry watchers said.

In its latest “WeDo” advertising campaign, the local arm of UK-based Prudential aims to deliver the message that it helps customers achieve their dreams, as it is always listening to their needs.

PCA Life joined several other foreign insurance companies in either exiting Taiwan or scaling down their operations during the global financial crisis.

PCA Life entered Taiwan’s life insurance market in November 1999 through the acquisition of ChinFon Life Insurance Co (慶豐人壽). The company in 2009 sold its assets and liabilities — excluding its bancassurance and telephone marketing businesses — to China Life Insurance Co (中國人壽) for the nominal sum of NT$1 (US$0.03).

Aside from PCA Life, ING Groep NV in 2008 sold ING Antai Life Insurance Co (安泰人壽) to Fubon Financial Holding Co (富邦金控) for US$600 million through stock swaps, while Aegon NV in 2009 sold Aegon Life Insurance (Taiwan) Inc (全球人壽) to Taipei-based consortium Zhongwei Co (中瑋一) for 65 million euros (US$73.43 million at the current exchange rate).

US-based Metlife Inc in 2010 sold MetLife Taiwan Insurance Co (大都會人壽) to Waterland Financial Holdings Co (國票金控) for US$112.5 billion, Canadian firm Manulife International Ltd in 2011 sold Manulife Insurance Co (宏利人壽) to CTBC Financial Holding Co (中信金控) for NT$724 million, and American International Group (AIG) in that same year divested its 97.57 percent share in Nan Shan Life Insurance Co (南山人壽) to Ruen Chen Investment Holding Co (潤成投資) for US$2.16 billion, while New York Life Insurance Taiwan Corp (國際紐約人壽) was in 2013 acquired by Yuanta Financial Holding Co (元大金控) from New York Life Insurance Co for NT$100 million.

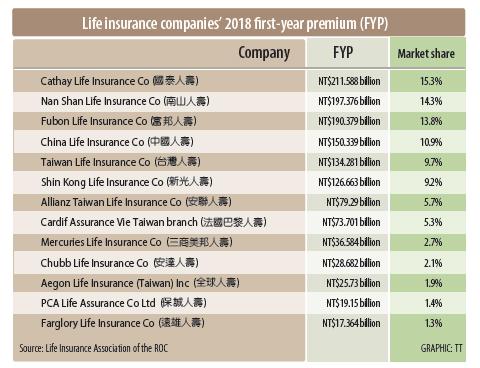

Last year, PCA Life reported first-year premiums (FYPs) of NT$19.15 billion through channels including telemarketing, bancassurance and brokering, accounting for 1.4 percent of total FYPs in Taiwan, Life Insurance Association of the ROC (壽險公會) statistics showed.

That was behind other foreign life insurance companies in terms of FYPs, such as Allianz Taiwan Life Insurance Co’s (安聯人壽) NT$79.29 billion, the Taiwan branch of Cardif Assurance Vie’s (法國巴黎人壽) NT$73.7 billion and Chubb Life Insurance Co’s (安達人壽) NT$28.68 billion, the data showed.

Relying on their own team of sales agents, in addition to other sales channels, local insurance companies Cathay Life Insurance Co (國泰人壽), Nan Shan and Fubon Life Insurance Co (富邦人壽) posted FYPs of NT$211.59 billion, NT$197.38 billion and NT$190.38 billion respectively last year, to take the top three spots, the data showed.

An executive at a local insurance company said that trust is fundamental to the insurance business, which requires long-term commitment and effort.

“PCA has good asset quality and product design, but it must improve its corporate image,” the unnamed executive told the Chinese-language Liberty Times (the Taipei Times’ sister newspaper) in a report published on Feb. 3.

The executive said that some foreign insurance companies have expressed an intention to move back to Taiwan, but consumers would have concerns over their long-term commitment to the local market.

Another issue is so-called “orphan policies” that have no active agent servicing the policyholder.

More than 4 million such policies were created in Taiwan during the global financial crisis, said Peng Jin-lung (彭金隆), an insurance professor at National Chengchi University.

While the rights and interests of holders of orphan policies are protected by law, consumers would have concerns about the quality of services being offered if their policies were to go into orphan mode, and that would impact their insurance company’s corporate image, Peng told the Liberty Times.

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted